Segall Bryant & Hamill LLC lifted its holdings in shares of Ciena Co. (NYSE:CIEN - Free Report) by 119.6% during the 3rd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund owned 239,389 shares of the communications equipment provider's stock after purchasing an additional 130,399 shares during the quarter. Segall Bryant & Hamill LLC owned about 0.17% of Ciena worth $14,744,000 as of its most recent SEC filing.

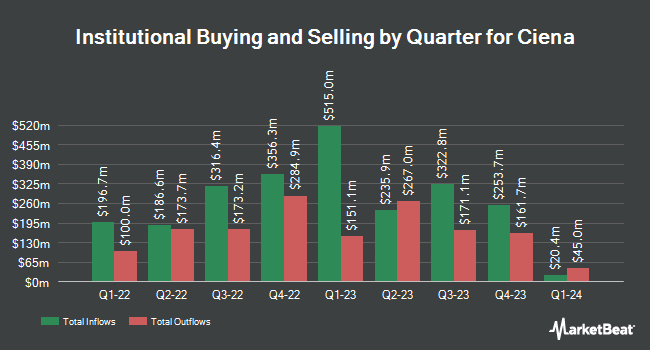

Several other institutional investors have also recently added to or reduced their stakes in CIEN. Hoese & Co LLP purchased a new stake in Ciena during the third quarter valued at about $25,000. UMB Bank n.a. raised its holdings in Ciena by 424.4% in the third quarter. UMB Bank n.a. now owns 451 shares of the communications equipment provider's stock valued at $28,000 after buying an additional 365 shares during the period. Canton Hathaway LLC acquired a new position in Ciena during the second quarter valued at approximately $40,000. Covestor Ltd lifted its holdings in shares of Ciena by 339.5% during the 1st quarter. Covestor Ltd now owns 1,213 shares of the communications equipment provider's stock valued at $60,000 after acquiring an additional 937 shares in the last quarter. Finally, Blue Trust Inc. boosted its position in Ciena by 241.5% during the 3rd quarter. Blue Trust Inc. now owns 1,424 shares of the communications equipment provider's stock worth $88,000 after purchasing an additional 1,007 shares during the period. 91.99% of the stock is currently owned by institutional investors and hedge funds.

Ciena Stock Performance

Shares of NYSE CIEN opened at $66.50 on Thursday. Ciena Co. has a 52-week low of $42.20 and a 52-week high of $73.47. The stock has a market capitalization of $9.60 billion, a P/E ratio of 70.75, a P/E/G ratio of 5.45 and a beta of 0.94. The company has a quick ratio of 2.99, a current ratio of 4.06 and a debt-to-equity ratio of 0.53. The firm's 50-day moving average price is $64.65 and its two-hundred day moving average price is $55.04.

Ciena (NYSE:CIEN - Get Free Report) last released its earnings results on Wednesday, September 4th. The communications equipment provider reported $0.35 EPS for the quarter, beating the consensus estimate of $0.26 by $0.09. The firm had revenue of $942.30 million for the quarter, compared to analysts' expectations of $928.31 million. Ciena had a net margin of 3.44% and a return on equity of 5.98%. Ciena's quarterly revenue was down 11.8% on a year-over-year basis. During the same quarter last year, the company earned $0.36 EPS. As a group, sell-side analysts forecast that Ciena Co. will post 1.13 earnings per share for the current year.

Ciena announced that its board has initiated a stock repurchase plan on Wednesday, October 2nd that allows the company to repurchase $1.00 billion in shares. This repurchase authorization allows the communications equipment provider to reacquire up to 10.5% of its shares through open market purchases. Shares repurchase plans are generally an indication that the company's management believes its shares are undervalued.

Analysts Set New Price Targets

A number of brokerages have commented on CIEN. Citigroup upgraded Ciena from a "sell" rating to a "buy" rating and boosted their price objective for the stock from $44.00 to $68.00 in a research note on Monday, September 23rd. BNP Paribas downgraded shares of Ciena from an "outperform" rating to a "neutral" rating and lifted their price target for the stock from $59.00 to $67.00 in a research note on Wednesday, October 9th. Needham & Company LLC reissued a "buy" rating and issued a $65.00 price objective on shares of Ciena in a research report on Thursday, September 5th. Barclays boosted their price target on Ciena from $55.00 to $67.00 and gave the stock an "overweight" rating in a research note on Thursday, September 5th. Finally, Bank of America restated a "neutral" rating and set a $59.00 price objective on shares of Ciena in a report on Thursday, September 5th. Eight analysts have rated the stock with a hold rating and six have issued a buy rating to the company. Based on data from MarketBeat.com, the company currently has a consensus rating of "Hold" and a consensus price target of $63.08.

View Our Latest Report on Ciena

Insider Buying and Selling

In related news, SVP David M. Rothenstein sold 3,500 shares of the firm's stock in a transaction that occurred on Monday, September 16th. The shares were sold at an average price of $56.24, for a total transaction of $196,840.00. Following the completion of the sale, the senior vice president now directly owns 205,421 shares in the company, valued at approximately $11,552,877.04. This trade represents a 1.68 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Also, SVP Joseph Cumello sold 1,289 shares of the business's stock in a transaction dated Friday, November 15th. The shares were sold at an average price of $68.99, for a total value of $88,928.11. Following the completion of the transaction, the senior vice president now owns 39,486 shares in the company, valued at $2,724,139.14. This trade represents a 3.16 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 10,489 shares of company stock worth $657,051 in the last three months. 0.83% of the stock is currently owned by insiders.

Ciena Company Profile

(

Free Report)

Ciena Corporation provides hardware and software services for delivery of video, data, and voice traffic metro, aggregation, and access communications network worldwide. The company's Networking Platforms segment offers convergence of coherent optical transport, open optical networking, optical transport network switching, IP routing, and switching services.

Featured Stories

Before you consider Ciena, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ciena wasn't on the list.

While Ciena currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.