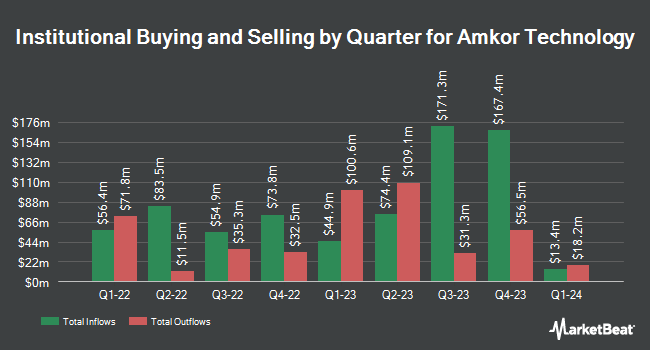

Segall Bryant & Hamill LLC lowered its holdings in Amkor Technology, Inc. (NASDAQ:AMKR - Free Report) by 26.2% during the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 120,258 shares of the semiconductor company's stock after selling 42,595 shares during the period. Segall Bryant & Hamill LLC's holdings in Amkor Technology were worth $3,680,000 at the end of the most recent reporting period.

A number of other hedge funds and other institutional investors have also made changes to their positions in the business. 1620 Investment Advisors Inc. acquired a new position in shares of Amkor Technology in the 2nd quarter valued at $31,000. Ashton Thomas Private Wealth LLC purchased a new position in shares of Amkor Technology in the second quarter worth approximately $40,000. Larson Financial Group LLC raised its holdings in shares of Amkor Technology by 911.3% during the second quarter. Larson Financial Group LLC now owns 1,254 shares of the semiconductor company's stock valued at $50,000 after acquiring an additional 1,130 shares during the period. Capital Performance Advisors LLP purchased a new stake in shares of Amkor Technology in the 3rd quarter valued at approximately $39,000. Finally, Rothschild Investment LLC acquired a new stake in Amkor Technology during the 2nd quarter worth about $52,000. 42.76% of the stock is currently owned by institutional investors.

Analysts Set New Price Targets

Several brokerages recently commented on AMKR. StockNews.com cut Amkor Technology from a "buy" rating to a "hold" rating in a research note on Tuesday, October 29th. Morgan Stanley reduced their price target on shares of Amkor Technology from $35.00 to $26.00 and set an "equal weight" rating for the company in a report on Tuesday, October 29th. KeyCorp cut their price objective on shares of Amkor Technology from $38.00 to $34.00 and set an "overweight" rating for the company in a research report on Tuesday, October 29th. The Goldman Sachs Group decreased their target price on Amkor Technology from $36.00 to $32.00 and set a "neutral" rating on the stock in a research report on Tuesday, October 29th. Finally, JPMorgan Chase & Co. cut their price target on Amkor Technology from $48.00 to $42.00 and set an "overweight" rating for the company in a report on Tuesday, October 29th. Four equities research analysts have rated the stock with a hold rating and five have issued a buy rating to the company's stock. Based on data from MarketBeat, the company has an average rating of "Moderate Buy" and a consensus price target of $36.29.

View Our Latest Analysis on AMKR

Insider Transactions at Amkor Technology

In other Amkor Technology news, CEO Guillaume Marie Jean Rutten sold 10,000 shares of the firm's stock in a transaction dated Tuesday, October 15th. The shares were sold at an average price of $31.51, for a total value of $315,100.00. Following the completion of the sale, the chief executive officer now owns 204,971 shares in the company, valued at approximately $6,458,636.21. This trade represents a 4.65 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Also, Director Winston J. Churchill sold 20,000 shares of the business's stock in a transaction dated Tuesday, August 27th. The stock was sold at an average price of $32.97, for a total transaction of $659,400.00. Following the completion of the transaction, the director now directly owns 19,871 shares of the company's stock, valued at approximately $655,146.87. This represents a 50.16 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 31.40% of the stock is owned by company insiders.

Amkor Technology Price Performance

Shares of AMKR stock traded up $0.19 during trading hours on Friday, hitting $26.54. The company had a trading volume of 801,621 shares, compared to its average volume of 1,579,365. The firm's fifty day moving average is $28.85 and its 200 day moving average is $32.69. Amkor Technology, Inc. has a 12 month low of $24.10 and a 12 month high of $44.86. The firm has a market capitalization of $6.55 billion, a price-to-earnings ratio of 17.93 and a beta of 1.85. The company has a debt-to-equity ratio of 0.21, a quick ratio of 1.84 and a current ratio of 2.06.

Amkor Technology (NASDAQ:AMKR - Get Free Report) last posted its earnings results on Monday, October 28th. The semiconductor company reported $0.49 earnings per share for the quarter, missing the consensus estimate of $0.50 by ($0.01). Amkor Technology had a return on equity of 8.98% and a net margin of 5.68%. The firm had revenue of $1.86 billion during the quarter, compared to the consensus estimate of $1.84 billion. During the same period in the previous year, the company posted $0.54 EPS. The firm's revenue for the quarter was up 2.2% compared to the same quarter last year. On average, sell-side analysts predict that Amkor Technology, Inc. will post 1.42 EPS for the current fiscal year.

Amkor Technology Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Monday, December 23rd. Stockholders of record on Wednesday, December 4th will be paid a $0.0827 dividend. The ex-dividend date is Wednesday, December 4th. This represents a $0.33 dividend on an annualized basis and a dividend yield of 1.25%. This is a boost from Amkor Technology's previous quarterly dividend of $0.08. Amkor Technology's payout ratio is 20.95%.

Amkor Technology Company Profile

(

Free Report)

Amkor Technology, Inc provides outsourced semiconductor packaging and test services in the United States, Japan, Europe, the Middle East, Africa, and the Asia Pacific. It offers turnkey packaging and test services, including semiconductor wafer bump, wafer probe, wafer back-grind, package design, packaging, system-level and final test, and drop shipment services; flip chip scale package products for smartphones, tablets, and other mobile consumer electronic devices; flip chip stacked chip scale packages that are used to stack memory digital baseband, and as applications processors in mobile devices; flip-chip ball grid array packages for various networking, storage, computing, automotive, and consumer applications; and memory products for system memory or platform data storage.

Featured Articles

Before you consider Amkor Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amkor Technology wasn't on the list.

While Amkor Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.