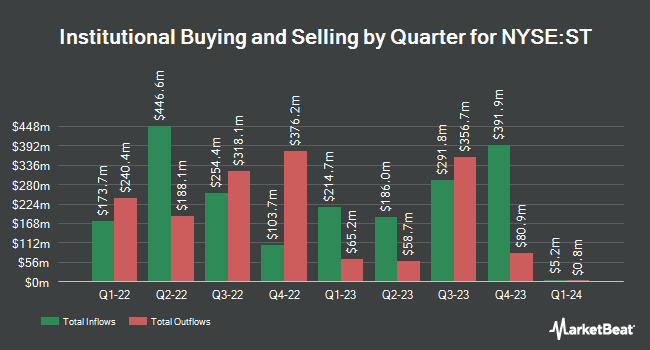

Quantbot Technologies LP trimmed its holdings in shares of Sensata Technologies Holding plc (NYSE:ST - Free Report) by 47.3% in the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 47,239 shares of the scientific and technical instruments company's stock after selling 42,319 shares during the period. Quantbot Technologies LP's holdings in Sensata Technologies were worth $1,694,000 as of its most recent SEC filing.

A number of other hedge funds and other institutional investors have also recently bought and sold shares of ST. Millennium Management LLC lifted its position in shares of Sensata Technologies by 84.8% during the second quarter. Millennium Management LLC now owns 5,059,047 shares of the scientific and technical instruments company's stock worth $189,158,000 after purchasing an additional 2,321,782 shares in the last quarter. Dimensional Fund Advisors LP lifted its holdings in Sensata Technologies by 16.5% during the 2nd quarter. Dimensional Fund Advisors LP now owns 4,643,665 shares of the scientific and technical instruments company's stock worth $173,627,000 after buying an additional 658,728 shares in the last quarter. FMR LLC lifted its holdings in Sensata Technologies by 18.9% during the 3rd quarter. FMR LLC now owns 3,895,776 shares of the scientific and technical instruments company's stock worth $139,703,000 after buying an additional 618,202 shares in the last quarter. Eminence Capital LP boosted its position in Sensata Technologies by 31.8% in the 2nd quarter. Eminence Capital LP now owns 3,423,317 shares of the scientific and technical instruments company's stock valued at $127,998,000 after buying an additional 826,353 shares during the last quarter. Finally, Massachusetts Financial Services Co. MA increased its stake in shares of Sensata Technologies by 0.4% in the 3rd quarter. Massachusetts Financial Services Co. MA now owns 2,721,353 shares of the scientific and technical instruments company's stock valued at $97,588,000 after buying an additional 11,798 shares during the period. 99.42% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Several brokerages have recently issued reports on ST. Oppenheimer cut their price target on Sensata Technologies from $47.00 to $44.00 and set an "outperform" rating on the stock in a research note on Tuesday, November 5th. UBS Group cut their target price on shares of Sensata Technologies from $44.00 to $39.00 and set a "buy" rating on the stock in a research report on Wednesday, November 6th. The Goldman Sachs Group lowered their price target on shares of Sensata Technologies from $41.00 to $39.00 and set a "neutral" rating for the company in a research report on Tuesday, October 1st. Evercore ISI cut their price objective on shares of Sensata Technologies from $60.00 to $50.00 and set an "outperform" rating on the stock in a report on Tuesday, October 15th. Finally, JPMorgan Chase & Co. lowered their target price on shares of Sensata Technologies from $34.00 to $32.00 and set an "underweight" rating for the company in a report on Tuesday, November 5th. One analyst has rated the stock with a sell rating, seven have assigned a hold rating and five have issued a buy rating to the company. According to MarketBeat.com, the company currently has an average rating of "Hold" and an average price target of $41.00.

Check Out Our Latest Report on ST

Sensata Technologies Trading Up 0.1 %

Shares of ST traded up $0.03 during trading hours on Friday, reaching $32.14. The stock had a trading volume of 579,438 shares, compared to its average volume of 1,830,203. The company has a market cap of $4.81 billion, a P/E ratio of -59.52, a P/E/G ratio of 0.94 and a beta of 1.25. Sensata Technologies Holding plc has a 52 week low of $30.43 and a 52 week high of $43.14. The company has a quick ratio of 1.76, a current ratio of 2.60 and a debt-to-equity ratio of 1.08. The firm has a 50-day moving average of $34.17 and a 200 day moving average of $36.87.

Sensata Technologies (NYSE:ST - Get Free Report) last released its quarterly earnings data on Monday, November 4th. The scientific and technical instruments company reported $0.86 earnings per share for the quarter, meeting the consensus estimate of $0.86. Sensata Technologies had a positive return on equity of 17.68% and a negative net margin of 1.98%. The business had revenue of $982.80 million for the quarter, compared to analysts' expectations of $983.93 million. During the same quarter in the previous year, the business posted $0.91 EPS. Sensata Technologies's revenue for the quarter was down 1.8% on a year-over-year basis. On average, sell-side analysts expect that Sensata Technologies Holding plc will post 3.43 earnings per share for the current fiscal year.

Sensata Technologies Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Wednesday, November 27th. Investors of record on Wednesday, November 13th were issued a dividend of $0.12 per share. The ex-dividend date of this dividend was Wednesday, November 13th. This represents a $0.48 dividend on an annualized basis and a dividend yield of 1.49%. Sensata Technologies's payout ratio is -88.89%.

Sensata Technologies Profile

(

Free Report)

Sensata Technologies Holding plc develops, manufactures, and sells sensors and sensor-rich solutions, electrical protection components and systems, and other products used in mission-critical systems and applications in the United States and internationally. It operates in two segments, Performance Sensing and Sensing Solutions.

Further Reading

Before you consider Sensata Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sensata Technologies wasn't on the list.

While Sensata Technologies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.