SEA (NYSE:SE - Get Free Report) is set to post its quarterly earnings results before the market opens on Tuesday, November 12th. Analysts expect SEA to post earnings of $0.57 per share for the quarter. Parties that are interested in registering for the company's conference call can do so using this link.

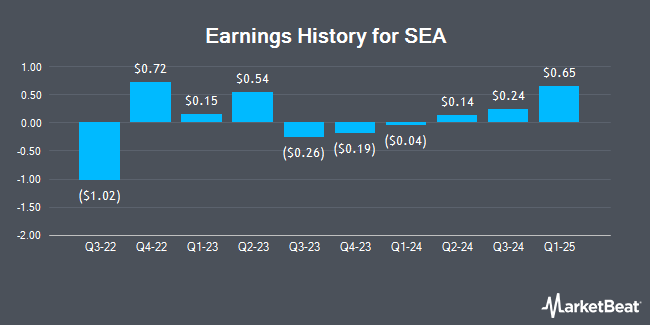

SEA (NYSE:SE - Get Free Report) last posted its quarterly earnings results on Tuesday, August 13th. The Internet company based in Singapore reported $0.14 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.59 by ($0.45). The company had revenue of $3.81 billion for the quarter, compared to analyst estimates of $3.73 billion. SEA had a negative net margin of 1.36% and a negative return on equity of 2.92%. SEA's revenue was up 23.0% on a year-over-year basis. During the same quarter in the previous year, the business posted $0.54 earnings per share. On average, analysts expect SEA to post $1 EPS for the current fiscal year and $1 EPS for the next fiscal year.

SEA Price Performance

Shares of SE traded up $0.56 on Tuesday, reaching $95.75. The stock had a trading volume of 1,683,475 shares, compared to its average volume of 5,395,839. The firm has a 50-day moving average of $90.18 and a 200 day moving average of $77.14. The firm has a market capitalization of $54.80 billion, a PE ratio of -271.80 and a beta of 1.52. SEA has a twelve month low of $34.35 and a twelve month high of $101.93. The company has a quick ratio of 1.48, a current ratio of 1.49 and a debt-to-equity ratio of 0.41.

Wall Street Analysts Forecast Growth

SE has been the subject of a number of research analyst reports. JPMorgan Chase & Co. upgraded SEA from a "neutral" rating to an "overweight" rating and raised their price target for the company from $66.00 to $90.00 in a research report on Wednesday, August 14th. Citigroup dropped their target price on shares of SEA from $81.00 to $80.00 and set a "buy" rating for the company in a report on Tuesday, July 23rd. Benchmark upped their price target on shares of SEA from $87.00 to $94.00 and gave the company a "buy" rating in a report on Wednesday, August 14th. Bank of America raised their price objective on shares of SEA from $84.00 to $96.00 and gave the stock a "buy" rating in a research note on Monday, September 23rd. Finally, Wedbush reaffirmed an "outperform" rating and issued a $105.00 target price (up previously from $84.00) on shares of SEA in a research note on Monday. Three investment analysts have rated the stock with a hold rating and eleven have assigned a buy rating to the company. Based on data from MarketBeat, SEA presently has an average rating of "Moderate Buy" and a consensus target price of $82.54.

Check Out Our Latest Analysis on SEA

SEA Company Profile

(

Get Free Report)

Sea Limited, together with its subsidiaries, engages in the digital entertainment, e-commerce, and digital financial service businesses in Southeast Asia, Latin America, rest of Asia, and internationally. It offers Garena digital entertainment platform for users to access mobile and PC online games, as well as promotes eSports operations.

Featured Stories

Before you consider SEA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SEA wasn't on the list.

While SEA currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.