Sherwin-Williams (NYSE:SHW - Get Free Report) had its price target cut by stock analysts at UBS Group from $430.00 to $400.00 in a research report issued to clients and investors on Monday,Benzinga reports. The firm currently has a "buy" rating on the specialty chemicals company's stock. UBS Group's price target would suggest a potential upside of 18.66% from the stock's current price.

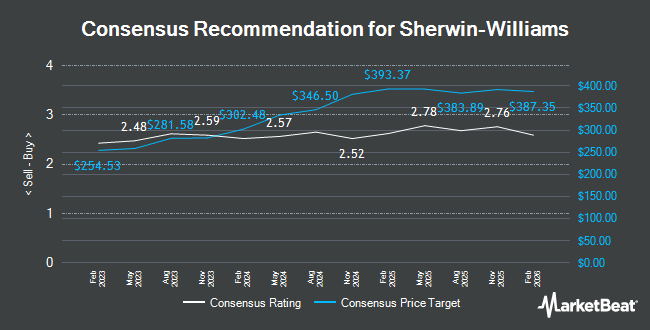

A number of other brokerages have also recently weighed in on SHW. Jefferies Financial Group restated a "hold" rating and issued a $380.00 price target (down previously from $423.00) on shares of Sherwin-Williams in a research report on Monday, March 10th. Wells Fargo & Company dropped their price objective on shares of Sherwin-Williams from $400.00 to $380.00 and set an "equal weight" rating for the company in a research note on Thursday, April 3rd. JPMorgan Chase & Co. boosted their price target on Sherwin-Williams from $370.00 to $390.00 and gave the stock an "overweight" rating in a report on Monday, February 3rd. Citigroup reissued a "buy" rating and issued a $423.00 target price (up previously from $418.00) on shares of Sherwin-Williams in a research note on Wednesday, February 26th. Finally, Royal Bank of Canada decreased their price target on shares of Sherwin-Williams from $438.00 to $415.00 and set an "outperform" rating on the stock in a research note on Monday, February 3rd. Six research analysts have rated the stock with a hold rating, eleven have assigned a buy rating and two have given a strong buy rating to the company's stock. According to data from MarketBeat, Sherwin-Williams presently has an average rating of "Moderate Buy" and an average price target of $393.31.

Read Our Latest Stock Report on SHW

Sherwin-Williams Stock Performance

NYSE SHW traded up $7.20 on Monday, hitting $337.11. 2,032,653 shares of the company's stock were exchanged, compared to its average volume of 1,781,910. The firm has a market cap of $84.79 billion, a price-to-earnings ratio of 31.95, a P/E/G ratio of 2.98 and a beta of 1.26. The firm's 50-day moving average price is $347.47 and its two-hundred day moving average price is $360.37. Sherwin-Williams has a fifty-two week low of $282.09 and a fifty-two week high of $400.42. The company has a debt-to-equity ratio of 2.02, a current ratio of 0.79 and a quick ratio of 0.46.

Sherwin-Williams (NYSE:SHW - Get Free Report) last announced its quarterly earnings data on Thursday, January 30th. The specialty chemicals company reported $2.09 EPS for the quarter, beating the consensus estimate of $2.07 by $0.02. Sherwin-Williams had a net margin of 11.61% and a return on equity of 74.50%. During the same period in the previous year, the business earned $1.81 earnings per share. On average, research analysts expect that Sherwin-Williams will post 12 EPS for the current year.

Insider Buying and Selling at Sherwin-Williams

In related news, insider Colin M. Davie sold 2,799 shares of the business's stock in a transaction that occurred on Thursday, February 27th. The stock was sold at an average price of $360.30, for a total transaction of $1,008,479.70. Following the transaction, the insider now directly owns 5,365 shares of the company's stock, valued at approximately $1,933,009.50. The trade was a 34.28 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through the SEC website. 0.60% of the stock is currently owned by corporate insiders.

Institutional Trading of Sherwin-Williams

Several large investors have recently modified their holdings of SHW. Midwest Capital Advisors LLC acquired a new stake in Sherwin-Williams in the fourth quarter valued at $26,000. Park Square Financial Group LLC bought a new stake in shares of Sherwin-Williams in the 4th quarter worth about $27,000. Perkins Coie Trust Co acquired a new stake in shares of Sherwin-Williams in the 1st quarter valued at about $27,000. Lee Danner & Bass Inc. bought a new position in shares of Sherwin-Williams during the fourth quarter worth about $28,000. Finally, Sierra Ocean LLC acquired a new position in Sherwin-Williams in the fourth quarter worth about $36,000. 77.67% of the stock is currently owned by institutional investors and hedge funds.

About Sherwin-Williams

(

Get Free Report)

The Sherwin-Williams Company engages in the development, manufacture, distribution, and sale of paints, coating, and related products to professional, industrial, commercial, and retail customers. It operates through three segments: Paint Stores Group, Consumer Brands Group, and Performance Coatings Group.

Featured Stories

Before you consider Sherwin-Williams, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sherwin-Williams wasn't on the list.

While Sherwin-Williams currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.