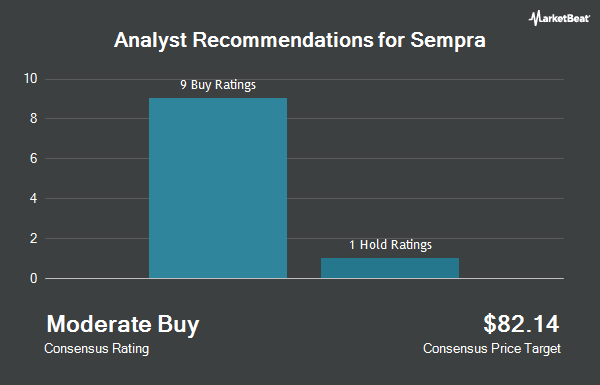

Sempra (NYSE:SRE - Get Free Report) has received an average recommendation of "Moderate Buy" from the eleven research firms that are currently covering the stock, Marketbeat Ratings reports. One research analyst has rated the stock with a hold rating and ten have assigned a buy rating to the company. The average 1-year price objective among brokers that have covered the stock in the last year is $89.00.

SRE has been the subject of several research reports. Jefferies Financial Group began coverage on Sempra in a research note on Thursday, October 24th. They issued a "buy" rating and a $98.00 target price for the company. Wells Fargo & Company boosted their price objective on Sempra from $87.00 to $96.00 and gave the stock an "overweight" rating in a report on Thursday. Barclays raised their target price on shares of Sempra from $87.00 to $89.00 and gave the company an "overweight" rating in a research note on Tuesday, October 1st. Morgan Stanley boosted their price target on shares of Sempra from $80.00 to $85.00 and gave the stock an "equal weight" rating in a research note on Wednesday, September 25th. Finally, BMO Capital Markets raised their price objective on shares of Sempra from $93.00 to $96.00 and gave the company an "outperform" rating in a research note on Monday, October 21st.

View Our Latest Analysis on SRE

Sempra Price Performance

Shares of SRE traded up $1.49 on Friday, hitting $91.25. The company's stock had a trading volume of 3,733,561 shares, compared to its average volume of 2,895,625. The company has a market capitalization of $57.77 billion, a PE ratio of 20.10, a PEG ratio of 2.82 and a beta of 0.75. Sempra has a fifty-two week low of $66.40 and a fifty-two week high of $91.88. The company has a 50 day moving average price of $83.60 and a 200 day moving average price of $79.21. The company has a debt-to-equity ratio of 0.86, a current ratio of 0.52 and a quick ratio of 0.41.

Sempra (NYSE:SRE - Get Free Report) last posted its quarterly earnings data on Wednesday, November 6th. The utilities provider reported $0.89 EPS for the quarter, missing analysts' consensus estimates of $1.06 by ($0.17). Sempra had a return on equity of 8.01% and a net margin of 22.63%. The business had revenue of $2.78 billion during the quarter, compared to analyst estimates of $3.54 billion. During the same period in the prior year, the firm posted $1.08 EPS. Sempra's revenue for the quarter was down 16.7% compared to the same quarter last year. On average, research analysts anticipate that Sempra will post 4.77 earnings per share for the current fiscal year.

Sempra Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, January 15th. Stockholders of record on Thursday, December 5th will be given a dividend of $0.62 per share. This represents a $2.48 annualized dividend and a dividend yield of 2.72%. The ex-dividend date of this dividend is Thursday, December 5th. Sempra's dividend payout ratio is 54.63%.

Institutional Investors Weigh In On Sempra

Institutional investors have recently added to or reduced their stakes in the stock. GSA Capital Partners LLP bought a new stake in Sempra in the 1st quarter valued at approximately $815,000. Envestnet Portfolio Solutions Inc. grew its position in Sempra by 12.1% in the first quarter. Envestnet Portfolio Solutions Inc. now owns 24,563 shares of the utilities provider's stock valued at $1,764,000 after purchasing an additional 2,645 shares in the last quarter. Empowered Funds LLC increased its position in shares of Sempra by 24.9% in the first quarter. Empowered Funds LLC now owns 9,896 shares of the utilities provider's stock valued at $711,000 after acquiring an additional 1,970 shares during the last quarter. SG Americas Securities LLC raised its holdings in Sempra by 249.9% during the first quarter. SG Americas Securities LLC now owns 155,854 shares of the utilities provider's stock worth $11,195,000 after acquiring an additional 111,314 shares in the last quarter. Finally, Forsta AP Fonden boosted its position in Sempra by 13.7% during the first quarter. Forsta AP Fonden now owns 117,200 shares of the utilities provider's stock valued at $8,418,000 after purchasing an additional 14,100 shares during the last quarter. 89.65% of the stock is owned by institutional investors.

Sempra Company Profile

(

Get Free ReportSempra operates as an energy infrastructure company in the United States and internationally. It operates through three segments: Sempra California, Sempra Texas Utilities, and Sempra Infrastructure. The Sempra California segment provides electric services; and natural gas services to San Diego County.

Featured Stories

Before you consider Sempra, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sempra wasn't on the list.

While Sempra currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.