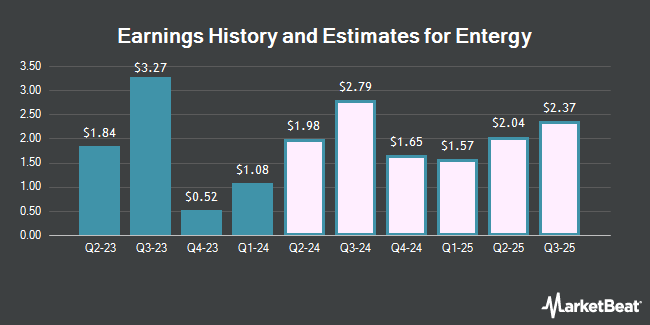

Entergy Corporation (NYSE:ETR - Free Report) - Investment analysts at Seaport Res Ptn upped their FY2024 EPS estimates for Entergy in a research report issued to clients and investors on Monday, January 6th. Seaport Res Ptn analyst A. Storozynski now anticipates that the utilities provider will earn $3.62 per share for the year, up from their previous estimate of $3.62. The consensus estimate for Entergy's current full-year earnings is $3.61 per share. Seaport Res Ptn also issued estimates for Entergy's FY2025 earnings at $3.93 EPS, FY2026 earnings at $4.35 EPS and FY2027 earnings at $4.76 EPS.

Entergy (NYSE:ETR - Get Free Report) last issued its earnings results on Thursday, October 31st. The utilities provider reported $1.50 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.46 by $0.04. The business had revenue of $3.39 billion during the quarter, compared to the consensus estimate of $3.46 billion. Entergy had a net margin of 14.83% and a return on equity of 9.53%. During the same period last year, the business posted $1.64 EPS.

Several other research firms also recently commented on ETR. Wells Fargo & Company upped their price objective on shares of Entergy from $68.50 to $85.00 and gave the company an "overweight" rating in a report on Friday, November 1st. Barclays increased their price target on shares of Entergy from $68.50 to $76.00 and gave the company an "overweight" rating in a report on Tuesday, November 5th. BMO Capital Markets reduced their price objective on Entergy from $83.00 to $79.50 and set an "outperform" rating for the company in a report on Monday, November 18th. Guggenheim increased their target price on Entergy from $72.50 to $82.50 and gave the stock a "buy" rating in a research note on Friday, November 1st. Finally, Royal Bank of Canada boosted their price target on Entergy from $68.50 to $70.00 and gave the company an "outperform" rating in a research note on Monday, October 14th. Six investment analysts have rated the stock with a hold rating, eight have given a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $77.37.

Check Out Our Latest Research Report on ETR

Entergy Stock Performance

Shares of ETR stock traded up $0.70 during trading on Tuesday, reaching $75.96. 2,420,015 shares of the company's stock were exchanged, compared to its average volume of 2,770,379. Entergy has a twelve month low of $48.08 and a twelve month high of $79.04. The firm's fifty day moving average price is $74.89 and its 200-day moving average price is $65.38. The company has a quick ratio of 0.59, a current ratio of 0.89 and a debt-to-equity ratio of 1.77. The stock has a market capitalization of $32.57 billion, a PE ratio of 18.50, a PEG ratio of 2.48 and a beta of 0.71.

Institutional Inflows and Outflows

Several institutional investors have recently modified their holdings of ETR. Legacy Investment Solutions LLC bought a new stake in Entergy during the 3rd quarter worth $27,000. Fortitude Family Office LLC increased its stake in shares of Entergy by 423.8% in the third quarter. Fortitude Family Office LLC now owns 220 shares of the utilities provider's stock valued at $29,000 after buying an additional 178 shares during the period. Cetera Trust Company N.A acquired a new stake in Entergy during the 3rd quarter worth approximately $29,000. Coastline Trust Co bought a new stake in Entergy during the 3rd quarter worth approximately $31,000. Finally, Ashton Thomas Securities LLC acquired a new position in Entergy in the 3rd quarter valued at approximately $42,000. 88.07% of the stock is currently owned by institutional investors and hedge funds.

Insider Activity at Entergy

In other Entergy news, insider Haley Fisackerly sold 8,268 shares of Entergy stock in a transaction dated Tuesday, November 12th. The stock was sold at an average price of $74.52, for a total value of $616,090.02. Following the transaction, the insider now owns 4,032 shares in the company, valued at $300,444.48. The trade was a 67.22 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Also, insider Deanna D. Rodriguez sold 6,088 shares of the stock in a transaction dated Friday, December 13th. The stock was sold at an average price of $73.94, for a total transaction of $450,146.72. Following the completion of the transaction, the insider now directly owns 3,952 shares of the company's stock, valued at $292,210.88. This trade represents a 60.64 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 14,756 shares of company stock valued at $1,095,637 over the last three months. 0.39% of the stock is owned by insiders.

Entergy Cuts Dividend

The company also recently declared a quarterly dividend, which was paid on Monday, December 2nd. Investors of record on Wednesday, November 13th were given a dividend of $0.60 per share. The ex-dividend date was Wednesday, November 13th. This represents a $2.40 annualized dividend and a dividend yield of 3.16%. Entergy's dividend payout ratio is 58.39%.

Entergy Company Profile

(

Get Free Report)

Entergy Corporation, together with its subsidiaries, engages in the production and retail distribution of electricity in the United States. It generates, transmits, distributes, and sells electric power in portions of Arkansas, Louisiana, Mississippi, and Texas, including the City of New Orleans; and distributes natural gas.

Featured Articles

Before you consider Entergy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Entergy wasn't on the list.

While Entergy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.