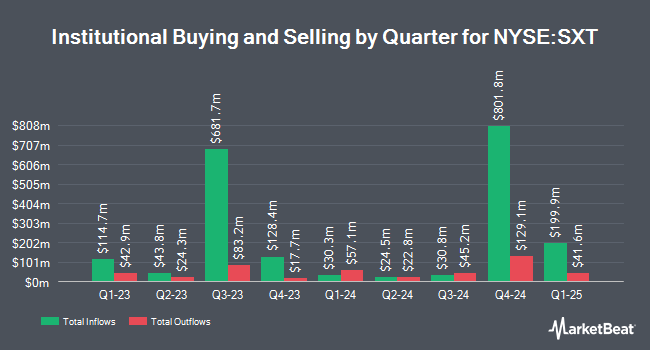

Thrivent Financial for Lutherans raised its holdings in Sensient Technologies Co. (NYSE:SXT - Free Report) by 66.7% in the third quarter, according to the company in its most recent disclosure with the SEC. The firm owned 58,643 shares of the specialty chemicals company's stock after acquiring an additional 23,474 shares during the quarter. Thrivent Financial for Lutherans owned 0.14% of Sensient Technologies worth $4,704,000 as of its most recent filing with the SEC.

Other institutional investors also recently made changes to their positions in the company. Van ECK Associates Corp grew its holdings in Sensient Technologies by 5.2% in the second quarter. Van ECK Associates Corp now owns 3,680 shares of the specialty chemicals company's stock valued at $273,000 after purchasing an additional 183 shares during the last quarter. Arizona State Retirement System increased its holdings in Sensient Technologies by 2.1% during the 2nd quarter. Arizona State Retirement System now owns 10,076 shares of the specialty chemicals company's stock valued at $748,000 after acquiring an additional 206 shares in the last quarter. Diversified Trust Co raised its position in Sensient Technologies by 2.4% during the second quarter. Diversified Trust Co now owns 11,664 shares of the specialty chemicals company's stock worth $865,000 after acquiring an additional 275 shares during the last quarter. US Bancorp DE lifted its holdings in shares of Sensient Technologies by 6.1% in the third quarter. US Bancorp DE now owns 6,355 shares of the specialty chemicals company's stock valued at $510,000 after purchasing an additional 366 shares in the last quarter. Finally, Quarry LP acquired a new stake in shares of Sensient Technologies in the second quarter valued at approximately $29,000. 90.86% of the stock is currently owned by hedge funds and other institutional investors.

Insider Transactions at Sensient Technologies

In related news, insider Michael C. Geraghty sold 4,000 shares of the firm's stock in a transaction that occurred on Wednesday, November 6th. The stock was sold at an average price of $80.48, for a total value of $321,920.00. Following the sale, the insider now owns 36,518 shares of the company's stock, valued at approximately $2,938,968.64. This trade represents a 9.87 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Insiders own 1.40% of the company's stock.

Wall Street Analyst Weigh In

A number of analysts recently commented on the company. StockNews.com raised Sensient Technologies from a "hold" rating to a "buy" rating in a research note on Monday, October 28th. Robert W. Baird raised their price target on shares of Sensient Technologies from $80.00 to $85.00 and gave the stock an "outperform" rating in a research note on Monday, July 29th.

Read Our Latest Report on SXT

Sensient Technologies Trading Up 1.9 %

SXT stock opened at $78.67 on Monday. The company has a quick ratio of 1.47, a current ratio of 3.74 and a debt-to-equity ratio of 0.58. The company has a market cap of $3.33 billion, a price-to-earnings ratio of 37.64 and a beta of 0.76. The business has a fifty day simple moving average of $77.83 and a 200-day simple moving average of $76.31. Sensient Technologies Co. has a 52 week low of $55.02 and a 52 week high of $82.99.

Sensient Technologies (NYSE:SXT - Get Free Report) last released its quarterly earnings data on Friday, October 25th. The specialty chemicals company reported $0.80 earnings per share (EPS) for the quarter, hitting the consensus estimate of $0.80. Sensient Technologies had a net margin of 5.80% and a return on equity of 11.41%. The company had revenue of $392.61 million during the quarter, compared to analyst estimates of $390.64 million. During the same quarter in the prior year, the business earned $0.75 earnings per share. The business's quarterly revenue was up 7.9% compared to the same quarter last year. On average, equities research analysts expect that Sensient Technologies Co. will post 2.82 EPS for the current year.

Sensient Technologies Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Monday, December 2nd. Shareholders of record on Monday, November 4th will be issued a dividend of $0.41 per share. This represents a $1.64 annualized dividend and a yield of 2.08%. The ex-dividend date of this dividend is Monday, November 4th. Sensient Technologies's dividend payout ratio is currently 78.47%.

Sensient Technologies Profile

(

Free Report)

Sensient Technologies Corporation, together with its subsidiaries, develops, manufactures, and markets colors, flavors, and other specialty ingredients in North America, Europe, Asia, Australia, South America, and Africa. The company offers flavor-delivery systems, and compounded and blended products; ingredient products, such as essential oils, natural and synthetic flavors, and natural extracts; and chili powder, paprika, and chili pepper, as well as dehydrated vegetables comprising parsley, celery, and spinach to the food, beverage, and personal care industries.

Featured Stories

Before you consider Sensient Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sensient Technologies wasn't on the list.

While Sensient Technologies currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.