Sheaff Brock Investment Advisors LLC decreased its position in shares of Arthur J. Gallagher & Co. (NYSE:AJG - Free Report) by 19.7% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 14,964 shares of the financial services provider's stock after selling 3,675 shares during the quarter. Sheaff Brock Investment Advisors LLC's holdings in Arthur J. Gallagher & Co. were worth $4,210,000 as of its most recent filing with the Securities & Exchange Commission.

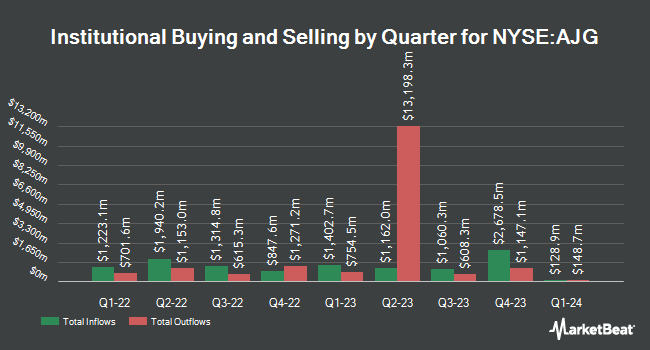

A number of other institutional investors also recently modified their holdings of AJG. W Advisors LLC raised its position in Arthur J. Gallagher & Co. by 2.4% in the 3rd quarter. W Advisors LLC now owns 1,514 shares of the financial services provider's stock valued at $426,000 after buying an additional 36 shares during the last quarter. Miracle Mile Advisors LLC grew its position in Arthur J. Gallagher & Co. by 0.8% during the third quarter. Miracle Mile Advisors LLC now owns 4,583 shares of the financial services provider's stock valued at $1,289,000 after buying an additional 38 shares during the period. Covenant Partners LLC raised its position in Arthur J. Gallagher & Co. by 0.7% in the third quarter. Covenant Partners LLC now owns 5,326 shares of the financial services provider's stock worth $1,499,000 after acquiring an additional 38 shares during the period. Disciplined Investments LLC increased its stake in shares of Arthur J. Gallagher & Co. by 0.7% during the 3rd quarter. Disciplined Investments LLC now owns 5,849 shares of the financial services provider's stock worth $1,635,000 after purchasing an additional 38 shares during the last quarter. Finally, Signaturefd LLC lifted its stake in Arthur J. Gallagher & Co. by 1.0% in the second quarter. Signaturefd LLC now owns 3,825 shares of the financial services provider's stock valued at $992,000 after purchasing an additional 39 shares during the last quarter. 85.53% of the stock is owned by institutional investors and hedge funds.

Insider Activity

In other Arthur J. Gallagher & Co. news, VP Christopher E. Mead sold 2,800 shares of the business's stock in a transaction that occurred on Monday, October 28th. The stock was sold at an average price of $287.00, for a total value of $803,600.00. Following the completion of the sale, the vice president now owns 14,674 shares in the company, valued at approximately $4,211,438. The trade was a 16.02 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, President Michael Robert Pesch sold 7,100 shares of the company's stock in a transaction on Friday, September 13th. The shares were sold at an average price of $296.20, for a total transaction of $2,103,020.00. Following the sale, the president now owns 33,267 shares of the company's stock, valued at $9,853,685.40. This represents a 17.59 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders sold 23,900 shares of company stock valued at $6,892,280. Corporate insiders own 1.60% of the company's stock.

Wall Street Analyst Weigh In

A number of research analysts have recently commented on the company. Keefe, Bruyette & Woods upped their price target on Arthur J. Gallagher & Co. from $241.00 to $252.00 and gave the company an "underperform" rating in a research report on Friday, July 26th. Royal Bank of Canada increased their target price on shares of Arthur J. Gallagher & Co. from $310.00 to $320.00 and gave the stock an "outperform" rating in a research report on Friday, September 20th. Truist Financial boosted their price target on shares of Arthur J. Gallagher & Co. from $265.00 to $275.00 and gave the company a "hold" rating in a research report on Friday, September 20th. Bank Of America (Bofa) lifted their price objective on shares of Arthur J. Gallagher & Co. from $255.00 to $265.00 and gave the company an "underperform" rating in a research note on Friday, July 26th. Finally, The Goldman Sachs Group lifted their price target on Arthur J. Gallagher & Co. from $272.00 to $286.00 in a research report on Friday, July 26th. Three equities research analysts have rated the stock with a sell rating, seven have assigned a hold rating and four have given a buy rating to the company. According to MarketBeat.com, the company currently has a consensus rating of "Hold" and an average price target of $289.14.

Check Out Our Latest Research Report on Arthur J. Gallagher & Co.

Arthur J. Gallagher & Co. Price Performance

AJG stock traded down $0.13 during midday trading on Friday, reaching $294.58. The company had a trading volume of 947,455 shares, compared to its average volume of 846,019. The firm has a 50-day moving average price of $288.48 and a 200-day moving average price of $274.26. The company has a market capitalization of $64.63 billion, a P/E ratio of 56.34, a P/E/G ratio of 2.54 and a beta of 0.72. Arthur J. Gallagher & Co. has a 1 year low of $218.63 and a 1 year high of $301.04. The company has a debt-to-equity ratio of 0.64, a current ratio of 1.06 and a quick ratio of 1.06.

Arthur J. Gallagher & Co. (NYSE:AJG - Get Free Report) last released its earnings results on Thursday, October 24th. The financial services provider reported $2.26 EPS for the quarter, meeting analysts' consensus estimates of $2.26. Arthur J. Gallagher & Co. had a return on equity of 19.12% and a net margin of 10.40%. The business had revenue of $2.77 billion for the quarter, compared to analysts' expectations of $2.78 billion. During the same quarter in the prior year, the firm earned $2.00 earnings per share. The firm's revenue was up 12.8% on a year-over-year basis. On average, research analysts anticipate that Arthur J. Gallagher & Co. will post 10.11 earnings per share for the current fiscal year.

Arthur J. Gallagher & Co. Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Friday, December 20th. Shareholders of record on Friday, December 6th will be paid a dividend of $0.60 per share. This represents a $2.40 annualized dividend and a dividend yield of 0.81%. The ex-dividend date of this dividend is Friday, December 6th. Arthur J. Gallagher & Co.'s dividend payout ratio (DPR) is presently 45.71%.

Arthur J. Gallagher & Co. Profile

(

Free Report)

Arthur J. Gallagher & Co, together with its subsidiaries, provides insurance and reinsurance brokerage, consulting, and third-party property/casualty claims settlement and administration services to entities and individuals worldwide. It operates in Brokerage and Risk Management segments. The Brokerage segment offers retail and wholesale insurance and reinsurance brokerage services; assists retail brokers and other non-affiliated brokers in the placement of specialized and hard-to-place insurance; and acts as a brokerage wholesaler, managing general agent, and managing general underwriter for distributing specialized insurance coverages to underwriting enterprises.

Further Reading

Before you consider Arthur J. Gallagher & Co., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arthur J. Gallagher & Co. wasn't on the list.

While Arthur J. Gallagher & Co. currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.