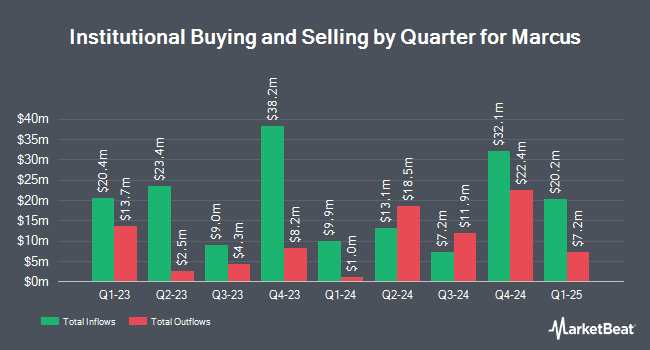

Semanteon Capital Management LP acquired a new position in shares of The Marcus Co. (NYSE:MCS - Free Report) in the fourth quarter, according to its most recent 13F filing with the SEC. The institutional investor acquired 26,996 shares of the company's stock, valued at approximately $580,000. Semanteon Capital Management LP owned about 0.09% of Marcus at the end of the most recent reporting period.

A number of other institutional investors also recently added to or reduced their stakes in MCS. Ieq Capital LLC bought a new stake in shares of Marcus in the 4th quarter valued at about $220,000. Y Intercept Hong Kong Ltd acquired a new stake in Marcus in the fourth quarter valued at approximately $274,000. SG Americas Securities LLC grew its holdings in Marcus by 54.9% in the fourth quarter. SG Americas Securities LLC now owns 19,944 shares of the company's stock worth $429,000 after purchasing an additional 7,067 shares during the last quarter. Walleye Trading LLC increased its position in shares of Marcus by 14.5% during the third quarter. Walleye Trading LLC now owns 34,000 shares of the company's stock worth $512,000 after purchasing an additional 4,300 shares in the last quarter. Finally, Proficio Capital Partners LLC purchased a new stake in shares of Marcus during the 4th quarter valued at $680,000. Institutional investors own 81.57% of the company's stock.

Wall Street Analysts Forecast Growth

Several equities research analysts have weighed in on the company. Benchmark reissued a "buy" rating and issued a $25.00 price target on shares of Marcus in a report on Thursday, January 30th. StockNews.com downgraded shares of Marcus from a "buy" rating to a "hold" rating in a research report on Tuesday, March 11th. Finally, Barrington Research restated an "outperform" rating and set a $27.00 price target on shares of Marcus in a research note on Thursday, February 27th.

Get Our Latest Stock Report on MCS

Marcus Stock Performance

Shares of NYSE:MCS traded up $0.23 during trading on Wednesday, hitting $17.41. The stock had a trading volume of 138,673 shares, compared to its average volume of 435,851. The company has a quick ratio of 0.54, a current ratio of 0.54 and a debt-to-equity ratio of 0.38. The Marcus Co. has a 12-month low of $9.56 and a 12-month high of $23.16. The stock has a market capitalization of $552.72 million, a price-to-earnings ratio of -51.20, a price-to-earnings-growth ratio of 3.12 and a beta of 1.57. The stock has a 50-day simple moving average of $19.40 and a two-hundred day simple moving average of $19.18.

Marcus Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Monday, March 17th. Shareholders of record on Tuesday, February 25th were given a dividend of $0.07 per share. This represents a $0.28 dividend on an annualized basis and a yield of 1.61%. The ex-dividend date was Tuesday, February 25th. Marcus's dividend payout ratio is presently -107.69%.

Marcus Company Profile

(

Free Report)

The Marcus Corporation, together with its subsidiaries, owns and operates movie theatres, and hotels and resorts in the United States. It operates a family entertainment center and multiscreen motion picture theatres under the Big Screen Bistro, Big Screen Bistro Express, BistroPlex, and Movie Tavern by Marcus brand names.

See Also

Before you consider Marcus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Marcus wasn't on the list.

While Marcus currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.