FMR LLC boosted its stake in Sensient Technologies Co. (NYSE:SXT - Free Report) by 124.0% during the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 59,223 shares of the specialty chemicals company's stock after purchasing an additional 32,784 shares during the quarter. FMR LLC owned about 0.14% of Sensient Technologies worth $4,751,000 as of its most recent SEC filing.

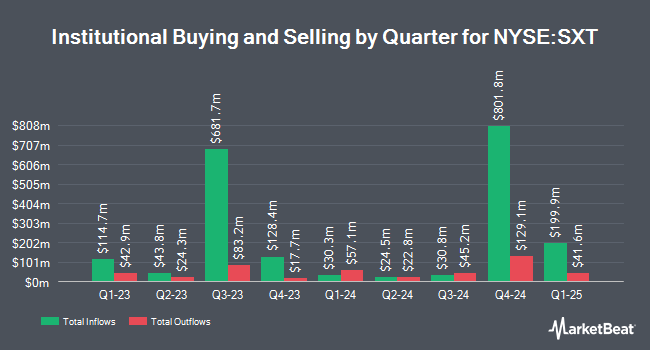

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Dimensional Fund Advisors LP raised its stake in shares of Sensient Technologies by 3.4% during the second quarter. Dimensional Fund Advisors LP now owns 1,208,815 shares of the specialty chemicals company's stock valued at $89,683,000 after acquiring an additional 39,290 shares in the last quarter. Charles Schwab Investment Management Inc. raised its holdings in shares of Sensient Technologies by 1.2% in the third quarter. Charles Schwab Investment Management Inc. now owns 590,149 shares of the specialty chemicals company's stock worth $47,342,000 after buying an additional 7,235 shares during the last quarter. Bank of New York Mellon Corp lifted its position in Sensient Technologies by 5.4% during the 2nd quarter. Bank of New York Mellon Corp now owns 541,998 shares of the specialty chemicals company's stock worth $40,211,000 after acquiring an additional 27,967 shares during the period. BNP PARIBAS ASSET MANAGEMENT Holding S.A. boosted its position in Sensient Technologies by 2.7% in the second quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. now owns 206,288 shares of the specialty chemicals company's stock valued at $15,304,000 after buying an additional 5,400 shares during the last quarter. Finally, Robeco Schweiz AG boosted its holdings in shares of Sensient Technologies by 12.1% in the 2nd quarter. Robeco Schweiz AG now owns 112,640 shares of the specialty chemicals company's stock valued at $8,357,000 after acquiring an additional 12,150 shares during the last quarter. 90.86% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

Separately, StockNews.com raised Sensient Technologies from a "hold" rating to a "buy" rating in a research note on Monday, October 28th.

Check Out Our Latest Stock Report on Sensient Technologies

Sensient Technologies Trading Down 0.1 %

NYSE SXT traded down $0.05 during trading on Friday, hitting $77.33. The stock had a trading volume of 99,988 shares, compared to its average volume of 174,634. The company has a quick ratio of 1.47, a current ratio of 3.74 and a debt-to-equity ratio of 0.58. The company has a market capitalization of $3.28 billion, a PE ratio of 36.98 and a beta of 0.76. The firm has a 50 day moving average price of $77.75 and a 200 day moving average price of $76.52. Sensient Technologies Co. has a twelve month low of $55.02 and a twelve month high of $82.99.

Sensient Technologies (NYSE:SXT - Get Free Report) last released its quarterly earnings data on Friday, October 25th. The specialty chemicals company reported $0.80 EPS for the quarter, meeting analysts' consensus estimates of $0.80. Sensient Technologies had a return on equity of 11.41% and a net margin of 5.80%. The business had revenue of $392.61 million for the quarter, compared to the consensus estimate of $390.64 million. During the same quarter in the prior year, the business posted $0.75 EPS. The business's revenue for the quarter was up 7.9% on a year-over-year basis. As a group, equities research analysts forecast that Sensient Technologies Co. will post 2.82 earnings per share for the current year.

Sensient Technologies Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Monday, December 2nd. Shareholders of record on Monday, November 4th were given a dividend of $0.41 per share. The ex-dividend date was Monday, November 4th. This represents a $1.64 annualized dividend and a yield of 2.12%. Sensient Technologies's payout ratio is currently 78.47%.

Insider Activity at Sensient Technologies

In other news, insider Michael C. Geraghty sold 4,000 shares of Sensient Technologies stock in a transaction on Wednesday, November 6th. The stock was sold at an average price of $80.48, for a total value of $321,920.00. Following the completion of the sale, the insider now owns 36,518 shares of the company's stock, valued at $2,938,968.64. The trade was a 9.87 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. 1.40% of the stock is currently owned by company insiders.

About Sensient Technologies

(

Free Report)

Sensient Technologies Corporation, together with its subsidiaries, develops, manufactures, and markets colors, flavors, and other specialty ingredients in North America, Europe, Asia, Australia, South America, and Africa. The company offers flavor-delivery systems, and compounded and blended products; ingredient products, such as essential oils, natural and synthetic flavors, and natural extracts; and chili powder, paprika, and chili pepper, as well as dehydrated vegetables comprising parsley, celery, and spinach to the food, beverage, and personal care industries.

Further Reading

Before you consider Sensient Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sensient Technologies wasn't on the list.

While Sensient Technologies currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.