Sheets Smith Wealth Management cut its stake in shares of CVS Health Co. (NYSE:CVS - Free Report) by 71.0% during the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 31,229 shares of the pharmacy operator's stock after selling 76,287 shares during the period. Sheets Smith Wealth Management's holdings in CVS Health were worth $1,964,000 at the end of the most recent quarter.

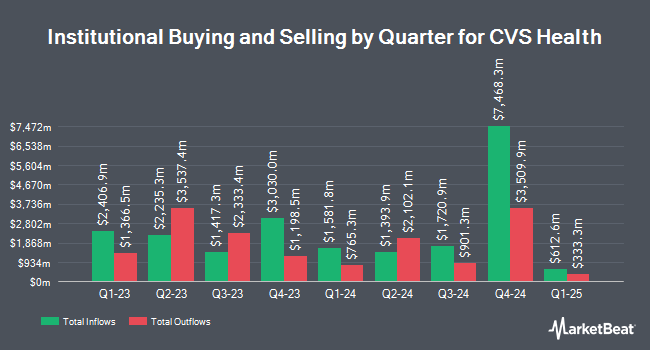

Several other hedge funds have also made changes to their positions in the company. Capital World Investors lifted its position in shares of CVS Health by 8.0% during the 1st quarter. Capital World Investors now owns 43,776,874 shares of the pharmacy operator's stock worth $3,491,643,000 after purchasing an additional 3,232,172 shares during the last quarter. Capital International Investors grew its position in CVS Health by 12.5% during the 1st quarter. Capital International Investors now owns 37,917,923 shares of the pharmacy operator's stock worth $3,024,334,000 after acquiring an additional 4,226,225 shares during the last quarter. Capital Research Global Investors increased its stake in shares of CVS Health by 1.4% in the first quarter. Capital Research Global Investors now owns 13,143,822 shares of the pharmacy operator's stock valued at $1,048,351,000 after buying an additional 184,297 shares in the last quarter. Pzena Investment Management LLC raised its stake in shares of CVS Health by 132.9% in the second quarter. Pzena Investment Management LLC now owns 12,936,388 shares of the pharmacy operator's stock worth $764,023,000 after acquiring an additional 7,382,931 shares during the last quarter. Finally, Lazard Asset Management LLC lifted its holdings in CVS Health by 5.9% during the 1st quarter. Lazard Asset Management LLC now owns 6,963,508 shares of the pharmacy operator's stock worth $555,406,000 after buying an additional 389,166 shares in the last quarter. Hedge funds and other institutional investors own 80.66% of the company's stock.

Analysts Set New Price Targets

A number of research analysts recently issued reports on the stock. Deutsche Bank Aktiengesellschaft decreased their price objective on shares of CVS Health from $64.00 to $63.00 and set a "hold" rating for the company in a report on Friday, August 9th. Royal Bank of Canada reaffirmed an "outperform" rating and issued a $68.00 target price on shares of CVS Health in a research report on Wednesday, September 4th. UBS Group increased their price target on shares of CVS Health from $60.00 to $62.00 and gave the company a "neutral" rating in a research note on Thursday. TD Cowen upgraded CVS Health from a "hold" rating to a "buy" rating and lifted their target price for the stock from $59.00 to $85.00 in a research note on Friday, October 4th. Finally, Mizuho decreased their price target on shares of CVS Health from $73.00 to $66.00 and set an "outperform" rating on the stock in a research note on Thursday, October 24th. Nine analysts have rated the stock with a hold rating and twelve have issued a buy rating to the company's stock. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average price target of $73.00.

View Our Latest Research Report on CVS

CVS Health Stock Performance

Shares of NYSE CVS traded down $1.53 during midday trading on Friday, hitting $55.54. 13,650,265 shares of the company's stock traded hands, compared to its average volume of 13,590,173. The company has a debt-to-equity ratio of 0.80, a quick ratio of 0.66 and a current ratio of 0.80. The stock has a market capitalization of $69.87 billion, a price-to-earnings ratio of 14.10, a price-to-earnings-growth ratio of 0.94 and a beta of 0.55. CVS Health Co. has a 1 year low of $52.77 and a 1 year high of $83.25. The firm has a fifty day moving average of $59.56 and a 200 day moving average of $59.12.

CVS Health (NYSE:CVS - Get Free Report) last released its quarterly earnings data on Wednesday, November 6th. The pharmacy operator reported $1.09 earnings per share for the quarter, topping analysts' consensus estimates of $1.08 by $0.01. The firm had revenue of $95.43 billion during the quarter, compared to analyst estimates of $92.72 billion. CVS Health had a return on equity of 10.72% and a net margin of 1.36%. The business's quarterly revenue was up 6.3% compared to the same quarter last year. During the same quarter in the prior year, the company posted $2.21 earnings per share. On average, analysts forecast that CVS Health Co. will post 6.18 earnings per share for the current year.

CVS Health Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Friday, November 1st. Stockholders of record on Monday, October 21st were paid a dividend of $0.665 per share. This represents a $2.66 dividend on an annualized basis and a dividend yield of 4.79%. The ex-dividend date was Monday, October 21st. CVS Health's dividend payout ratio is currently 67.51%.

CVS Health Profile

(

Free Report)

CVS Health Corporation provides health solutions in the United States. It operates through Health Care Benefits, Health Services, and Pharmacy & Consumer Wellness segments. The Health Care Benefits segment offers traditional, voluntary, and consumer-directed health insurance products and related services.

See Also

Before you consider CVS Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CVS Health wasn't on the list.

While CVS Health currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.