Sei Investments Co. trimmed its stake in Astera Labs, Inc. (NASDAQ:ALAB - Free Report) by 21.0% during the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 99,198 shares of the company's stock after selling 26,405 shares during the period. Sei Investments Co. owned approximately 0.06% of Astera Labs worth $13,136,000 at the end of the most recent quarter.

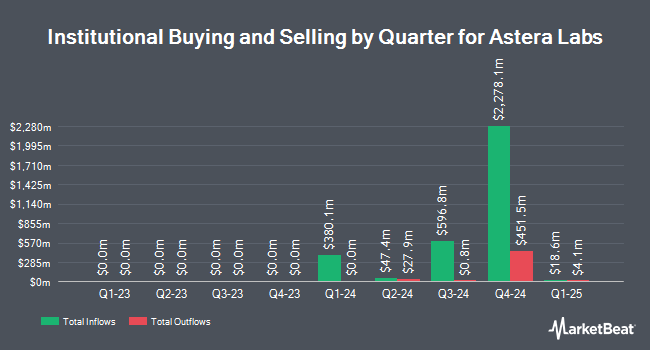

Other hedge funds and other institutional investors have also recently bought and sold shares of the company. Whittier Trust Co. of Nevada Inc. acquired a new position in Astera Labs in the fourth quarter valued at $25,000. Steward Partners Investment Advisory LLC boosted its position in shares of Astera Labs by 99.0% in the 4th quarter. Steward Partners Investment Advisory LLC now owns 199 shares of the company's stock valued at $26,000 after purchasing an additional 99 shares during the period. Kestra Investment Management LLC acquired a new stake in shares of Astera Labs in the 4th quarter valued at about $28,000. Geneos Wealth Management Inc. purchased a new position in Astera Labs during the 4th quarter worth approximately $36,000. Finally, Global Retirement Partners LLC increased its position in Astera Labs by 3,155.6% during the fourth quarter. Global Retirement Partners LLC now owns 293 shares of the company's stock worth $39,000 after buying an additional 284 shares during the period. 60.47% of the stock is currently owned by institutional investors and hedge funds.

Analysts Set New Price Targets

A number of equities analysts have recently issued reports on ALAB shares. Northland Securities upgraded shares of Astera Labs from a "market perform" rating to an "outperform" rating and set a $120.00 target price on the stock in a research report on Tuesday, January 28th. Stifel Nicolaus raised their price objective on shares of Astera Labs from $100.00 to $150.00 and gave the stock a "buy" rating in a research report on Monday, January 6th. Morgan Stanley dropped their price objective on shares of Astera Labs from $142.00 to $114.00 and set an "equal weight" rating on the stock in a research note on Tuesday, January 28th. Needham & Company LLC reiterated a "buy" rating and set a $140.00 target price on shares of Astera Labs in a research note on Tuesday, February 11th. Finally, Northland Capmk upgraded Astera Labs from a "hold" rating to a "strong-buy" rating in a research report on Tuesday, January 28th. One equities research analyst has rated the stock with a hold rating, twelve have issued a buy rating and one has given a strong buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Buy" and a consensus target price of $112.77.

Read Our Latest Stock Report on ALAB

Astera Labs Stock Up 3.3 %

Shares of Astera Labs stock traded up $2.07 during trading on Wednesday, reaching $64.08. The company's stock had a trading volume of 4,512,056 shares, compared to its average volume of 3,673,721. The business has a 50 day moving average price of $81.10 and a 200-day moving average price of $90.61. Astera Labs, Inc. has a 12-month low of $36.22 and a 12-month high of $147.39. The company has a market capitalization of $10.39 billion and a P/E ratio of -37.04.

Astera Labs (NASDAQ:ALAB - Get Free Report) last released its earnings results on Monday, February 10th. The company reported $0.10 EPS for the quarter, missing analysts' consensus estimates of $0.26 by ($0.16). Astera Labs had a negative net margin of 21.05% and a negative return on equity of 10.40%. Research analysts predict that Astera Labs, Inc. will post 0.34 EPS for the current fiscal year.

Insider Buying and Selling

In other news, CEO Jitendra Mohan sold 350,680 shares of Astera Labs stock in a transaction that occurred on Wednesday, February 19th. The shares were sold at an average price of $89.51, for a total transaction of $31,389,366.80. Following the completion of the sale, the chief executive officer now directly owns 2,353,655 shares in the company, valued at approximately $210,675,659.05. This trade represents a 12.97 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, Director Michael E. Hurlston sold 2,500 shares of the company's stock in a transaction that occurred on Tuesday, February 18th. The stock was sold at an average price of $92.08, for a total value of $230,200.00. Following the completion of the sale, the director now owns 91,794 shares in the company, valued at approximately $8,452,391.52. This represents a 2.65 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 570,990 shares of company stock valued at $50,242,702.

Astera Labs Company Profile

(

Free Report)

Astera Labs, Inc designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure. Its Intelligent Connectivity Platform is comprised of a portfolio of data, network, and memory connectivity products, which are built on a unifying software-defined architecture that enables customers to deploy and operate high performance cloud and AI infrastructure at scale.

Recommended Stories

Before you consider Astera Labs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Astera Labs wasn't on the list.

While Astera Labs currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.