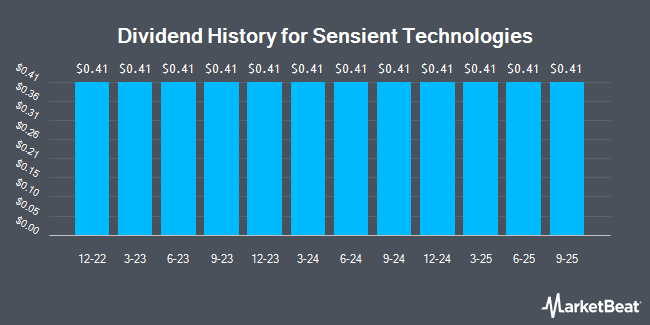

Sensient Technologies Co. (NYSE:SXT - Get Free Report) announced a quarterly dividend on Friday, January 17th,RTT News reports. Investors of record on Tuesday, February 4th will be given a dividend of 0.41 per share by the specialty chemicals company on Monday, March 3rd. This represents a $1.64 annualized dividend and a yield of 2.22%.

Sensient Technologies has raised its dividend by an average of 1.3% annually over the last three years. Sensient Technologies has a dividend payout ratio of 42.9% meaning its dividend is sufficiently covered by earnings.

Sensient Technologies Trading Up 1.4 %

SXT stock traded up $1.01 during mid-day trading on Friday, hitting $73.73. 150,496 shares of the company were exchanged, compared to its average volume of 236,692. The company has a quick ratio of 1.47, a current ratio of 3.74 and a debt-to-equity ratio of 0.58. The firm has a market capitalization of $3.12 billion, a P/E ratio of 35.28 and a beta of 0.77. The business has a fifty day simple moving average of $74.94 and a 200-day simple moving average of $75.90. Sensient Technologies has a 12-month low of $55.02 and a 12-month high of $82.99.

Sensient Technologies (NYSE:SXT - Get Free Report) last announced its earnings results on Friday, October 25th. The specialty chemicals company reported $0.80 earnings per share for the quarter, hitting the consensus estimate of $0.80. The company had revenue of $392.61 million during the quarter, compared to analyst estimates of $390.64 million. Sensient Technologies had a net margin of 5.80% and a return on equity of 11.41%. Sensient Technologies's revenue was up 7.9% compared to the same quarter last year. During the same quarter last year, the firm posted $0.75 earnings per share. On average, equities research analysts predict that Sensient Technologies will post 2.82 earnings per share for the current fiscal year.

Insider Activity

In other Sensient Technologies news, insider Michael C. Geraghty sold 4,000 shares of the firm's stock in a transaction that occurred on Wednesday, November 6th. The shares were sold at an average price of $80.48, for a total transaction of $321,920.00. Following the sale, the insider now owns 36,518 shares of the company's stock, valued at approximately $2,938,968.64. This trade represents a 9.87 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Insiders own 1.40% of the company's stock.

Wall Street Analysts Forecast Growth

Separately, StockNews.com raised shares of Sensient Technologies from a "hold" rating to a "buy" rating in a research note on Monday, October 28th.

Get Our Latest Research Report on SXT

Sensient Technologies Company Profile

(

Get Free Report)

Sensient Technologies Corporation, together with its subsidiaries, develops, manufactures, and markets colors, flavors, and other specialty ingredients in North America, Europe, Asia, Australia, South America, and Africa. The company offers flavor-delivery systems, and compounded and blended products; ingredient products, such as essential oils, natural and synthetic flavors, and natural extracts; and chili powder, paprika, and chili pepper, as well as dehydrated vegetables comprising parsley, celery, and spinach to the food, beverage, and personal care industries.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Sensient Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sensient Technologies wasn't on the list.

While Sensient Technologies currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.