Dana Investment Advisors Inc. trimmed its position in shares of ServiceNow, Inc. (NYSE:NOW - Free Report) by 9.2% in the 4th quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 30,376 shares of the information technology services provider's stock after selling 3,084 shares during the period. ServiceNow comprises approximately 1.1% of Dana Investment Advisors Inc.'s portfolio, making the stock its 11th biggest holding. Dana Investment Advisors Inc.'s holdings in ServiceNow were worth $32,202,000 as of its most recent filing with the Securities and Exchange Commission.

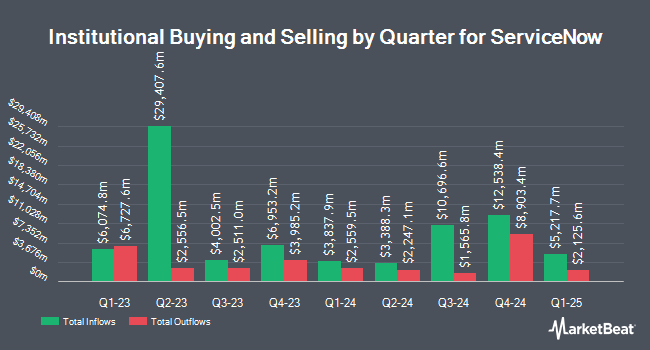

Several other hedge funds and other institutional investors have also modified their holdings of NOW. Truvestments Capital LLC bought a new position in ServiceNow during the third quarter valued at about $30,000. FPC Investment Advisory Inc. raised its holdings in ServiceNow by 725.0% during the fourth quarter. FPC Investment Advisory Inc. now owns 33 shares of the information technology services provider's stock valued at $34,000 after buying an additional 29 shares in the last quarter. Noble Wealth Management PBC bought a new position in ServiceNow during the fourth quarter valued at about $34,000. Heck Capital Advisors LLC bought a new position in ServiceNow during the fourth quarter valued at about $37,000. Finally, Stonebridge Financial Group LLC bought a new position in ServiceNow during the fourth quarter valued at about $37,000. 87.18% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

Several equities analysts have weighed in on NOW shares. StockNews.com lowered ServiceNow from a "buy" rating to a "hold" rating in a report on Tuesday, February 11th. Cantor Fitzgerald started coverage on ServiceNow in a research report on Friday, January 17th. They issued an "overweight" rating and a $1,332.00 price target on the stock. Wells Fargo & Company raised their price target on ServiceNow from $1,150.00 to $1,250.00 and gave the company an "overweight" rating in a research report on Thursday, December 5th. Canaccord Genuity Group raised their price target on ServiceNow from $1,200.00 to $1,275.00 and gave the company a "buy" rating in a research report on Thursday, January 30th. Finally, Redburn Atlantic started coverage on ServiceNow in a research report on Wednesday, February 19th. They issued a "buy" rating on the stock. One analyst has rated the stock with a sell rating, four have assigned a hold rating, twenty-five have issued a buy rating and two have assigned a strong buy rating to the company. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and a consensus price target of $1,129.72.

Get Our Latest Stock Report on NOW

Insider Buying and Selling

In related news, CEO William R. Mcdermott sold 1,263 shares of the business's stock in a transaction that occurred on Monday, February 10th. The shares were sold at an average price of $1,019.10, for a total value of $1,287,123.30. Following the completion of the transaction, the chief executive officer now owns 2,595 shares in the company, valued at $2,644,564.50. The trade was a 32.74 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. Also, Vice Chairman Nicholas Tzitzon sold 2,945 shares of the business's stock in a transaction that occurred on Tuesday, February 25th. The stock was sold at an average price of $923.72, for a total transaction of $2,720,355.40. Following the completion of the transaction, the insider now owns 3,649 shares of the company's stock, valued at $3,370,654.28. This trade represents a 44.66 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 20,351 shares of company stock worth $20,050,076 in the last quarter. Insiders own 0.25% of the company's stock.

ServiceNow Stock Performance

NYSE:NOW opened at $916.34 on Thursday. ServiceNow, Inc. has a 1 year low of $637.99 and a 1 year high of $1,198.09. The firm has a 50 day moving average of $1,026.73 and a 200-day moving average of $984.57. The company has a current ratio of 1.10, a quick ratio of 1.10 and a debt-to-equity ratio of 0.15. The stock has a market capitalization of $188.77 billion, a P/E ratio of 134.16, a price-to-earnings-growth ratio of 4.51 and a beta of 0.99.

ServiceNow (NYSE:NOW - Get Free Report) last posted its quarterly earnings data on Wednesday, January 29th. The information technology services provider reported $3.67 earnings per share for the quarter, hitting the consensus estimate of $3.67. ServiceNow had a net margin of 12.97% and a return on equity of 17.11%. As a group, sell-side analysts anticipate that ServiceNow, Inc. will post 8.93 EPS for the current fiscal year.

ServiceNow announced that its Board of Directors has approved a stock repurchase plan on Wednesday, January 29th that allows the company to buyback $3.00 billion in shares. This buyback authorization allows the information technology services provider to reacquire up to 1.3% of its stock through open market purchases. Stock buyback plans are generally a sign that the company's board believes its stock is undervalued.

ServiceNow Profile

(

Free Report)

ServiceNow, Inc provides end to-end intelligent workflow automation platform solutions for digital businesses in the North America, Europe, the Middle East and Africa, Asia Pacific, and internationally. The company operates the Now platform for end-to-end digital transformation, artificial intelligence, machine learning, robotic process automation, process mining, performance analytics, and collaboration and development tools.

Featured Stories

Want to see what other hedge funds are holding NOW? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for ServiceNow, Inc. (NYSE:NOW - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider ServiceNow, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ServiceNow wasn't on the list.

While ServiceNow currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report