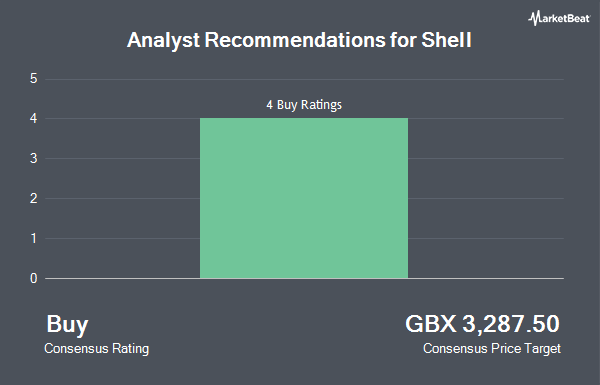

Jefferies Financial Group restated their buy rating on shares of Shell (LON:SHEL - Free Report) in a report released on Monday,London Stock Exchange reports. Jefferies Financial Group currently has a GBX 3,200 ($40.60) price target on the stock.

A number of other analysts also recently commented on SHEL. JPMorgan Chase & Co. restated an "overweight" rating on shares of Shell in a research report on Tuesday, September 24th. Bank of America reiterated a "buy" rating and set a GBX 3,400 ($43.14) price target on shares of Shell in a research report on Wednesday, September 4th. Six analysts have rated the stock with a buy rating, According to data from MarketBeat.com, the company currently has a consensus rating of "Buy" and a consensus target price of GBX 3,366.67 ($42.71).

Check Out Our Latest Stock Report on Shell

Shell Stock Performance

Shares of LON SHEL traded down GBX 40 ($0.51) during mid-day trading on Monday, hitting GBX 2,458.50 ($31.19). The company had a trading volume of 6,868,322 shares, compared to its average volume of 11,374,676. Shell has a 12 month low of GBX 2,345 ($29.75) and a 12 month high of GBX 2,961 ($37.57). The company has a debt-to-equity ratio of 40.32, a current ratio of 1.41 and a quick ratio of 0.87. The firm's 50 day simple moving average is GBX 2,550.15 and its two-hundred day simple moving average is GBX 2,657.43. The stock has a market cap of £151.94 billion, a price-to-earnings ratio of 1,143.58, a PEG ratio of 2.50 and a beta of 0.51.

Shell Dividend Announcement

The firm also recently declared a dividend, which will be paid on Thursday, December 19th. Stockholders of record on Thursday, November 14th will be given a $0.34 dividend. This represents a dividend yield of 1.06%. The ex-dividend date is Thursday, November 14th. Shell's dividend payout ratio is currently 4,883.72%.

About Shell

(

Get Free Report)

Shell plc operates as an energy and petrochemical company Europe, Asia, Oceania, Africa, the United States, and Rest of the Americas. The company operates through Integrated Gas, Upstream, Marketing, Chemicals and Products, and Renewables and Energy Solutions segments. It explores for and extracts crude oil, natural gas, and natural gas liquids; markets and transports oil and gas; produces gas-to-liquids fuels and other products; and operates upstream and midstream infrastructure to deliver gas to market.

Featured Stories

Before you consider Shell, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Shell wasn't on the list.

While Shell currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.