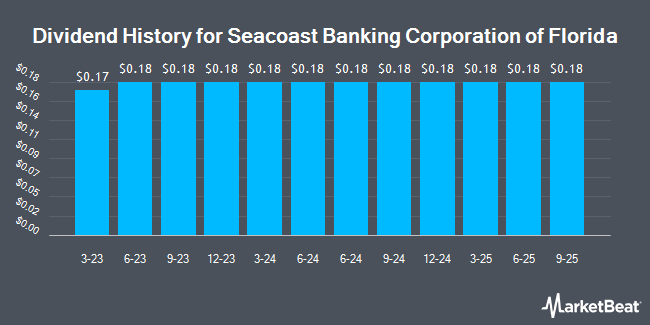

Seacoast Banking Co. of Florida (NASDAQ:SBCF - Get Free Report) announced a quarterly dividend on Friday, January 24th,Wall Street Journal reports. Investors of record on Friday, March 14th will be paid a dividend of 0.18 per share by the financial services provider on Monday, March 31st. This represents a $0.72 annualized dividend and a dividend yield of 2.69%. The ex-dividend date is Friday, March 14th.

Seacoast Banking Co. of Florida has increased its dividend payment by an average of 22.7% per year over the last three years. Seacoast Banking Co. of Florida has a payout ratio of 38.9% indicating that its dividend is sufficiently covered by earnings. Analysts expect Seacoast Banking Co. of Florida to earn $1.59 per share next year, which means the company should continue to be able to cover its $0.72 annual dividend with an expected future payout ratio of 45.3%.

Seacoast Banking Co. of Florida Price Performance

SBCF remained flat at $26.73 on Friday. 273,583 shares of the company were exchanged, compared to its average volume of 343,666. Seacoast Banking Co. of Florida has a 52-week low of $21.90 and a 52-week high of $31.68. The firm has a market capitalization of $2.28 billion, a PE ratio of 19.37 and a beta of 1.09. The company has a current ratio of 0.86, a quick ratio of 0.86 and a debt-to-equity ratio of 0.16. The business has a fifty day moving average price of $28.28 and a two-hundred day moving average price of $27.35.

Seacoast Banking Co. of Florida (NASDAQ:SBCF - Get Free Report) last posted its quarterly earnings results on Thursday, October 24th. The financial services provider reported $0.36 earnings per share (EPS) for the quarter, meeting analysts' consensus estimates of $0.36. Seacoast Banking Co. of Florida had a return on equity of 5.44% and a net margin of 14.55%. The business had revenue of $130.30 million during the quarter, compared to analyst estimates of $129.20 million. During the same period in the prior year, the business earned $0.37 earnings per share. The business's revenue was up 5.5% compared to the same quarter last year. As a group, research analysts predict that Seacoast Banking Co. of Florida will post 1.39 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

Several research analysts have recently commented on SBCF shares. Stephens lifted their price target on Seacoast Banking Co. of Florida from $25.00 to $26.00 and gave the stock an "equal weight" rating in a report on Monday, October 28th. Truist Financial reduced their target price on shares of Seacoast Banking Co. of Florida from $30.00 to $28.00 and set a "hold" rating on the stock in a research note on Monday, October 28th. Three investment analysts have rated the stock with a hold rating and two have issued a buy rating to the stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and an average price target of $28.70.

Check Out Our Latest Stock Report on Seacoast Banking Co. of Florida

Insider Buying and Selling at Seacoast Banking Co. of Florida

In other news, CEO Charles M. Shaffer sold 21,255 shares of the company's stock in a transaction on Monday, November 11th. The stock was sold at an average price of $30.36, for a total transaction of $645,301.80. Following the sale, the chief executive officer now owns 126,232 shares of the company's stock, valued at approximately $3,832,403.52. This represents a 14.41 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. 1.50% of the stock is currently owned by corporate insiders.

About Seacoast Banking Co. of Florida

(

Get Free Report)

Seacoast Banking Corp. of Florida is a financial holding company, which engages in the provision of integrated financial services. It provides banking and investment services to businesses and consumers, including personal and business deposit products, Internet and mobile banking, personal, commercial and mortgage loans, wealth management services, and treasury management solutions.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Seacoast Banking Co. of Florida, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Seacoast Banking Co. of Florida wasn't on the list.

While Seacoast Banking Co. of Florida currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.