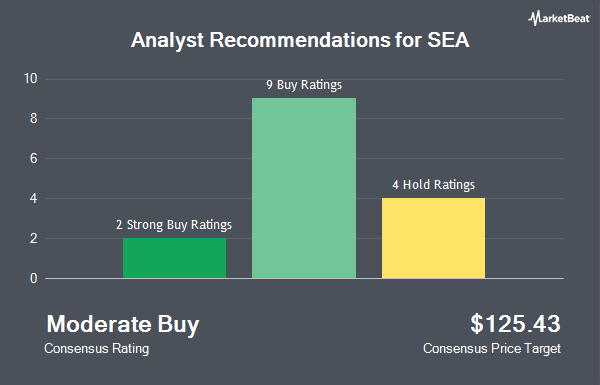

Sea Limited (NYSE:SE - Get Free Report) has been assigned an average rating of "Moderate Buy" from the fifteen ratings firms that are currently covering the stock, Marketbeat.com reports. One analyst has rated the stock with a sell rating, two have assigned a hold rating, eleven have assigned a buy rating and one has given a strong buy rating to the company. The average 1 year price objective among brokers that have updated their coverage on the stock in the last year is $91.21.

Several research analysts recently commented on SE shares. Barclays raised their price target on shares of SEA from $94.00 to $131.00 and gave the company an "overweight" rating in a report on Thursday, November 14th. Wedbush restated an "outperform" rating and issued a $105.00 price target (up previously from $84.00) on shares of SEA in a report on Monday, November 4th. Dbs Bank upgraded shares of SEA from a "hold" rating to a "strong-buy" rating in a report on Wednesday, November 13th. Phillip Securities reaffirmed a "reduce" rating and issued a $100.00 price objective (up previously from $80.00) on shares of SEA in a research report on Tuesday, November 19th. Finally, Benchmark raised their price target on shares of SEA from $94.00 to $130.00 and gave the stock a "buy" rating in a research report on Wednesday, November 13th.

View Our Latest Research Report on SE

Institutional Investors Weigh In On SEA

A number of hedge funds and other institutional investors have recently modified their holdings of SE. Duquesne Family Office LLC bought a new stake in SEA in the second quarter worth about $4,778,000. WCM Investment Management LLC raised its position in SEA by 35.9% in the third quarter. WCM Investment Management LLC now owns 20,902,378 shares of the Internet company based in Singapore's stock worth $1,971,303,000 after acquiring an additional 5,517,559 shares in the last quarter. Robeco Institutional Asset Management B.V. raised its position in SEA by 1.8% in the third quarter. Robeco Institutional Asset Management B.V. now owns 404,096 shares of the Internet company based in Singapore's stock worth $38,098,000 after acquiring an additional 7,175 shares in the last quarter. Toronto Dominion Bank raised its position in SEA by 28.2% in the second quarter. Toronto Dominion Bank now owns 892,969 shares of the Internet company based in Singapore's stock worth $63,776,000 after acquiring an additional 196,506 shares in the last quarter. Finally, Kaizen Investment Management Pte. Ltd. bought a new stake in SEA in the third quarter worth about $587,544,000. 59.53% of the stock is currently owned by institutional investors.

SEA Trading Down 1.7 %

Shares of SEA stock traded down $1.91 during mid-day trading on Friday, hitting $113.80. 2,622,592 shares of the stock were exchanged, compared to its average volume of 5,362,728. The stock has a market capitalization of $65.13 billion, a price-to-earnings ratio of 758.67 and a beta of 1.52. SEA has a twelve month low of $34.35 and a twelve month high of $117.85. The company has a current ratio of 1.62, a quick ratio of 1.60 and a debt-to-equity ratio of 0.36. The company has a 50-day simple moving average of $100.60 and a 200 day simple moving average of $82.71.

SEA (NYSE:SE - Get Free Report) last announced its quarterly earnings data on Tuesday, November 12th. The Internet company based in Singapore reported $0.24 earnings per share for the quarter, missing the consensus estimate of $0.59 by ($0.35). The company had revenue of $4.33 billion for the quarter, compared to analysts' expectations of $4.09 billion. SEA had a return on equity of 1.40% and a net margin of 0.64%. The company's revenue was up 30.8% on a year-over-year basis. During the same quarter in the previous year, the company earned ($0.26) earnings per share. Research analysts forecast that SEA will post 0.81 EPS for the current year.

SEA Company Profile

(

Get Free ReportSea Limited, together with its subsidiaries, engages in the digital entertainment, e-commerce, and digital financial service businesses in Southeast Asia, Latin America, rest of Asia, and internationally. It offers Garena digital entertainment platform for users to access mobile and PC online games, as well as promotes eSports operations.

See Also

Before you consider SEA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SEA wasn't on the list.

While SEA currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.