Synovus Financial Corp lifted its holdings in Shell plc (NYSE:SHEL - Free Report) by 23.7% in the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 105,674 shares of the energy company's stock after acquiring an additional 20,241 shares during the period. Synovus Financial Corp's holdings in Shell were worth $6,969,000 at the end of the most recent reporting period.

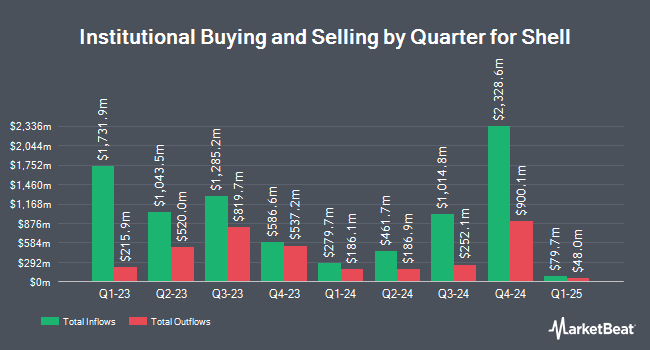

Other institutional investors have also recently made changes to their positions in the company. FMR LLC lifted its stake in Shell by 5.2% in the 3rd quarter. FMR LLC now owns 65,298,943 shares of the energy company's stock worth $4,306,465,000 after purchasing an additional 3,255,347 shares in the last quarter. Fisher Asset Management LLC boosted its stake in Shell by 2.1% during the third quarter. Fisher Asset Management LLC now owns 24,530,647 shares of the energy company's stock valued at $1,617,796,000 after buying an additional 507,311 shares during the last quarter. Dimensional Fund Advisors LP grew its holdings in Shell by 0.4% during the 2nd quarter. Dimensional Fund Advisors LP now owns 22,722,317 shares of the energy company's stock valued at $1,640,082,000 after buying an additional 96,549 shares in the last quarter. Mawer Investment Management Ltd. raised its holdings in shares of Shell by 8.7% during the 3rd quarter. Mawer Investment Management Ltd. now owns 5,282,868 shares of the energy company's stock worth $348,405,000 after acquiring an additional 422,329 shares in the last quarter. Finally, Holocene Advisors LP boosted its position in shares of Shell by 29.8% during the 3rd quarter. Holocene Advisors LP now owns 3,773,617 shares of the energy company's stock valued at $248,870,000 after acquiring an additional 866,954 shares during the last quarter. Hedge funds and other institutional investors own 28.60% of the company's stock.

Shell Stock Down 0.7 %

Shares of NYSE SHEL traded down $0.46 during midday trading on Friday, reaching $63.54. 4,470,658 shares of the company's stock traded hands, compared to its average volume of 4,204,738. The company has a market cap of $196.68 billion, a price-to-earnings ratio of 13.07, a P/E/G ratio of 4.92 and a beta of 0.55. Shell plc has a one year low of $60.34 and a one year high of $74.61. The company has a quick ratio of 1.13, a current ratio of 1.40 and a debt-to-equity ratio of 0.34. The stock's 50 day simple moving average is $66.23 and its 200-day simple moving average is $69.13.

Shell Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Thursday, December 19th. Shareholders of record on Friday, November 15th will be paid a $0.688 dividend. The ex-dividend date is Friday, November 15th. This represents a $2.75 annualized dividend and a yield of 4.33%. Shell's dividend payout ratio (DPR) is 56.58%.

Analyst Ratings Changes

SHEL has been the subject of a number of analyst reports. Scotiabank lowered their price target on shares of Shell from $90.00 to $80.00 and set a "sector outperform" rating for the company in a report on Thursday, October 10th. Barclays upgraded Shell to a "strong-buy" rating in a report on Wednesday, October 2nd. Sanford C. Bernstein upgraded Shell to a "strong-buy" rating in a report on Friday, October 11th. Citigroup upgraded shares of Shell to a "hold" rating in a research report on Wednesday, October 2nd. Finally, Wells Fargo & Company dropped their price target on shares of Shell from $88.00 to $87.00 and set an "overweight" rating for the company in a research note on Monday, December 9th. Two equities research analysts have rated the stock with a hold rating, four have given a buy rating and three have assigned a strong buy rating to the stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Buy" and an average price target of $81.75.

Check Out Our Latest Research Report on SHEL

About Shell

(

Free Report)

Shell plc operates as an energy and petrochemical company Europe, Asia, Oceania, Africa, the United States, and Rest of the Americas. The company operates through Integrated Gas, Upstream, Marketing, Chemicals and Products, and Renewables and Energy Solutions segments. It explores for and extracts crude oil, natural gas, and natural gas liquids; markets and transports oil and gas; produces gas-to-liquids fuels and other products; and operates upstream and midstream infrastructure to deliver gas to market.

See Also

Before you consider Shell, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Shell wasn't on the list.

While Shell currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.