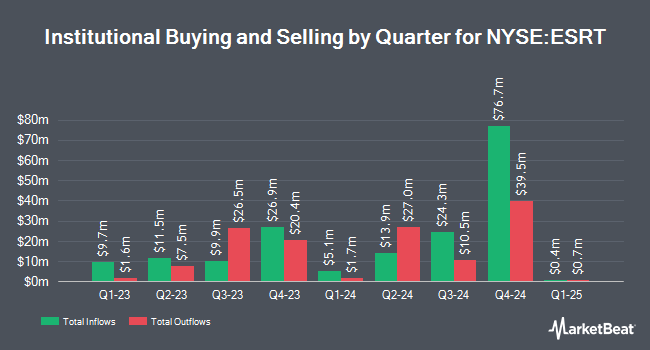

Sei Investments Co. decreased its stake in shares of Empire State Realty Trust, Inc. (NYSE:ESRT - Free Report) by 88.9% during the 4th quarter, according to the company in its most recent filing with the SEC. The firm owned 69,030 shares of the real estate investment trust's stock after selling 554,476 shares during the quarter. Sei Investments Co.'s holdings in Empire State Realty Trust were worth $712,000 as of its most recent filing with the SEC.

Other large investors have also made changes to their positions in the company. Versor Investments LP bought a new position in Empire State Realty Trust in the fourth quarter worth $105,000. Quadrature Capital Ltd acquired a new position in shares of Empire State Realty Trust in the 3rd quarter valued at $115,000. Inspire Advisors LLC acquired a new position in shares of Empire State Realty Trust in the 4th quarter valued at $125,000. Cibc World Markets Corp bought a new position in shares of Empire State Realty Trust during the 4th quarter worth about $132,000. Finally, Longboard Asset Management LP acquired a new stake in shares of Empire State Realty Trust during the 4th quarter valued at about $137,000. Institutional investors and hedge funds own 67.10% of the company's stock.

Empire State Realty Trust Price Performance

Shares of Empire State Realty Trust stock traded up $0.18 during mid-day trading on Friday, reaching $7.04. 1,372,281 shares of the stock were exchanged, compared to its average volume of 1,191,177. Empire State Realty Trust, Inc. has a fifty-two week low of $6.56 and a fifty-two week high of $11.62. The firm has a 50-day simple moving average of $8.32 and a 200 day simple moving average of $9.76. The company has a current ratio of 3.72, a quick ratio of 3.72 and a debt-to-equity ratio of 1.23. The company has a market cap of $1.18 billion, a price-to-earnings ratio of 25.13 and a beta of 1.39.

Empire State Realty Trust (NYSE:ESRT - Get Free Report) last released its quarterly earnings results on Wednesday, February 19th. The real estate investment trust reported $0.24 earnings per share for the quarter, beating analysts' consensus estimates of $0.05 by $0.19. The firm had revenue of $155.13 million during the quarter, compared to analysts' expectations of $192.62 million. Empire State Realty Trust had a return on equity of 2.84% and a net margin of 6.45%. On average, sell-side analysts predict that Empire State Realty Trust, Inc. will post 0.88 EPS for the current fiscal year.

Empire State Realty Trust Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Monday, March 31st. Investors of record on Friday, March 14th were given a dividend of $0.035 per share. The ex-dividend date was Friday, March 14th. This represents a $0.14 annualized dividend and a yield of 1.99%. Empire State Realty Trust's dividend payout ratio (DPR) is 50.00%.

Analysts Set New Price Targets

ESRT has been the subject of several recent research reports. Wolfe Research raised shares of Empire State Realty Trust from a "peer perform" rating to an "outperform" rating and set a $10.00 price target for the company in a research report on Tuesday, March 25th. StockNews.com raised Empire State Realty Trust from a "sell" rating to a "hold" rating in a report on Thursday, April 3rd.

View Our Latest Analysis on ESRT

Insiders Place Their Bets

In other news, EVP Thomas P. Durels sold 11,843 shares of the business's stock in a transaction on Monday, March 24th. The stock was sold at an average price of $8.02, for a total transaction of $94,980.86. Following the completion of the sale, the executive vice president now owns 44,185 shares in the company, valued at $354,363.70. The trade was a 21.14 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available through this link. Over the last three months, insiders sold 30,122 shares of company stock valued at $242,761. Insiders own 13.95% of the company's stock.

About Empire State Realty Trust

(

Free Report)

Empire State Realty Trust, Inc NYSE: ESRT is a NYC-focused REIT that owns and operates a portfolio of modernized, amenitized, and well-located office, retail, and multifamily assets. The company is the recognized leader in energy efficiency and indoor environmental quality. ESRT's flagship Empire State Building - the "World's Most Famous Building" - includes its Observatory, Tripadvisor's 2023 Travelers' Choice Awards: Best of the Best the #1 attraction in the US for two consecutive years.

See Also

Before you consider Empire State Realty Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Empire State Realty Trust wasn't on the list.

While Empire State Realty Trust currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.