Segall Bryant & Hamill LLC lifted its stake in shares of Installed Building Products, Inc. (NYSE:IBP - Free Report) by 149.3% during the third quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 81,075 shares of the construction company's stock after purchasing an additional 48,559 shares during the quarter. Segall Bryant & Hamill LLC owned 0.29% of Installed Building Products worth $19,966,000 as of its most recent SEC filing.

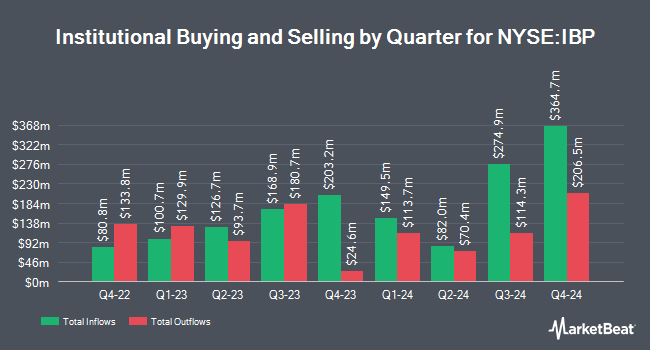

Other institutional investors have also added to or reduced their stakes in the company. Swedbank AB purchased a new position in shares of Installed Building Products during the 1st quarter valued at $96,248,000. Price T Rowe Associates Inc. MD boosted its stake in Installed Building Products by 1,328.2% during the first quarter. Price T Rowe Associates Inc. MD now owns 197,526 shares of the construction company's stock valued at $51,107,000 after buying an additional 183,696 shares during the period. Millennium Management LLC increased its stake in Installed Building Products by 395.3% in the 2nd quarter. Millennium Management LLC now owns 143,166 shares of the construction company's stock worth $29,446,000 after acquiring an additional 114,259 shares during the last quarter. Thrivent Financial for Lutherans raised its holdings in shares of Installed Building Products by 379.5% in the 3rd quarter. Thrivent Financial for Lutherans now owns 93,439 shares of the construction company's stock valued at $23,012,000 after acquiring an additional 73,952 shares in the last quarter. Finally, Leeward Investments LLC MA bought a new stake in shares of Installed Building Products during the 3rd quarter valued at about $17,972,000. Hedge funds and other institutional investors own 99.61% of the company's stock.

Analyst Upgrades and Downgrades

Several equities research analysts have issued reports on the stock. Royal Bank of Canada lowered shares of Installed Building Products from a "sector perform" rating to an "underperform" rating and dropped their target price for the company from $203.00 to $197.00 in a research report on Friday, November 8th. Evercore ISI increased their target price on Installed Building Products from $271.00 to $272.00 and gave the company an "outperform" rating in a research note on Wednesday, October 16th. The Goldman Sachs Group lifted their price target on Installed Building Products from $260.00 to $295.00 and gave the stock a "buy" rating in a research note on Friday, August 2nd. Jefferies Financial Group increased their price objective on Installed Building Products from $240.00 to $252.00 and gave the company a "hold" rating in a research report on Wednesday, October 9th. Finally, Stephens reaffirmed an "equal weight" rating and issued a $240.00 target price on shares of Installed Building Products in a research note on Monday, August 5th. One analyst has rated the stock with a sell rating, four have issued a hold rating and six have assigned a buy rating to the company's stock. According to MarketBeat.com, the company has an average rating of "Hold" and an average target price of $252.30.

View Our Latest Stock Report on Installed Building Products

Installed Building Products Trading Up 0.8 %

Shares of IBP opened at $208.53 on Thursday. The firm has a fifty day simple moving average of $230.78 and a two-hundred day simple moving average of $223.50. Installed Building Products, Inc. has a twelve month low of $143.97 and a twelve month high of $281.04. The stock has a market capitalization of $5.87 billion, a P/E ratio of 23.17 and a beta of 1.95. The company has a quick ratio of 2.50, a current ratio of 2.99 and a debt-to-equity ratio of 1.18.

Installed Building Products Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Tuesday, December 31st. Investors of record on Sunday, December 15th will be issued a dividend of $0.35 per share. The ex-dividend date is Friday, December 13th. This represents a $1.40 dividend on an annualized basis and a yield of 0.67%. Installed Building Products's dividend payout ratio is presently 15.56%.

About Installed Building Products

(

Free Report)

Installed Building Products, Inc, together with its subsidiaries, engages in the installation of insulation, waterproofing, fire-stopping, fireproofing, garage doors, rain gutters, window blinds, shower doors, closet shelving and mirrors, and other products in the United States. It operates through Installation, Distribution, and Manufacturing operation segments.

Featured Articles

Before you consider Installed Building Products, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Installed Building Products wasn't on the list.

While Installed Building Products currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.