SG Americas Securities LLC reduced its stake in shares of Box, Inc. (NYSE:BOX - Free Report) by 84.9% in the fourth quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 5,781 shares of the software maker's stock after selling 32,535 shares during the quarter. SG Americas Securities LLC's holdings in BOX were worth $183,000 at the end of the most recent quarter.

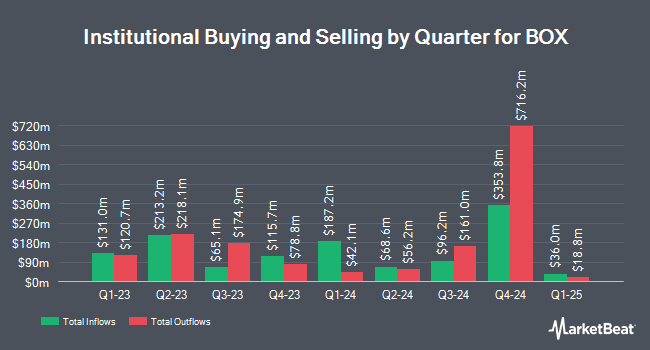

Other institutional investors have also recently added to or reduced their stakes in the company. Itau Unibanco Holding S.A. acquired a new position in BOX during the 3rd quarter worth $36,000. GAMMA Investing LLC boosted its position in BOX by 143.1% during the 3rd quarter. GAMMA Investing LLC now owns 1,337 shares of the software maker's stock worth $44,000 after acquiring an additional 787 shares during the period. Farther Finance Advisors LLC boosted its position in BOX by 245.4% during the 3rd quarter. Farther Finance Advisors LLC now owns 2,162 shares of the software maker's stock worth $71,000 after acquiring an additional 1,536 shares during the period. Central Pacific Bank Trust Division boosted its position in BOX by 9.6% during the 4th quarter. Central Pacific Bank Trust Division now owns 6,070 shares of the software maker's stock worth $192,000 after acquiring an additional 530 shares during the period. Finally, Wealth Enhancement Advisory Services LLC acquired a new position in BOX during the 3rd quarter worth $211,000. 86.74% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

A number of brokerages have issued reports on BOX. Bank of America began coverage on BOX in a research report on Thursday, December 12th. They set a "buy" rating and a $40.00 price target for the company. Morgan Stanley upped their price objective on BOX from $33.00 to $36.00 and gave the company an "equal weight" rating in a report on Wednesday, December 4th. William Blair restated an "outperform" rating on shares of BOX in a report on Thursday, November 14th. DA Davidson began coverage on BOX in a report on Wednesday, December 18th. They issued a "buy" rating and a $45.00 price objective for the company. Finally, UBS Group upped their price objective on BOX from $34.00 to $42.00 and gave the company a "buy" rating in a report on Wednesday, December 4th. One equities research analyst has rated the stock with a sell rating, two have assigned a hold rating and nine have assigned a buy rating to the company. Based on data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average target price of $35.89.

View Our Latest Stock Analysis on BOX

Insider Activity

In related news, CEO Aaron Levie sold 10,000 shares of the company's stock in a transaction on Tuesday, December 10th. The stock was sold at an average price of $32.54, for a total transaction of $325,400.00. Following the transaction, the chief executive officer now directly owns 2,999,155 shares of the company's stock, valued at approximately $97,592,503.70. The trade was a 0.33 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, Director Daniel J. Levin sold 5,886 shares of the company's stock in a transaction on Wednesday, December 11th. The shares were sold at an average price of $32.50, for a total value of $191,295.00. Following the transaction, the director now directly owns 51,530 shares in the company, valued at $1,674,725. The trade was a 10.25 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 89,041 shares of company stock valued at $2,889,758 over the last three months. Insiders own 4.10% of the company's stock.

BOX Stock Up 1.3 %

Shares of NYSE BOX traded up $0.45 during mid-day trading on Wednesday, hitting $35.09. 1,173,082 shares of the company traded hands, compared to its average volume of 1,352,638. Box, Inc. has a 1 year low of $24.56 and a 1 year high of $35.74. The stock has a market capitalization of $5.04 billion, a price-to-earnings ratio of 43.86, a PEG ratio of 4.40 and a beta of 0.88. The business has a 50 day moving average of $32.27 and a two-hundred day moving average of $31.93.

BOX Company Profile

(

Free Report)

Box, Inc engages in the provision of an enterprise content platform that enables organizations to securely manage enterprise content while allowing easy, secure access and sharing of this content from anywhere, on any device. Its products include cloud content management, IT and admin controls, Box Governance, Box Zones, Box Relay, Box Shuttle, and Box KeySafe.

Further Reading

Before you consider BOX, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BOX wasn't on the list.

While BOX currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.