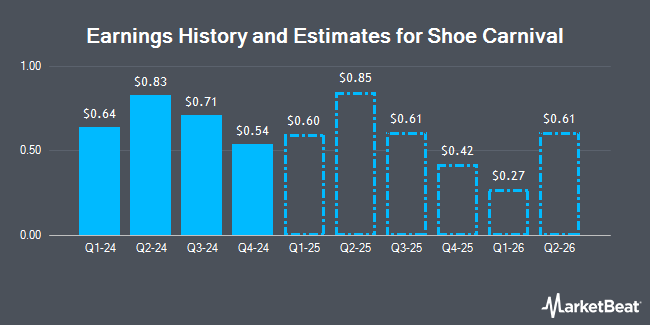

Shoe Carnival, Inc. (NASDAQ:SCVL - Free Report) - Seaport Res Ptn decreased their FY2025 earnings estimates for shares of Shoe Carnival in a research report issued to clients and investors on Monday, November 18th. Seaport Res Ptn analyst M. Kummetz now expects that the company will earn $2.54 per share for the year, down from their prior forecast of $2.65. The consensus estimate for Shoe Carnival's current full-year earnings is $2.65 per share. Seaport Res Ptn also issued estimates for Shoe Carnival's Q4 2025 earnings at $0.44 EPS.

Shoe Carnival (NASDAQ:SCVL - Get Free Report) last released its quarterly earnings data on Thursday, September 5th. The company reported $0.83 earnings per share for the quarter, topping analysts' consensus estimates of $0.80 by $0.03. The business had revenue of $332.70 million for the quarter, compared to analysts' expectations of $331.45 million. Shoe Carnival had a net margin of 6.26% and a return on equity of 13.26%. The company's revenue for the quarter was up 12.9% compared to the same quarter last year. During the same quarter last year, the company earned $0.71 EPS.

Separately, Williams Trading upped their price target on shares of Shoe Carnival from $42.00 to $51.00 and gave the stock a "buy" rating in a research report on Thursday, August 29th.

Get Our Latest Stock Analysis on SCVL

Shoe Carnival Stock Down 2.7 %

SCVL traded down $0.92 during trading on Wednesday, reaching $32.75. 253,813 shares of the company's stock were exchanged, compared to its average volume of 241,324. Shoe Carnival has a fifty-two week low of $22.75 and a fifty-two week high of $46.92. The business has a 50 day moving average price of $39.15 and a 200 day moving average price of $38.74. The company has a market capitalization of $889.82 million, a P/E ratio of 11.94 and a beta of 1.56.

Institutional Inflows and Outflows

A number of hedge funds have recently modified their holdings of SCVL. Sei Investments Co. lifted its holdings in shares of Shoe Carnival by 16.1% in the first quarter. Sei Investments Co. now owns 52,221 shares of the company's stock worth $1,914,000 after acquiring an additional 7,232 shares during the last quarter. Russell Investments Group Ltd. grew its holdings in shares of Shoe Carnival by 2.3% during the 1st quarter. Russell Investments Group Ltd. now owns 82,153 shares of the company's stock valued at $3,010,000 after purchasing an additional 1,853 shares during the last quarter. State Board of Administration of Florida Retirement System bought a new stake in shares of Shoe Carnival during the 1st quarter valued at approximately $335,000. CANADA LIFE ASSURANCE Co grew its holdings in shares of Shoe Carnival by 11.3% during the 1st quarter. CANADA LIFE ASSURANCE Co now owns 15,369 shares of the company's stock valued at $562,000 after purchasing an additional 1,562 shares during the last quarter. Finally, BOKF NA bought a new stake in shares of Shoe Carnival during the 1st quarter valued at approximately $308,000. Institutional investors own 66.05% of the company's stock.

Shoe Carnival Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Monday, October 21st. Investors of record on Monday, October 7th were given a $0.135 dividend. This represents a $0.54 dividend on an annualized basis and a dividend yield of 1.65%. The ex-dividend date was Monday, October 7th. Shoe Carnival's payout ratio is currently 19.15%.

About Shoe Carnival

(

Get Free Report)

Shoe Carnival, Inc, together with its subsidiaries, operates as a family footwear retailer in the United States. The company offers range of dress, casual, work, and athletic shoes, as well as sandals and boots for men, women, and children; and various accessories. The company also operates stores, and sells its products through online shopping at shoecarnival.com, as well as through mobile app.

Recommended Stories

Before you consider Shoe Carnival, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Shoe Carnival wasn't on the list.

While Shoe Carnival currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.