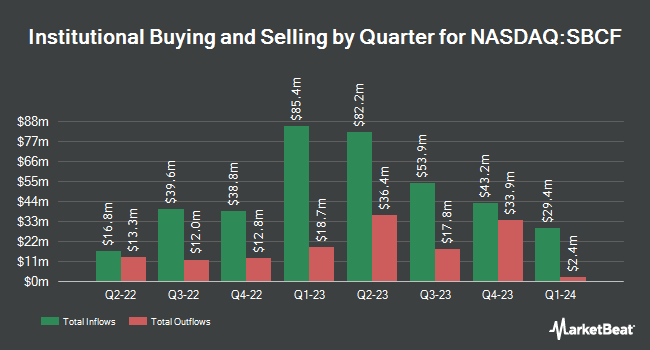

Aptus Capital Advisors LLC lifted its position in shares of Seacoast Banking Co. of Florida (NASDAQ:SBCF - Free Report) by 23.1% in the 3rd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 221,281 shares of the financial services provider's stock after acquiring an additional 41,452 shares during the period. Aptus Capital Advisors LLC owned approximately 0.26% of Seacoast Banking Co. of Florida worth $5,897,000 as of its most recent filing with the Securities & Exchange Commission.

Other hedge funds also recently added to or reduced their stakes in the company. GAMMA Investing LLC grew its stake in shares of Seacoast Banking Co. of Florida by 73.4% in the third quarter. GAMMA Investing LLC now owns 973 shares of the financial services provider's stock worth $26,000 after acquiring an additional 412 shares during the period. Innealta Capital LLC purchased a new stake in Seacoast Banking Co. of Florida during the 2nd quarter valued at $55,000. Janney Montgomery Scott LLC raised its stake in Seacoast Banking Co. of Florida by 6.0% during the 1st quarter. Janney Montgomery Scott LLC now owns 8,127 shares of the financial services provider's stock valued at $206,000 after buying an additional 460 shares during the last quarter. Xcel Wealth Management LLC bought a new position in shares of Seacoast Banking Co. of Florida during the 3rd quarter valued at $223,000. Finally, Algert Global LLC purchased a new position in shares of Seacoast Banking Co. of Florida in the 2nd quarter worth $202,000. 81.77% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

A number of research firms have weighed in on SBCF. Hovde Group downgraded Seacoast Banking Co. of Florida from an "outperform" rating to a "market perform" rating and increased their target price for the company from $29.00 to $31.00 in a report on Monday, July 29th. Keefe, Bruyette & Woods reiterated an "outperform" rating and issued a $31.00 price objective on shares of Seacoast Banking Co. of Florida in a research note on Wednesday, August 21st. Truist Financial cut their target price on shares of Seacoast Banking Co. of Florida from $30.00 to $28.00 and set a "hold" rating for the company in a research report on Monday, October 28th. Finally, Stephens increased their price target on shares of Seacoast Banking Co. of Florida from $25.00 to $26.00 and gave the stock an "equal weight" rating in a research report on Monday, October 28th. Three research analysts have rated the stock with a hold rating and two have given a buy rating to the stock. According to data from MarketBeat, the company currently has an average rating of "Hold" and a consensus target price of $28.70.

Get Our Latest Stock Analysis on SBCF

Insiders Place Their Bets

In related news, CEO Charles M. Shaffer sold 21,255 shares of Seacoast Banking Co. of Florida stock in a transaction that occurred on Monday, November 11th. The stock was sold at an average price of $30.36, for a total transaction of $645,301.80. Following the sale, the chief executive officer now owns 126,232 shares of the company's stock, valued at approximately $3,832,403.52. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. 1.50% of the stock is currently owned by company insiders.

Seacoast Banking Co. of Florida Stock Performance

Shares of NASDAQ:SBCF traded down $0.11 during mid-day trading on Wednesday, reaching $29.81. 392,398 shares of the company traded hands, compared to its average volume of 414,540. The company's 50 day moving average price is $27.12 and its 200-day moving average price is $25.61. The firm has a market cap of $2.55 billion, a PE ratio of 21.60 and a beta of 1.07. Seacoast Banking Co. of Florida has a 52 week low of $21.23 and a 52 week high of $30.78. The company has a debt-to-equity ratio of 0.16, a current ratio of 0.86 and a quick ratio of 0.86.

Seacoast Banking Co. of Florida (NASDAQ:SBCF - Get Free Report) last posted its quarterly earnings results on Thursday, October 24th. The financial services provider reported $0.36 earnings per share for the quarter, hitting analysts' consensus estimates of $0.36. The business had revenue of $130.30 million during the quarter, compared to analyst estimates of $129.20 million. Seacoast Banking Co. of Florida had a net margin of 14.55% and a return on equity of 5.44%. The company's revenue was up 5.5% on a year-over-year basis. During the same period in the prior year, the business posted $0.37 earnings per share. On average, equities analysts expect that Seacoast Banking Co. of Florida will post 1.42 EPS for the current fiscal year.

Seacoast Banking Co. of Florida Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Tuesday, December 31st. Shareholders of record on Friday, December 13th will be paid a $0.18 dividend. The ex-dividend date is Friday, December 13th. This represents a $0.72 dividend on an annualized basis and a yield of 2.42%. Seacoast Banking Co. of Florida's payout ratio is presently 52.17%.

Seacoast Banking Co. of Florida Profile

(

Free Report)

Seacoast Banking Corporation of Florida operates as the bank holding company for Seacoast National Bank that provides integrated financial services to retail and commercial customers in Florida. The company offers noninterest and interest-bearing demand deposit, money market, savings, and customer sweep accounts; time certificates of deposit; construction and land development, commercial and residential real estate, and commercial and financial loans; and consumer loans, including installment loans and revolving lines, as well as loans for automobiles, boats, and personal and family purposes.

Recommended Stories

Before you consider Seacoast Banking Co. of Florida, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Seacoast Banking Co. of Florida wasn't on the list.

While Seacoast Banking Co. of Florida currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.