Cerity Partners LLC boosted its stake in shares of Seagate Technology Holdings plc (NASDAQ:STX - Free Report) by 25.1% during the 3rd quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 35,794 shares of the data storage provider's stock after purchasing an additional 7,177 shares during the period. Cerity Partners LLC's holdings in Seagate Technology were worth $3,921,000 at the end of the most recent quarter.

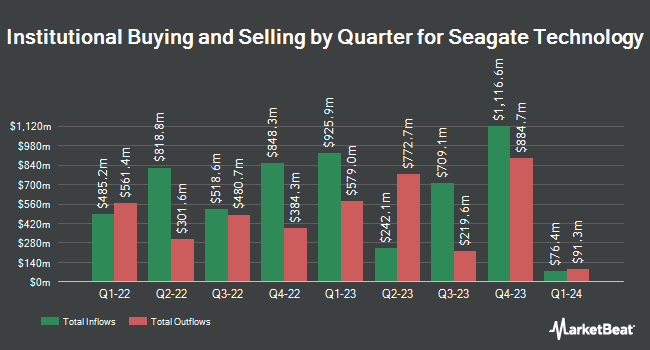

Other hedge funds have also bought and sold shares of the company. Price T Rowe Associates Inc. MD boosted its position in shares of Seagate Technology by 2.4% in the first quarter. Price T Rowe Associates Inc. MD now owns 258,033 shares of the data storage provider's stock worth $24,011,000 after purchasing an additional 6,044 shares during the period. Tidal Investments LLC lifted its stake in shares of Seagate Technology by 24.5% during the 1st quarter. Tidal Investments LLC now owns 4,289 shares of the data storage provider's stock valued at $399,000 after buying an additional 844 shares in the last quarter. Swedbank AB bought a new position in Seagate Technology in the 1st quarter worth $3,456,000. Burney Co. boosted its holdings in Seagate Technology by 3.3% in the 1st quarter. Burney Co. now owns 3,948 shares of the data storage provider's stock worth $367,000 after buying an additional 125 shares during the period. Finally, Cetera Investment Advisers increased its stake in Seagate Technology by 77.5% in the 1st quarter. Cetera Investment Advisers now owns 55,643 shares of the data storage provider's stock worth $5,178,000 after buying an additional 24,287 shares in the last quarter. Institutional investors own 92.87% of the company's stock.

Insiders Place Their Bets

In related news, Director Yolanda Lee Conyers sold 750 shares of the company's stock in a transaction dated Wednesday, September 4th. The shares were sold at an average price of $96.10, for a total value of $72,075.00. Following the completion of the sale, the director now directly owns 3,034 shares of the company's stock, valued at $291,567.40. This represents a 19.82 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Also, SVP John Christopher Morris sold 1,131 shares of the firm's stock in a transaction dated Tuesday, October 22nd. The shares were sold at an average price of $111.90, for a total transaction of $126,558.90. Following the transaction, the senior vice president now directly owns 7,191 shares in the company, valued at $804,672.90. This trade represents a 13.59 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 201,820 shares of company stock worth $21,892,856 in the last three months. Corporate insiders own 0.81% of the company's stock.

Wall Street Analyst Weigh In

Several equities analysts have recently commented on STX shares. Citigroup boosted their price objective on Seagate Technology from $125.00 to $130.00 and gave the company a "buy" rating in a research report on Wednesday, October 23rd. StockNews.com raised Seagate Technology from a "hold" rating to a "buy" rating in a report on Thursday, October 17th. Benchmark restated a "hold" rating on shares of Seagate Technology in a research note on Wednesday, October 23rd. Cantor Fitzgerald reiterated a "neutral" rating and set a $125.00 price objective on shares of Seagate Technology in a research report on Wednesday, October 23rd. Finally, Rosenblatt Securities upped their target price on shares of Seagate Technology from $125.00 to $140.00 and gave the stock a "buy" rating in a research report on Wednesday, October 23rd. Two research analysts have rated the stock with a sell rating, six have issued a hold rating and twelve have given a buy rating to the company. Based on data from MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus target price of $118.83.

Check Out Our Latest Analysis on STX

Seagate Technology Trading Up 1.3 %

Shares of STX stock traded up $1.33 during trading hours on Friday, reaching $101.33. 1,460,313 shares of the stock were exchanged, compared to its average volume of 2,472,311. The firm has a market capitalization of $21.43 billion, a price-to-earnings ratio of 26.46 and a beta of 1.05. Seagate Technology Holdings plc has a 12-month low of $76.87 and a 12-month high of $115.32. The company's 50-day moving average price is $104.51 and its 200-day moving average price is $101.94.

Seagate Technology (NASDAQ:STX - Get Free Report) last released its earnings results on Tuesday, October 22nd. The data storage provider reported $1.58 EPS for the quarter, beating analysts' consensus estimates of $1.30 by $0.28. Seagate Technology had a negative return on equity of 32.19% and a net margin of 11.34%. The firm had revenue of $2.17 billion for the quarter, compared to analysts' expectations of $2.13 billion. During the same quarter in the prior year, the firm posted ($0.34) earnings per share. The company's quarterly revenue was up 49.1% on a year-over-year basis. On average, sell-side analysts expect that Seagate Technology Holdings plc will post 7.18 EPS for the current year.

Seagate Technology Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Monday, January 6th. Shareholders of record on Sunday, December 15th will be given a $0.72 dividend. This represents a $2.88 annualized dividend and a yield of 2.84%. This is a boost from Seagate Technology's previous quarterly dividend of $0.70. The ex-dividend date is Friday, December 13th. Seagate Technology's payout ratio is 75.20%.

About Seagate Technology

(

Free Report)

Seagate Technology Holdings plc provides data storage technology and solutions in Singapore, the United States, the Netherlands, and internationally. It provides mass capacity storage products, including enterprise nearline hard disk drives (HDDs), enterprise nearline solid state drives (SSDs), enterprise nearline systems, video and image HDDs, and network-attached storage drives.

Recommended Stories

Before you consider Seagate Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Seagate Technology wasn't on the list.

While Seagate Technology currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.