Sei Investments Co. lifted its holdings in W. P. Carey Inc. (NYSE:WPC - Free Report) by 17.1% in the 4th quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 56,085 shares of the real estate investment trust's stock after acquiring an additional 8,197 shares during the period. Sei Investments Co.'s holdings in W. P. Carey were worth $3,056,000 as of its most recent SEC filing.

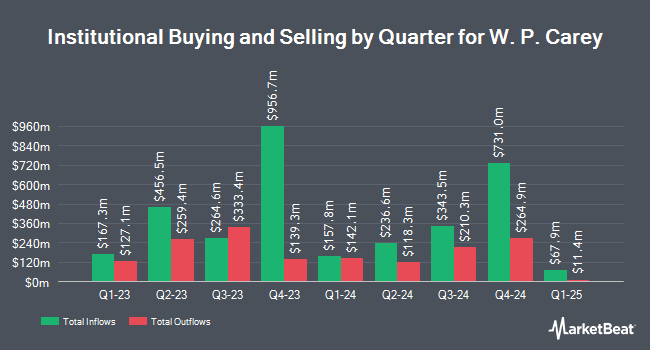

A number of other hedge funds have also made changes to their positions in WPC. National Pension Service acquired a new stake in W. P. Carey in the 4th quarter valued at $25,000. Wingate Wealth Advisors Inc. acquired a new stake in shares of W. P. Carey in the fourth quarter valued at about $37,000. Millstone Evans Group LLC acquired a new stake in shares of W. P. Carey in the fourth quarter valued at about $37,000. Plato Investment Management Ltd purchased a new stake in shares of W. P. Carey during the 4th quarter valued at about $48,000. Finally, Roxbury Financial LLC acquired a new position in W. P. Carey during the 4th quarter worth approximately $58,000. Hedge funds and other institutional investors own 73.73% of the company's stock.

W. P. Carey Stock Down 1.7 %

Shares of W. P. Carey stock traded down $0.95 during trading on Tuesday, reaching $56.01. The company had a trading volume of 1,333,222 shares, compared to its average volume of 1,183,238. The company has a debt-to-equity ratio of 0.95, a quick ratio of 0.98 and a current ratio of 0.98. W. P. Carey Inc. has a fifty-two week low of $52.91 and a fifty-two week high of $66.10. The firm's fifty day moving average is $60.70 and its 200-day moving average is $58.23. The company has a market cap of $12.26 billion, a price-to-earnings ratio of 26.80, a price-to-earnings-growth ratio of 1.06 and a beta of 0.81.

W. P. Carey Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, April 15th. Shareholders of record on Monday, March 31st will be paid a dividend of $0.89 per share. The ex-dividend date of this dividend is Monday, March 31st. This represents a $3.56 annualized dividend and a yield of 6.36%. This is a boost from W. P. Carey's previous quarterly dividend of $0.88. W. P. Carey's dividend payout ratio is presently 170.33%.

Analyst Ratings Changes

WPC has been the subject of several recent research reports. Scotiabank increased their price objective on shares of W. P. Carey from $59.00 to $63.00 and gave the company a "sector perform" rating in a research report on Wednesday, March 12th. Royal Bank of Canada lifted their price target on shares of W. P. Carey from $61.00 to $62.00 and gave the stock an "outperform" rating in a research note on Thursday, February 13th. BMO Capital Markets upgraded shares of W. P. Carey from a "market perform" rating to an "outperform" rating and boosted their price objective for the stock from $60.00 to $67.00 in a report on Tuesday, February 18th. Evercore ISI raised their target price on W. P. Carey from $60.00 to $64.00 and gave the company an "in-line" rating in a research note on Wednesday, February 19th. Finally, Wells Fargo & Company boosted their price target on W. P. Carey from $58.00 to $66.00 and gave the stock an "equal weight" rating in a research note on Monday, March 10th. One investment analyst has rated the stock with a sell rating, five have assigned a hold rating and three have given a buy rating to the stock. According to data from MarketBeat.com, the company has a consensus rating of "Hold" and a consensus target price of $63.75.

View Our Latest Stock Report on WPC

W. P. Carey Company Profile

(

Free Report)

W. P. Carey ranks among the largest net lease REITs with a well-diversified portfolio of high-quality, operationally critical commercial real estate, which includes 1,424 net lease properties covering approximately 173 million square feet and a portfolio of 89 self-storage operating properties as of December 31, 2023.

Read More

Before you consider W. P. Carey, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and W. P. Carey wasn't on the list.

While W. P. Carey currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.