Stifel Financial Corp increased its holdings in Sea Limited (NYSE:SE - Free Report) by 132.8% during the 3rd quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 155,799 shares of the Internet company based in Singapore's stock after acquiring an additional 88,886 shares during the quarter. Stifel Financial Corp's holdings in SEA were worth $14,689,000 as of its most recent filing with the SEC.

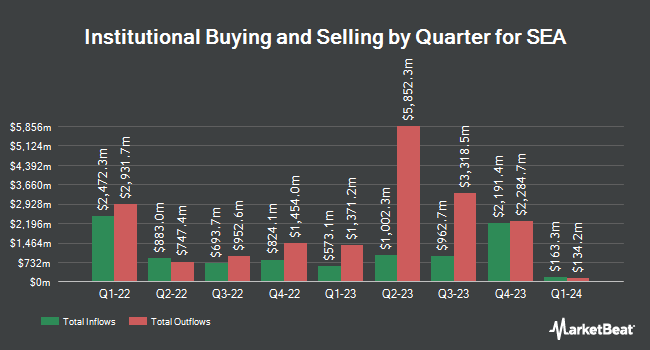

A number of other hedge funds have also recently bought and sold shares of SE. Rosenberg Matthew Hamilton grew its stake in SEA by 213.7% in the third quarter. Rosenberg Matthew Hamilton now owns 298 shares of the Internet company based in Singapore's stock worth $28,000 after purchasing an additional 203 shares in the last quarter. Truvestments Capital LLC acquired a new stake in shares of SEA during the 3rd quarter valued at approximately $41,000. SOA Wealth Advisors LLC. bought a new position in SEA during the second quarter worth $32,000. Icon Wealth Advisors LLC acquired a new position in SEA in the third quarter worth $47,000. Finally, First Horizon Advisors Inc. boosted its holdings in SEA by 248.3% in the third quarter. First Horizon Advisors Inc. now owns 700 shares of the Internet company based in Singapore's stock worth $66,000 after purchasing an additional 499 shares during the period. Institutional investors and hedge funds own 59.53% of the company's stock.

SEA Price Performance

Shares of NYSE SE traded up $4.53 during mid-day trading on Wednesday, reaching $116.58. 1,911,760 shares of the company traded hands, compared to its average volume of 5,306,821. Sea Limited has a fifty-two week low of $34.35 and a fifty-two week high of $119.47. The firm has a market cap of $66.72 billion, a PE ratio of 769.60 and a beta of 1.53. The stock has a fifty day simple moving average of $103.54 and a 200-day simple moving average of $85.02. The company has a debt-to-equity ratio of 0.36, a current ratio of 1.62 and a quick ratio of 1.60.

SEA (NYSE:SE - Get Free Report) last released its earnings results on Tuesday, November 12th. The Internet company based in Singapore reported $0.24 EPS for the quarter, missing analysts' consensus estimates of $0.59 by ($0.35). The business had revenue of $4.33 billion during the quarter, compared to the consensus estimate of $4.09 billion. SEA had a return on equity of 1.40% and a net margin of 0.64%. The firm's revenue for the quarter was up 30.8% compared to the same quarter last year. During the same quarter in the previous year, the firm earned ($0.26) earnings per share. Equities research analysts anticipate that Sea Limited will post 0.81 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

A number of research analysts have recently issued reports on SE shares. Barclays raised their price target on shares of SEA from $94.00 to $131.00 and gave the stock an "overweight" rating in a research report on Thursday, November 14th. Dbs Bank upgraded SEA from a "hold" rating to a "strong-buy" rating in a research note on Wednesday, November 13th. Bank of America increased their price target on SEA from $84.00 to $96.00 and gave the stock a "buy" rating in a research report on Monday, September 23rd. Wedbush restated an "outperform" rating and set a $105.00 price objective (up previously from $84.00) on shares of SEA in a research report on Monday, November 4th. Finally, Benchmark increased their target price on SEA from $94.00 to $130.00 and gave the stock a "buy" rating in a research report on Wednesday, November 13th. One investment analyst has rated the stock with a sell rating, two have issued a hold rating, eleven have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat, SEA has an average rating of "Moderate Buy" and an average target price of $91.21.

Get Our Latest Stock Analysis on SE

About SEA

(

Free Report)

Sea Limited, together with its subsidiaries, engages in the digital entertainment, e-commerce, and digital financial service businesses in Southeast Asia, Latin America, rest of Asia, and internationally. It offers Garena digital entertainment platform for users to access mobile and PC online games, as well as promotes eSports operations.

Featured Articles

Before you consider SEA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SEA wasn't on the list.

While SEA currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.