Senvest Management LLC increased its position in shares of The Lovesac Company (NASDAQ:LOVE - Free Report) by 47.3% during the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 943,022 shares of the company's stock after acquiring an additional 302,643 shares during the quarter. Lovesac accounts for about 0.9% of Senvest Management LLC's holdings, making the stock its 26th largest position. Senvest Management LLC owned approximately 6.06% of Lovesac worth $27,018,000 at the end of the most recent reporting period.

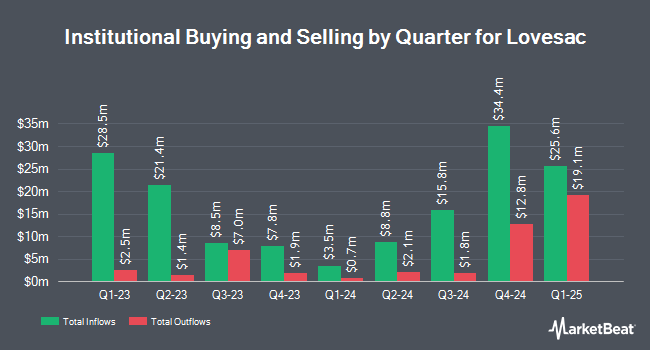

Other hedge funds have also made changes to their positions in the company. EntryPoint Capital LLC purchased a new stake in shares of Lovesac in the first quarter valued at $39,000. Meeder Asset Management Inc. acquired a new stake in Lovesac during the 2nd quarter worth about $43,000. SG Americas Securities LLC acquired a new stake in Lovesac during the 3rd quarter worth about $170,000. Quest Partners LLC grew its stake in Lovesac by 797.6% during the 2nd quarter. Quest Partners LLC now owns 8,572 shares of the company's stock valued at $194,000 after acquiring an additional 7,617 shares in the last quarter. Finally, Price T Rowe Associates Inc. MD increased its holdings in shares of Lovesac by 8.2% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 9,633 shares of the company's stock valued at $218,000 after purchasing an additional 726 shares during the period. Hedge funds and other institutional investors own 91.32% of the company's stock.

Insider Buying and Selling at Lovesac

In other Lovesac news, Director Albert Jack Krause sold 10,000 shares of the firm's stock in a transaction that occurred on Thursday, October 3rd. The stock was sold at an average price of $26.22, for a total value of $262,200.00. Following the sale, the director now owns 177,849 shares of the company's stock, valued at $4,663,200.78. This trade represents a 5.32 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is available through this link. Corporate insiders own 12.33% of the company's stock.

Lovesac Price Performance

Shares of LOVE stock traded down $0.69 on Friday, hitting $34.71. The company's stock had a trading volume of 362,333 shares, compared to its average volume of 257,620. The stock has a market capitalization of $540.09 million, a price-to-earnings ratio of 68.06, a P/E/G ratio of 0.93 and a beta of 2.91. The Lovesac Company has a fifty-two week low of $18.21 and a fifty-two week high of $36.88. The firm's fifty day moving average price is $28.82 and its 200-day moving average price is $26.31.

Lovesac (NASDAQ:LOVE - Get Free Report) last announced its quarterly earnings results on Thursday, September 12th. The company reported ($0.38) earnings per share for the quarter, topping analysts' consensus estimates of ($0.46) by $0.08. The company had revenue of $156.59 million during the quarter, compared to analysts' expectations of $154.01 million. Lovesac had a return on equity of 4.83% and a net margin of 1.41%. Analysts predict that The Lovesac Company will post 1.09 EPS for the current fiscal year.

Analysts Set New Price Targets

LOVE has been the topic of a number of research analyst reports. Canaccord Genuity Group reaffirmed a "buy" rating and set a $36.00 price objective on shares of Lovesac in a research report on Friday, September 13th. Craig Hallum boosted their price target on shares of Lovesac from $30.00 to $35.00 and gave the company a "buy" rating in a report on Friday, September 13th. Roth Mkm increased their price objective on Lovesac from $31.00 to $35.00 and gave the stock a "buy" rating in a report on Tuesday, November 19th. Finally, DA Davidson reissued a "buy" rating and set a $32.00 price objective on shares of Lovesac in a research report on Thursday, October 3rd. Six research analysts have rated the stock with a buy rating, According to data from MarketBeat, the stock currently has an average rating of "Buy" and an average price target of $35.17.

View Our Latest Report on LOVE

Lovesac Profile

(

Free Report)

The Lovesac Company designs, manufactures, and sells furniture. It offers sactionals, such as seats and sides; sacs, including foam beanbag chairs; and other products comprising drink holders, footsac blankets, decorative pillows, fitted seat tables, and ottomans. The company markets its products primarily through www.lovesac.com website, as well as showrooms at top tier malls, lifestyle centers, mobile concierges, kiosks, and street locations in 41 states in the United States; and in store pop-up- shops and shop-in-shops, and barter inventory transactions.

Featured Stories

Before you consider Lovesac, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lovesac wasn't on the list.

While Lovesac currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.