Heartland Advisors Inc. grew its stake in shares of Seaboard Co. (NYSEAMERICAN:SEB - Free Report) by 33.3% during the fourth quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 1,600 shares of the company's stock after buying an additional 400 shares during the period. Heartland Advisors Inc. owned 0.16% of Seaboard worth $3,887,000 at the end of the most recent reporting period.

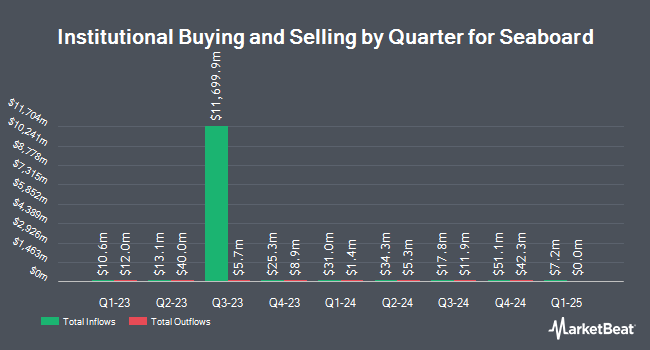

Several other hedge funds also recently bought and sold shares of the company. Wilmington Savings Fund Society FSB bought a new stake in shares of Seaboard during the third quarter valued at approximately $25,000. SG Americas Securities LLC bought a new stake in Seaboard in the 4th quarter valued at $102,000. Bfsg LLC lifted its stake in Seaboard by 22.4% in the 4th quarter. Bfsg LLC now owns 71 shares of the company's stock worth $173,000 after purchasing an additional 13 shares in the last quarter. Aigen Investment Management LP bought a new position in shares of Seaboard during the 4th quarter valued at about $209,000. Finally, Levin Capital Strategies L.P. purchased a new position in shares of Seaboard during the fourth quarter valued at about $219,000. Institutional investors own 22.57% of the company's stock.

Seaboard Trading Up 2.6 %

Shares of NYSEAMERICAN:SEB traded up $70.87 during mid-day trading on Tuesday, reaching $2,767.99. The stock had a trading volume of 1,511 shares, compared to its average volume of 2,747. The business has a 50 day moving average of $2,639.68. Seaboard Co. has a 1 year low of $2,365.00 and a 1 year high of $3,412.00. The firm has a market cap of $2.68 billion, a P/E ratio of 30.55 and a beta of 0.36. The company has a debt-to-equity ratio of 0.21, a quick ratio of 1.50 and a current ratio of 2.50.

Seaboard Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Thursday, March 6th. Stockholders of record on Monday, February 24th were issued a $2.25 dividend. The ex-dividend date of this dividend was Monday, February 24th. This represents a $9.00 dividend on an annualized basis and a dividend yield of 0.33%. Seaboard's dividend payout ratio (DPR) is presently 9.93%.

Seaboard Company Profile

(

Free Report)

Seaboard Corporation, together with its subsidiaries, operates as an agricultural and ocean transportation company worldwide. It operates through six segments: Pork, Commodity Trading and Milling (CT&M), Marine, Sugar and Alcohol, Power, and Turkey. The Pork segment produces and sells pork products to further processors, food service operators, grocery stores, and distributors; hogs; and biodiesel.

Featured Stories

Before you consider Seaboard, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Seaboard wasn't on the list.

While Seaboard currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.