Sei Investments Co. acquired a new position in IDT Co. (NYSE:IDT - Free Report) in the 4th quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm acquired 6,193 shares of the utilities provider's stock, valued at approximately $294,000.

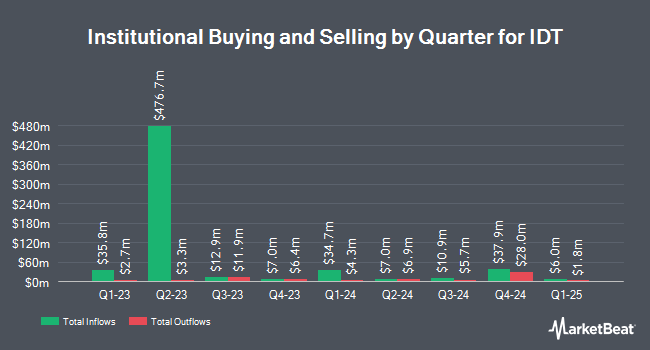

Other hedge funds and other institutional investors have also added to or reduced their stakes in the company. Geode Capital Management LLC raised its position in shares of IDT by 6.5% during the 3rd quarter. Geode Capital Management LLC now owns 421,096 shares of the utilities provider's stock valued at $16,077,000 after buying an additional 25,541 shares in the last quarter. State Street Corp increased its holdings in IDT by 0.5% during the 3rd quarter. State Street Corp now owns 390,145 shares of the utilities provider's stock valued at $14,911,000 after purchasing an additional 2,071 shares during the period. Charles Schwab Investment Management Inc. lifted its holdings in IDT by 3.1% in the 4th quarter. Charles Schwab Investment Management Inc. now owns 162,665 shares of the utilities provider's stock worth $7,730,000 after buying an additional 4,857 shares during the period. Bank of New York Mellon Corp increased its stake in shares of IDT by 76.3% during the fourth quarter. Bank of New York Mellon Corp now owns 111,536 shares of the utilities provider's stock valued at $5,300,000 after buying an additional 48,288 shares during the period. Finally, FMR LLC boosted its holdings in IDT by 26.8% in the third quarter. FMR LLC now owns 83,868 shares of the utilities provider's stock valued at $3,201,000 after acquiring an additional 17,725 shares in the last quarter. 59.34% of the stock is currently owned by institutional investors.

IDT Stock Performance

Shares of IDT stock traded up $0.32 during midday trading on Wednesday, hitting $49.41. The company had a trading volume of 3,672 shares, compared to its average volume of 97,626. The company has a 50 day moving average of $49.20 and a 200 day moving average of $48.21. The stock has a market capitalization of $1.25 billion, a P/E ratio of 16.92 and a beta of 0.58. IDT Co. has a 52-week low of $33.84 and a 52-week high of $58.77.

IDT (NYSE:IDT - Get Free Report) last announced its quarterly earnings results on Thursday, March 6th. The utilities provider reported $0.81 earnings per share (EPS) for the quarter. The company had revenue of $303.35 million for the quarter. IDT had a net margin of 6.10% and a return on equity of 22.18%.

IDT Increases Dividend

The business also recently announced a quarterly dividend, which was paid on Tuesday, March 25th. Shareholders of record on Monday, March 17th were paid a dividend of $0.06 per share. The ex-dividend date was Monday, March 17th. This represents a $0.24 annualized dividend and a yield of 0.49%. This is a boost from IDT's previous quarterly dividend of $0.05. IDT's dividend payout ratio is currently 7.62%.

Analyst Ratings Changes

Separately, StockNews.com raised IDT from a "buy" rating to a "strong-buy" rating in a research report on Tuesday, March 18th.

Read Our Latest Research Report on IDT

Insider Activity

In related news, CTO David Wartell sold 10,735 shares of the company's stock in a transaction on Tuesday, March 18th. The stock was sold at an average price of $48.99, for a total transaction of $525,907.65. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Insiders own 25.32% of the company's stock.

IDT Company Profile

(

Free Report)

IDT Corporation provides communications and payment services in the United States, the United Kingdom, and internationally. It operates through Fintech, National Retail Solutions, net2phone, and Traditional Communications segments. The company operates point of sale, a terminal-based platform which provides independent retailers store management software, electronic payment processing, and other ancillary merchant services; and provides marketers with digital out-of-home advertising and transaction data.

Further Reading

Before you consider IDT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IDT wasn't on the list.

While IDT currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.