Senvest Management LLC grew its position in Pacific Biosciences of California, Inc. (NASDAQ:PACB - Free Report) by 36.1% during the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 1,093,954 shares of the biotechnology company's stock after acquiring an additional 290,000 shares during the quarter. Senvest Management LLC owned 0.40% of Pacific Biosciences of California worth $1,860,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

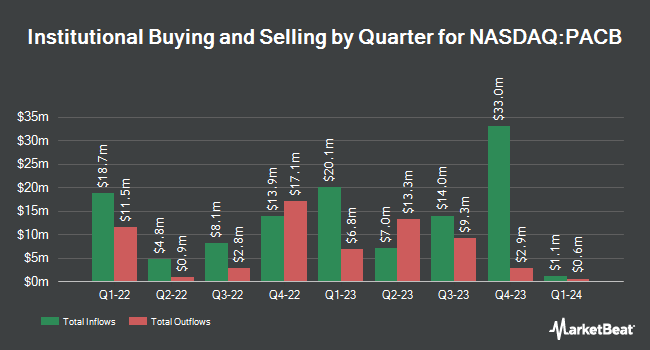

A number of other large investors have also added to or reduced their stakes in the company. Kennedy Capital Management LLC purchased a new position in shares of Pacific Biosciences of California in the 1st quarter worth approximately $64,000. Water Island Capital LLC boosted its holdings in shares of Pacific Biosciences of California by 91.1% in the 2nd quarter. Water Island Capital LLC now owns 20,000 shares of the biotechnology company's stock worth $27,000 after purchasing an additional 9,537 shares during the period. Simplicity Wealth LLC purchased a new position in shares of Pacific Biosciences of California in the 2nd quarter worth approximately $29,000. SG Americas Securities LLC purchased a new position in shares of Pacific Biosciences of California in the 1st quarter worth approximately $80,000. Finally, Atria Investments Inc boosted its holdings in shares of Pacific Biosciences of California by 85.7% in the 3rd quarter. Atria Investments Inc now owns 21,968 shares of the biotechnology company's stock worth $37,000 after purchasing an additional 10,138 shares during the period.

Pacific Biosciences of California Stock Up 1.7 %

NASDAQ:PACB traded up $0.03 during mid-day trading on Friday, hitting $1.80. 8,724,995 shares of the company's stock traded hands, compared to its average volume of 12,568,518. The company has a fifty day moving average of $1.91 and a 200 day moving average of $1.76. Pacific Biosciences of California, Inc. has a twelve month low of $1.16 and a twelve month high of $10.65. The company has a market capitalization of $492.96 million, a P/E ratio of -1.23 and a beta of 2.01. The company has a debt-to-equity ratio of 1.97, a quick ratio of 8.64 and a current ratio of 9.74.

Wall Street Analyst Weigh In

A number of research firms recently issued reports on PACB. UBS Group cut Pacific Biosciences of California from a "buy" rating to a "neutral" rating and set a $2.00 price objective for the company. in a report on Monday, November 11th. Piper Sandler boosted their price objective on Pacific Biosciences of California from $2.00 to $2.50 and gave the company a "neutral" rating in a report on Monday, November 11th. Cantor Fitzgerald restated an "overweight" rating and set a $3.50 price objective on shares of Pacific Biosciences of California in a report on Thursday, August 8th. Morgan Stanley dropped their price objective on Pacific Biosciences of California from $4.00 to $2.00 and set an "equal weight" rating for the company in a report on Monday, August 12th. Finally, Scotiabank dropped their price objective on Pacific Biosciences of California from $7.00 to $6.00 and set a "sector outperform" rating for the company in a report on Monday, November 11th. One investment analyst has rated the stock with a sell rating, eight have given a hold rating and seven have assigned a buy rating to the company. According to MarketBeat, Pacific Biosciences of California currently has an average rating of "Hold" and an average target price of $3.63.

Get Our Latest Stock Analysis on Pacific Biosciences of California

Pacific Biosciences of California Profile

(

Free Report)

Pacific Biosciences of California, Inc designs, develops, and manufactures sequencing solution to resolve genetically complex problems. The company provides sequencing systems; consumable products, including single molecule real-time (SMRT) technology; long-red sequencing; and various reagent kits designed for specific workflow, such as preparation kit to convert DNA into SMRTbell double-stranded DNA library formats, including molecular biology reagents, such as ligase, buffers, and exonucleases.

See Also

Before you consider Pacific Biosciences of California, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pacific Biosciences of California wasn't on the list.

While Pacific Biosciences of California currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.