Sellaronda Global Management LP acquired a new stake in TKO Group Holdings, Inc. (NYSE:TKO - Free Report) in the 4th quarter, according to its most recent filing with the SEC. The fund acquired 90,000 shares of the company's stock, valued at approximately $12,790,000. TKO Group accounts for about 12.9% of Sellaronda Global Management LP's investment portfolio, making the stock its 2nd biggest holding. Sellaronda Global Management LP owned about 0.05% of TKO Group as of its most recent SEC filing.

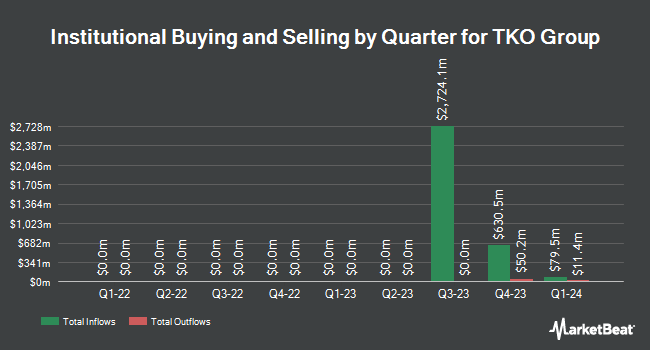

A number of other large investors have also bought and sold shares of TKO. HighTower Advisors LLC boosted its holdings in shares of TKO Group by 177.2% in the third quarter. HighTower Advisors LLC now owns 26,197 shares of the company's stock valued at $3,225,000 after buying an additional 16,746 shares during the period. Janus Henderson Group PLC lifted its position in TKO Group by 1.1% in the 3rd quarter. Janus Henderson Group PLC now owns 34,245 shares of the company's stock valued at $4,237,000 after acquiring an additional 367 shares in the last quarter. Integrated Wealth Concepts LLC boosted its stake in TKO Group by 6.2% in the 3rd quarter. Integrated Wealth Concepts LLC now owns 2,126 shares of the company's stock worth $263,000 after purchasing an additional 125 shares during the period. Quantinno Capital Management LP boosted its stake in TKO Group by 0.7% in the 3rd quarter. Quantinno Capital Management LP now owns 28,675 shares of the company's stock worth $3,547,000 after purchasing an additional 207 shares during the period. Finally, Stifel Financial Corp increased its holdings in TKO Group by 3.0% during the 3rd quarter. Stifel Financial Corp now owns 24,837 shares of the company's stock worth $3,073,000 after purchasing an additional 729 shares in the last quarter. 89.79% of the stock is owned by institutional investors.

Analyst Ratings Changes

TKO has been the subject of several recent research reports. Benchmark reaffirmed a "hold" rating on shares of TKO Group in a research report on Monday, March 3rd. Seaport Res Ptn raised TKO Group from a "hold" rating to a "strong-buy" rating in a research report on Tuesday, March 4th. UBS Group lifted their price objective on shares of TKO Group from $135.00 to $170.00 and gave the company a "buy" rating in a report on Tuesday, January 7th. The Goldman Sachs Group boosted their price objective on shares of TKO Group from $142.00 to $165.00 and gave the stock a "buy" rating in a research report on Friday, January 24th. Finally, Citigroup raised their target price on shares of TKO Group from $137.00 to $170.00 and gave the company a "buy" rating in a research report on Tuesday, December 17th. Two analysts have rated the stock with a hold rating, ten have assigned a buy rating and one has given a strong buy rating to the company's stock. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and a consensus target price of $159.36.

Check Out Our Latest Research Report on TKO Group

Insider Buying and Selling at TKO Group

In other TKO Group news, CEO Ariel Emanuel bought 115,952 shares of the firm's stock in a transaction on Wednesday, January 22nd. The shares were purchased at an average price of $143.85 per share, for a total transaction of $16,679,695.20. Following the transaction, the chief executive officer now directly owns 1,031,804 shares in the company, valued at approximately $148,425,005.40. This trade represents a 12.66 % increase in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, Director Sonya E. Medina purchased 233 shares of the company's stock in a transaction dated Monday, March 17th. The stock was acquired at an average price of $142.93 per share, with a total value of $33,302.69. Following the completion of the transaction, the director now owns 2,000 shares of the company's stock, valued at $285,860. This represents a 13.19 % increase in their position. The disclosure for this purchase can be found here. In the last three months, insiders have purchased 1,921,383 shares of company stock valued at $304,417,051 and have sold 5,833 shares valued at $838,785. Insiders own 53.80% of the company's stock.

TKO Group Stock Performance

TKO stock traded down $0.85 during midday trading on Friday, reaching $144.24. 1,233,871 shares of the company were exchanged, compared to its average volume of 1,090,779. The firm has a market capitalization of $24.69 billion, a price-to-earnings ratio of -343.43 and a beta of 0.90. The business has a 50-day moving average price of $153.95 and a two-hundred day moving average price of $141.59. TKO Group Holdings, Inc. has a one year low of $94.32 and a one year high of $179.09. The company has a debt-to-equity ratio of 0.34, a current ratio of 1.17 and a quick ratio of 1.17.

TKO Group Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Monday, March 31st. Investors of record on Friday, March 14th were paid a $0.38 dividend. The ex-dividend date of this dividend was Friday, March 14th. This represents a $1.52 dividend on an annualized basis and a yield of 1.05%. TKO Group's dividend payout ratio (DPR) is currently 7,600.00%.

TKO Group Profile

(

Free Report)

TKO Group Holdings, Inc operates as a sports and entertainment company. The company produces and licenses live events, television programs, and long-form and short-form content, reality series, and other filmed entertainment on digital and linear channels and via pay-per-view. It is involved in the merchandising of video games, apparel, equipment, trading cards, memorabilia, digital goods, and toys, as well as sale of travel packages and tickets.

See Also

Before you consider TKO Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TKO Group wasn't on the list.

While TKO Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for April 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report