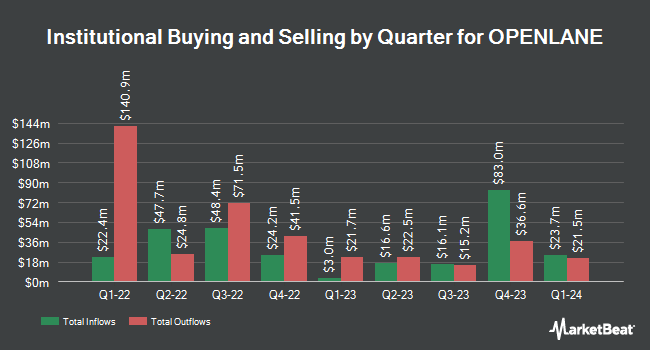

Sei Investments Co. lowered its stake in shares of OPENLANE, Inc. (NYSE:KAR - Free Report) by 14.4% during the fourth quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 115,954 shares of the specialty retailer's stock after selling 19,571 shares during the quarter. Sei Investments Co. owned about 0.11% of OPENLANE worth $2,300,000 at the end of the most recent quarter.

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Smartleaf Asset Management LLC lifted its holdings in shares of OPENLANE by 435.9% during the fourth quarter. Smartleaf Asset Management LLC now owns 2,535 shares of the specialty retailer's stock worth $51,000 after purchasing an additional 2,062 shares during the period. KBC Group NV boosted its holdings in shares of OPENLANE by 51.1% in the fourth quarter. KBC Group NV now owns 5,314 shares of the specialty retailer's stock valued at $105,000 after acquiring an additional 1,798 shares in the last quarter. Pacer Advisors Inc. acquired a new position in shares of OPENLANE during the fourth quarter worth about $187,000. Versor Investments LP purchased a new position in OPENLANE during the fourth quarter worth about $254,000. Finally, Natixis Advisors LLC lifted its position in OPENLANE by 19.9% in the fourth quarter. Natixis Advisors LLC now owns 15,137 shares of the specialty retailer's stock valued at $300,000 after purchasing an additional 2,512 shares during the period. 99.76% of the stock is owned by hedge funds and other institutional investors.

OPENLANE Stock Performance

KAR stock traded up $1.41 on Wednesday, reaching $18.98. The company had a trading volume of 1,012,966 shares, compared to its average volume of 738,554. OPENLANE, Inc. has a 1 year low of $15.44 and a 1 year high of $22.47. The company's fifty day moving average is $20.42 and its 200 day moving average is $19.39. The company has a market cap of $2.03 billion, a P/E ratio of 35.81, a PEG ratio of 1.85 and a beta of 1.38.

OPENLANE (NYSE:KAR - Get Free Report) last released its quarterly earnings results on Wednesday, February 19th. The specialty retailer reported $0.21 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.20 by $0.01. OPENLANE had a net margin of 6.27% and a return on equity of 9.20%. The company had revenue of $455.00 million for the quarter, compared to analysts' expectations of $416.64 million. On average, sell-side analysts predict that OPENLANE, Inc. will post 0.95 earnings per share for the current year.

Wall Street Analyst Weigh In

Several analysts have recently commented on KAR shares. JPMorgan Chase & Co. cut OPENLANE from an "overweight" rating to a "neutral" rating and reduced their price target for the company from $23.00 to $20.00 in a report on Thursday, March 27th. StockNews.com downgraded shares of OPENLANE from a "buy" rating to a "hold" rating in a report on Friday, March 28th. Barrington Research reaffirmed an "outperform" rating and issued a $25.00 target price on shares of OPENLANE in a report on Friday, February 21st. Finally, Stephens raised OPENLANE from an "equal weight" rating to an "overweight" rating and boosted their price target for the stock from $20.00 to $26.00 in a research note on Friday, February 28th. Three analysts have rated the stock with a hold rating and three have issued a buy rating to the stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $22.20.

View Our Latest Report on OPENLANE

OPENLANE Company Profile

(

Free Report)

OPENLANE, Inc, together with its subsidiaries, operates as a digital marketplace for used vehicles, which connects sellers and buyers in North America, Europe, the Philippines, and Uruguay. The company operates through two segments, Marketplace and Finance. The Marketplace segment offers digital marketplace services for buying and selling used vehicles.

Read More

Before you consider OPENLANE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and OPENLANE wasn't on the list.

While OPENLANE currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.