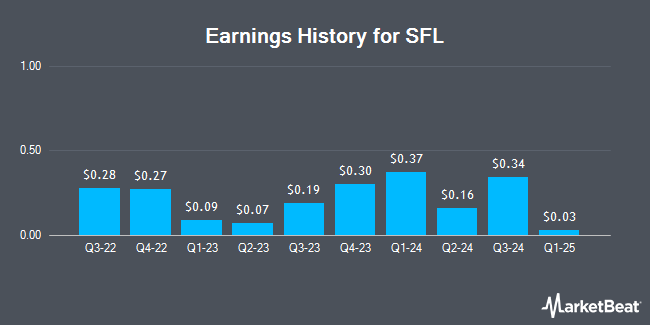

SFL (NYSE:SFL - Get Free Report) posted its quarterly earnings results on Wednesday. The shipping company reported $0.34 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.37 by ($0.03), Briefing.com reports. SFL had a net margin of 16.03% and a return on equity of 14.96%. The company had revenue of $255.30 million during the quarter, compared to analyst estimates of $243.98 million. During the same period in the prior year, the business earned $0.23 EPS. SFL's revenue for the quarter was up 24.6% on a year-over-year basis.

SFL Stock Performance

NYSE SFL traded down $0.26 during trading hours on Friday, hitting $10.30. The company had a trading volume of 1,585,360 shares, compared to its average volume of 837,400. The company has a market cap of $1.43 billion, a PE ratio of 9.28 and a beta of 0.68. The company has a debt-to-equity ratio of 1.65, a quick ratio of 0.34 and a current ratio of 0.34. SFL has a 1-year low of $10.12 and a 1-year high of $14.62. The business has a 50 day moving average of $11.19 and a 200-day moving average of $12.42.

SFL Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Friday, December 27th. Stockholders of record on Friday, December 13th will be given a dividend of $0.27 per share. The ex-dividend date of this dividend is Friday, December 13th. This represents a $1.08 annualized dividend and a dividend yield of 10.49%. SFL's dividend payout ratio is presently 97.30%.

Analyst Upgrades and Downgrades

A number of brokerages recently issued reports on SFL. Pareto Securities upgraded shares of SFL from a "hold" rating to a "buy" rating in a research note on Tuesday, August 20th. StockNews.com upgraded shares of SFL from a "hold" rating to a "buy" rating in a research note on Tuesday, July 16th.

View Our Latest Research Report on SFL

About SFL

(

Get Free Report)

SFL Corporation Ltd., a maritime and offshore asset owning and chartering company, engages in the ownership, operation, and chartering out of vessels and offshore related assets on medium and long-term charters. The company operates in various sectors of the maritime, and shipping and offshore industries, including oil transportation, dry bulk shipments, chemical transportation, oil products transportation, container transportation, car transportation, and drilling rigs.

Read More

Before you consider SFL, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SFL wasn't on the list.

While SFL currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.