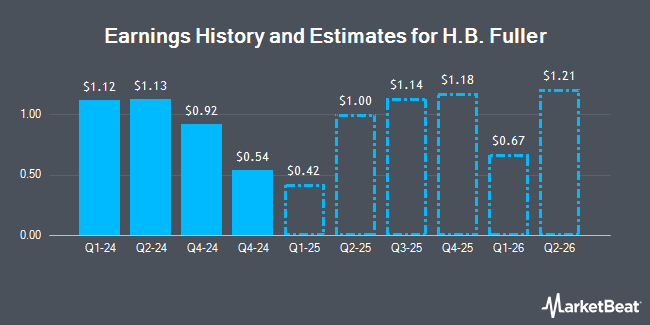

H.B. Fuller (NYSE:FUL - Free Report) - Investment analysts at Seaport Res Ptn cut their Q4 2024 EPS estimates for shares of H.B. Fuller in a research report issued on Monday, January 6th. Seaport Res Ptn analyst M. Harrison now anticipates that the specialty chemicals company will earn $0.92 per share for the quarter, down from their prior estimate of $1.21. The consensus estimate for H.B. Fuller's current full-year earnings is $4.17 per share. Seaport Res Ptn also issued estimates for H.B. Fuller's FY2025 earnings at $4.02 EPS and FY2026 earnings at $4.81 EPS.

Several other equities analysts have also recently weighed in on FUL. StockNews.com cut H.B. Fuller from a "buy" rating to a "hold" rating in a research report on Wednesday, September 18th. Vertical Research lowered H.B. Fuller from a "buy" rating to a "hold" rating in a report on Monday. Finally, Citigroup lowered their price target on shares of H.B. Fuller from $78.00 to $68.00 and set a "neutral" rating on the stock in a report on Friday, January 3rd. Four equities research analysts have rated the stock with a hold rating and one has assigned a buy rating to the stock. According to data from MarketBeat, the stock currently has an average rating of "Hold" and an average price target of $90.25.

View Our Latest Report on FUL

H.B. Fuller Stock Performance

FUL stock traded up $0.26 during midday trading on Thursday, reaching $63.17. 364,437 shares of the company's stock traded hands, compared to its average volume of 509,727. The firm has a market capitalization of $3.45 billion, a PE ratio of 19.50, a price-to-earnings-growth ratio of 1.24 and a beta of 1.43. The company has a 50-day moving average price of $72.42 and a two-hundred day moving average price of $77.37. H.B. Fuller has a 52 week low of $61.71 and a 52 week high of $87.67. The company has a debt-to-equity ratio of 1.10, a quick ratio of 1.16 and a current ratio of 1.89.

Hedge Funds Weigh In On H.B. Fuller

Several hedge funds and other institutional investors have recently added to or reduced their stakes in FUL. S&CO Inc. boosted its position in shares of H.B. Fuller by 0.3% during the 3rd quarter. S&CO Inc. now owns 267,192 shares of the specialty chemicals company's stock valued at $21,209,000 after acquiring an additional 920 shares during the last quarter. Marshall Wace LLP raised its stake in H.B. Fuller by 9.9% in the second quarter. Marshall Wace LLP now owns 290,005 shares of the specialty chemicals company's stock valued at $22,319,000 after purchasing an additional 26,239 shares in the last quarter. Lord Abbett & CO. LLC lifted its position in H.B. Fuller by 79.8% during the third quarter. Lord Abbett & CO. LLC now owns 730,058 shares of the specialty chemicals company's stock valued at $57,952,000 after purchasing an additional 324,056 shares during the last quarter. Finally, Geode Capital Management LLC grew its stake in H.B. Fuller by 1.5% in the 3rd quarter. Geode Capital Management LLC now owns 1,258,752 shares of the specialty chemicals company's stock worth $99,939,000 after buying an additional 18,734 shares in the last quarter. 95.93% of the stock is currently owned by hedge funds and other institutional investors.

About H.B. Fuller

(

Get Free Report)

H.B. Fuller Company, together with its subsidiaries, formulates, manufactures, and markets adhesives, sealants, coatings, polymers, tapes, encapsulants, additives, and other specialty chemical products. It operates through three segments: Hygiene, Health and Consumable Adhesives; Engineering Adhesives; and Construction Adhesives.

See Also

Before you consider H.B. Fuller, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and H.B. Fuller wasn't on the list.

While H.B. Fuller currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.