Segall Bryant & Hamill LLC lifted its stake in shares of NeoGenomics, Inc. (NASDAQ:NEO - Free Report) by 67.0% during the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm owned 1,893,407 shares of the medical research company's stock after acquiring an additional 759,524 shares during the period. Segall Bryant & Hamill LLC owned 1.48% of NeoGenomics worth $27,928,000 as of its most recent filing with the Securities & Exchange Commission.

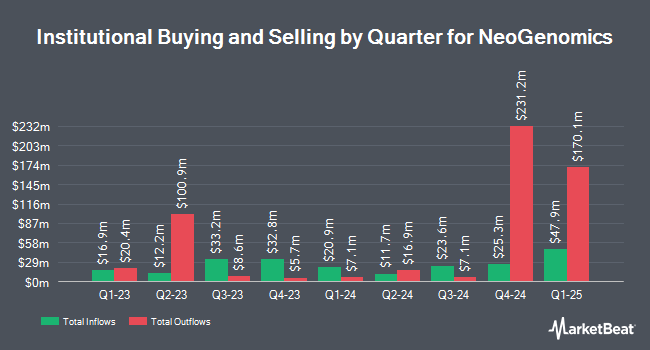

A number of other institutional investors also recently bought and sold shares of the company. Bellevue Group AG purchased a new stake in shares of NeoGenomics in the 1st quarter valued at approximately $14,872,000. Kopp LeRoy C acquired a new position in shares of NeoGenomics during the first quarter worth about $14,062,000. First Light Asset Management LLC increased its stake in shares of NeoGenomics by 14.5% during the second quarter. First Light Asset Management LLC now owns 3,782,561 shares of the medical research company's stock worth $52,464,000 after buying an additional 480,396 shares during the period. Dimensional Fund Advisors LP raised its holdings in NeoGenomics by 7.0% in the second quarter. Dimensional Fund Advisors LP now owns 3,324,624 shares of the medical research company's stock valued at $46,108,000 after acquiring an additional 217,687 shares in the last quarter. Finally, American Century Companies Inc. lifted its stake in NeoGenomics by 5.4% in the second quarter. American Century Companies Inc. now owns 3,261,756 shares of the medical research company's stock worth $45,241,000 after acquiring an additional 167,145 shares during the last quarter. 98.50% of the stock is owned by hedge funds and other institutional investors.

NeoGenomics Stock Performance

Shares of NeoGenomics stock traded down $0.20 during trading on Wednesday, reaching $15.16. The company's stock had a trading volume of 130,328 shares, compared to its average volume of 812,796. The firm has a market cap of $1.95 billion, a PE ratio of -25.18 and a beta of 1.19. The company has a 50-day moving average price of $14.66 and a two-hundred day moving average price of $14.82. The company has a current ratio of 1.99, a quick ratio of 1.91 and a debt-to-equity ratio of 0.37. NeoGenomics, Inc. has a fifty-two week low of $12.77 and a fifty-two week high of $21.22.

NeoGenomics (NASDAQ:NEO - Get Free Report) last posted its quarterly earnings data on Tuesday, November 5th. The medical research company reported $0.05 earnings per share for the quarter, topping analysts' consensus estimates of $0.01 by $0.04. The company had revenue of $167.80 million during the quarter, compared to analysts' expectations of $167.00 million. NeoGenomics had a negative return on equity of 2.11% and a negative net margin of 12.07%. The firm's revenue for the quarter was up 10.5% on a year-over-year basis. During the same period last year, the firm earned ($0.06) EPS. On average, analysts forecast that NeoGenomics, Inc. will post -0.17 EPS for the current year.

Insider Transactions at NeoGenomics

In other news, General Counsel Alicia C. Olivo sold 5,175 shares of the company's stock in a transaction on Friday, November 15th. The shares were sold at an average price of $15.36, for a total transaction of $79,488.00. Following the transaction, the general counsel now directly owns 37,129 shares of the company's stock, valued at $570,301.44. This represents a 12.23 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Company insiders own 1.30% of the company's stock.

Analyst Upgrades and Downgrades

A number of equities research analysts have recently weighed in on NEO shares. Benchmark restated a "buy" rating and issued a $18.00 price objective on shares of NeoGenomics in a report on Tuesday, September 24th. Stephens reaffirmed an "overweight" rating and set a $19.00 price target on shares of NeoGenomics in a report on Tuesday, July 30th. Finally, Needham & Company LLC reaffirmed a "buy" rating and set a $19.00 price objective on shares of NeoGenomics in a research report on Wednesday, November 6th. Nine analysts have rated the stock with a buy rating, According to MarketBeat.com, NeoGenomics has an average rating of "Buy" and a consensus target price of $20.25.

Check Out Our Latest Stock Report on NEO

NeoGenomics Profile

(

Free Report)

NeoGenomics, Inc operates a network of cancer-focused testing laboratories in the United States and the United Kingdom. It operates through Clinical Services and Advanced Diagnostics segments. The company offers testing services to hospitals, academic centers, pathologists, oncologists, clinicians, pharmaceutical companies, and clinical laboratories.

Further Reading

Before you consider NeoGenomics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NeoGenomics wasn't on the list.

While NeoGenomics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.