Senvest Management LLC lessened its holdings in shares of LendingClub Co. (NYSE:LC - Free Report) by 22.2% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 1,479,587 shares of the credit services provider's stock after selling 422,792 shares during the quarter. Senvest Management LLC owned about 1.32% of LendingClub worth $16,912,000 at the end of the most recent quarter.

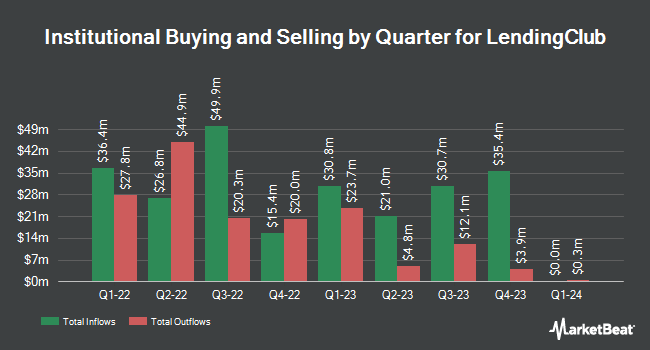

Several other hedge funds and other institutional investors have also added to or reduced their stakes in LC. Assenagon Asset Management S.A. boosted its stake in LendingClub by 120.3% during the third quarter. Assenagon Asset Management S.A. now owns 1,517,986 shares of the credit services provider's stock valued at $17,351,000 after buying an additional 828,958 shares during the last quarter. American Century Companies Inc. grew its holdings in shares of LendingClub by 24.8% in the second quarter. American Century Companies Inc. now owns 1,658,679 shares of the credit services provider's stock valued at $14,032,000 after purchasing an additional 329,279 shares in the last quarter. Interval Partners LP bought a new stake in LendingClub in the first quarter worth $2,821,000. Dimensional Fund Advisors LP raised its stake in LendingClub by 5.4% during the second quarter. Dimensional Fund Advisors LP now owns 5,898,545 shares of the credit services provider's stock valued at $49,901,000 after purchasing an additional 300,536 shares in the last quarter. Finally, Marshall Wace LLP bought a new position in LendingClub during the second quarter valued at $2,412,000. 74.08% of the stock is currently owned by institutional investors.

Insider Activity

In other LendingClub news, General Counsel Jordan Cheng sold 22,000 shares of the stock in a transaction that occurred on Friday, November 8th. The stock was sold at an average price of $14.83, for a total transaction of $326,260.00. Following the transaction, the general counsel now owns 89,385 shares in the company, valued at approximately $1,325,579.55. This represents a 19.75 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, CEO Scott Sanborn sold 17,000 shares of the stock in a transaction that occurred on Thursday, September 5th. The shares were sold at an average price of $11.36, for a total value of $193,120.00. Following the transaction, the chief executive officer now owns 1,373,273 shares in the company, valued at $15,600,381.28. This trade represents a 1.22 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 75,500 shares of company stock valued at $996,940 in the last ninety days. Insiders own 3.31% of the company's stock.

Wall Street Analysts Forecast Growth

A number of research analysts recently commented on LC shares. Maxim Group lifted their price target on LendingClub from $16.00 to $19.00 and gave the stock a "buy" rating in a research report on Friday, October 25th. Keefe, Bruyette & Woods raised LendingClub from a "market perform" rating to an "outperform" rating and raised their price objective for the company from $11.50 to $15.00 in a research note on Thursday, October 10th. StockNews.com downgraded LendingClub from a "hold" rating to a "sell" rating in a research report on Friday, October 25th. Wedbush raised their price target on LendingClub from $14.00 to $17.00 and gave the stock an "outperform" rating in a research report on Thursday, October 24th. Finally, Piper Sandler reiterated an "overweight" rating and set a $15.00 price objective (up previously from $13.00) on shares of LendingClub in a research report on Thursday, October 24th. One equities research analyst has rated the stock with a sell rating and eight have assigned a buy rating to the stock. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $15.38.

Read Our Latest Stock Report on LC

LendingClub Stock Up 5.2 %

Shares of LendingClub stock traded up $0.83 on Friday, reaching $16.73. The stock had a trading volume of 2,106,481 shares, compared to its average volume of 2,033,169. LendingClub Co. has a 1 year low of $5.51 and a 1 year high of $16.75. The company has a 50 day moving average price of $13.09 and a 200 day moving average price of $10.96. The stock has a market capitalization of $1.88 billion, a P/E ratio of 36.37 and a beta of 2.01.

LendingClub (NYSE:LC - Get Free Report) last posted its quarterly earnings data on Wednesday, October 23rd. The credit services provider reported $0.13 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.07 by $0.06. LendingClub had a net margin of 6.85% and a return on equity of 4.02%. The firm had revenue of $201.90 million for the quarter, compared to the consensus estimate of $190.40 million. During the same quarter in the prior year, the company posted $0.05 earnings per share. The company's revenue for the quarter was up .5% compared to the same quarter last year. On average, analysts forecast that LendingClub Co. will post 0.47 earnings per share for the current fiscal year.

About LendingClub

(

Free Report)

LendingClub Corporation, operates as a bank holding company, that provides range of financial products and services in the United States. It offers deposit products, including savings accounts, checking accounts, and certificates of deposit. The company also provides loan products, such as consumer loans comprising unsecured personal loans, secured auto refinance loans, and patient and education finance loans; and commercial loans, including small business loans.

Featured Stories

Before you consider LendingClub, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LendingClub wasn't on the list.

While LendingClub currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.