Segall Bryant & Hamill LLC acquired a new stake in Wipro Limited (NYSE:WIT - Free Report) in the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor acquired 94,100 shares of the information technology services provider's stock, valued at approximately $610,000.

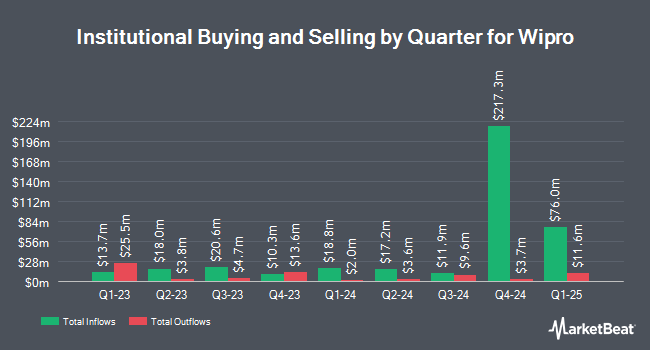

Several other hedge funds have also recently added to or reduced their stakes in the stock. Millennium Management LLC boosted its position in shares of Wipro by 67.6% during the second quarter. Millennium Management LLC now owns 5,622,699 shares of the information technology services provider's stock worth $34,298,000 after purchasing an additional 2,267,995 shares in the last quarter. Marshall Wace LLP bought a new position in Wipro during the second quarter worth about $7,994,000. Jane Street Group LLC grew its stake in Wipro by 292.0% in the first quarter. Jane Street Group LLC now owns 1,344,674 shares of the information technology services provider's stock valued at $7,732,000 after acquiring an additional 1,001,644 shares during the period. Lazard Asset Management LLC increased its holdings in shares of Wipro by 154.1% in the first quarter. Lazard Asset Management LLC now owns 855,496 shares of the information technology services provider's stock worth $4,919,000 after acquiring an additional 518,866 shares in the last quarter. Finally, Squarepoint Ops LLC raised its position in shares of Wipro by 143.4% during the second quarter. Squarepoint Ops LLC now owns 821,228 shares of the information technology services provider's stock worth $5,009,000 after purchasing an additional 483,893 shares during the period. Institutional investors and hedge funds own 2.36% of the company's stock.

Wipro Stock Up 1.3 %

Shares of NYSE:WIT traded up $0.09 during mid-day trading on Monday, reaching $7.07. 3,722,246 shares of the stock were exchanged, compared to its average volume of 2,511,022. The stock's 50 day simple moving average is $6.60 and its 200-day simple moving average is $6.18. Wipro Limited has a one year low of $4.68 and a one year high of $7.12. The company has a market cap of $36.94 billion, a P/E ratio of 26.19, a P/E/G ratio of 4.72 and a beta of 0.89. The company has a quick ratio of 2.69, a current ratio of 2.69 and a debt-to-equity ratio of 0.08.

Wipro's stock is going to split before the market opens on Wednesday, December 11th. The 2-1 split was announced on Tuesday, October 22nd. The newly minted shares will be distributed to shareholders after the market closes on Tuesday, December 10th.

Wipro (NYSE:WIT - Get Free Report) last announced its earnings results on Thursday, October 17th. The information technology services provider reported $0.07 EPS for the quarter, hitting the consensus estimate of $0.07. Wipro had a net margin of 13.23% and a return on equity of 14.98%. The business had revenue of $2.66 billion during the quarter, compared to analysts' expectations of $2.66 billion. As a group, equities research analysts predict that Wipro Limited will post 0.27 EPS for the current year.

Analysts Set New Price Targets

Several brokerages recently issued reports on WIT. Investec lowered Wipro from a "hold" rating to a "sell" rating in a research report on Thursday, October 3rd. StockNews.com cut shares of Wipro from a "buy" rating to a "hold" rating in a report on Monday, November 18th. Three research analysts have rated the stock with a sell rating, one has issued a hold rating, one has assigned a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat, Wipro has a consensus rating of "Hold" and an average price target of $5.60.

Get Our Latest Stock Analysis on WIT

About Wipro

(

Free Report)

Wipro Limited operates as an information technology (IT), consulting, and business process services company worldwide. It operates through IT Services and IT Products segments. The IT Services segment offers IT and IT-enabled services, including digital strategy advisory, customer-centric design, technology and IT consulting, custom application design, development, re-engineering and maintenance, systems integration, package implementation, cloud and infrastructure, business process, cloud, mobility and analytics, research and development, and hardware and software design services to enterprises.

Read More

Before you consider Wipro, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wipro wasn't on the list.

While Wipro currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.