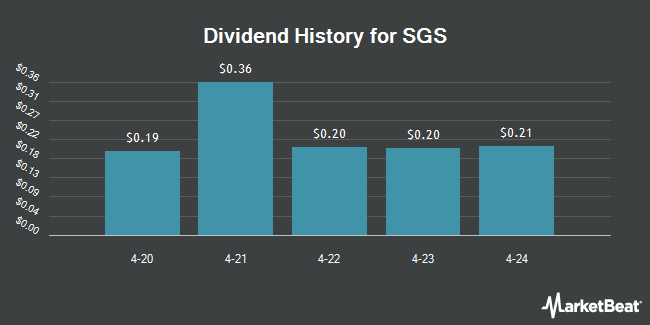

SGS SA (OTCMKTS:SGSOY - Get Free Report) announced a dividend on Monday, March 10th, NASDAQ Dividends reports. Shareholders of record on Thursday, April 3rd will be given a dividend of 0.363 per share on Friday, May 9th. The ex-dividend date of this dividend is Thursday, April 3rd. This is a 75.9% increase from SGS's previous dividend of $0.21.

SGS Stock Performance

Shares of SGS stock traded down $0.21 on Tuesday, hitting $9.75. The company had a trading volume of 83,448 shares, compared to its average volume of 90,955. The business has a 50-day simple moving average of $10.07 and a 200-day simple moving average of $10.39. SGS has a 52 week low of $8.68 and a 52 week high of $11.54. The company has a current ratio of 1.23, a quick ratio of 1.09 and a debt-to-equity ratio of 4.45.

SGS Company Profile

(

Get Free Report)

SGS SA provides inspection, testing, and verification services in Europe, Africa, the Middle East, the Americas, and the Asia Pacific. It operates in five segments: Connectivity & Products, Health & Nutrition, Industries & Environment, Natural Resources, and Business Assurance. The company provides laboratory testing, product inspection and consulting, process assessment, technical and transactional assistance; and automotive, connectivity, softlines and accessories, and hardgoods, toys, and juvenile products, as well as government and trade facilitation services.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider SGS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SGS wasn't on the list.

While SGS currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.