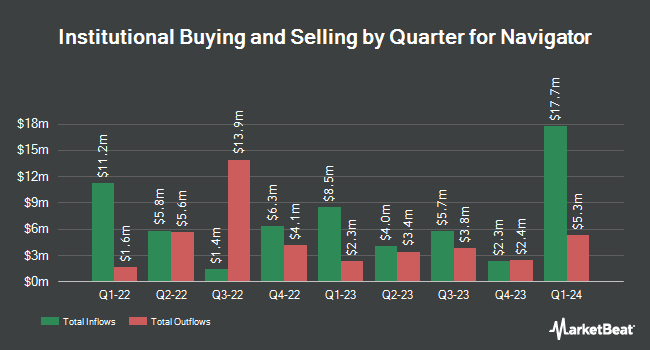

Sei Investments Co. lifted its position in shares of Navigator Holdings Ltd. (NYSE:NVGS - Free Report) by 30.8% during the fourth quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 117,108 shares of the shipping company's stock after purchasing an additional 27,584 shares during the quarter. Sei Investments Co. owned 0.16% of Navigator worth $1,798,000 at the end of the most recent reporting period.

Other institutional investors and hedge funds also recently made changes to their positions in the company. R Squared Ltd bought a new stake in Navigator during the 4th quarter worth approximately $31,000. Quarry LP boosted its holdings in shares of Navigator by 61.0% in the third quarter. Quarry LP now owns 4,383 shares of the shipping company's stock valued at $70,000 after buying an additional 1,661 shares during the period. Point72 Asset Management L.P. increased its position in shares of Navigator by 754.5% during the third quarter. Point72 Asset Management L.P. now owns 18,800 shares of the shipping company's stock worth $302,000 after acquiring an additional 16,600 shares in the last quarter. Barclays PLC raised its holdings in shares of Navigator by 10.7% during the third quarter. Barclays PLC now owns 19,640 shares of the shipping company's stock worth $316,000 after acquiring an additional 1,895 shares during the period. Finally, Magnetar Financial LLC acquired a new stake in shares of Navigator during the fourth quarter worth $361,000. Institutional investors and hedge funds own 18.95% of the company's stock.

Navigator Stock Down 3.1 %

NVGS traded down $0.38 during trading hours on Thursday, hitting $11.85. 457,602 shares of the company's stock were exchanged, compared to its average volume of 216,995. The stock has a market cap of $822.02 million, a price-to-earnings ratio of 10.48 and a beta of 1.07. Navigator Holdings Ltd. has a 1-year low of $10.55 and a 1-year high of $18.18. The stock's 50-day moving average is $14.45 and its two-hundred day moving average is $15.43. The company has a quick ratio of 0.71, a current ratio of 0.75 and a debt-to-equity ratio of 0.45.

Navigator (NYSE:NVGS - Get Free Report) last announced its quarterly earnings data on Wednesday, March 12th. The shipping company reported $0.38 earnings per share for the quarter, beating the consensus estimate of $0.37 by $0.01. Navigator had a return on equity of 7.40% and a net margin of 14.48%. The company had revenue of $144.03 million during the quarter, compared to analysts' expectations of $120.87 million. Sell-side analysts predict that Navigator Holdings Ltd. will post 1.25 earnings per share for the current fiscal year.

Navigator Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Thursday, April 3rd. Shareholders of record on Monday, March 24th were given a dividend of $0.05 per share. This represents a $0.20 annualized dividend and a dividend yield of 1.69%. The ex-dividend date was Monday, March 24th. Navigator's dividend payout ratio (DPR) is 16.67%.

Wall Street Analysts Forecast Growth

Separately, Jefferies Financial Group reiterated a "buy" rating and set a $20.00 target price on shares of Navigator in a report on Wednesday, March 12th. Six investment analysts have rated the stock with a buy rating, According to data from MarketBeat, the stock presently has an average rating of "Buy" and a consensus target price of $21.60.

Get Our Latest Analysis on Navigator

Navigator Company Profile

(

Free Report)

Navigator Holdings Ltd. engages in owning and operating a fleet of liquefied gas carriers worldwide. It provides international and regional seaborne transportation services of petrochemical gases, liquefied petroleum gases, and ammonia for energy companies, industrial users, and commodity traders. The company also offers ship shore infrastructure and consultancy services.

Featured Stories

Before you consider Navigator, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Navigator wasn't on the list.

While Navigator currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.