Seascape Capital Management trimmed its holdings in ArcelorMittal S.A. (NYSE:MT - Free Report) by 58.4% in the fourth quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 10,877 shares of the basic materials company's stock after selling 15,293 shares during the quarter. Seascape Capital Management's holdings in ArcelorMittal were worth $252,000 as of its most recent SEC filing.

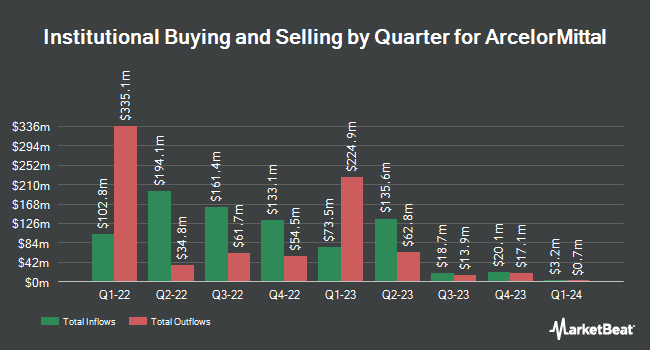

Several other hedge funds also recently added to or reduced their stakes in MT. GAMMA Investing LLC increased its position in ArcelorMittal by 68.5% in the 4th quarter. GAMMA Investing LLC now owns 1,464 shares of the basic materials company's stock valued at $34,000 after acquiring an additional 595 shares during the period. Oppenheimer Asset Management Inc. increased its holdings in shares of ArcelorMittal by 154.7% in the third quarter. Oppenheimer Asset Management Inc. now owns 57,106 shares of the basic materials company's stock valued at $1,500,000 after purchasing an additional 34,688 shares during the period. Natixis Advisors LLC raised its stake in shares of ArcelorMittal by 171.4% during the third quarter. Natixis Advisors LLC now owns 130,100 shares of the basic materials company's stock worth $3,416,000 after purchasing an additional 82,164 shares during the last quarter. Wealth Enhancement Advisory Services LLC acquired a new stake in shares of ArcelorMittal during the third quarter worth $642,000. Finally, Mediolanum International Funds Ltd purchased a new position in ArcelorMittal in the 3rd quarter valued at $3,042,000. 9.29% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

Several analysts have recently commented on MT shares. Morgan Stanley cut shares of ArcelorMittal from an "overweight" rating to an "equal weight" rating in a research note on Friday, February 14th. Bank of America upgraded shares of ArcelorMittal from a "neutral" rating to a "buy" rating and raised their price objective for the company from $30.00 to $32.90 in a research report on Thursday, November 14th. Four research analysts have rated the stock with a hold rating and three have assigned a buy rating to the company. According to MarketBeat, the company currently has an average rating of "Hold" and a consensus price target of $31.17.

Get Our Latest Stock Analysis on MT

ArcelorMittal Price Performance

Shares of ArcelorMittal stock traded down $0.79 during trading on Wednesday, hitting $28.11. 2,093,298 shares of the company were exchanged, compared to its average volume of 2,205,056. ArcelorMittal S.A. has a fifty-two week low of $20.52 and a fifty-two week high of $29.38. The company has a quick ratio of 0.59, a current ratio of 1.35 and a debt-to-equity ratio of 0.17. The firm has a 50 day moving average price of $24.45 and a 200 day moving average price of $24.20. The stock has a market capitalization of $23.03 billion, a price-to-earnings ratio of 17.03, a P/E/G ratio of 0.14 and a beta of 1.74.

ArcelorMittal (NYSE:MT - Get Free Report) last released its quarterly earnings results on Thursday, February 6th. The basic materials company reported $0.52 earnings per share for the quarter, missing analysts' consensus estimates of $0.61 by ($0.09). ArcelorMittal had a return on equity of 4.31% and a net margin of 2.14%. On average, equities analysts expect that ArcelorMittal S.A. will post 3.72 earnings per share for the current fiscal year.

ArcelorMittal Profile

(

Free Report)

ArcelorMittal SA, together with its subsidiaries, operates as integrated steel and mining companies in the United States, Europe, and internationally. It offers semi-finished flat products, including slabs; finished flat products comprising plates, hot- and cold-rolled coils and sheets, hot-dipped and electro-galvanized coils and sheets, tinplate, and color coated coils and sheets; semi-finished long products, such as blooms and billets; finished long products consisting of bars, wire-rods, structural sections, rails, sheet piles, and wire-products; and seamless and welded pipes and tubes.

Read More

Before you consider ArcelorMittal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ArcelorMittal wasn't on the list.

While ArcelorMittal currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.