Victory Capital Management Inc. lessened its holdings in shares of Shift4 Payments, Inc. (NYSE:FOUR - Free Report) by 30.8% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 289,209 shares of the company's stock after selling 128,915 shares during the quarter. Victory Capital Management Inc. owned approximately 0.33% of Shift4 Payments worth $25,624,000 at the end of the most recent quarter.

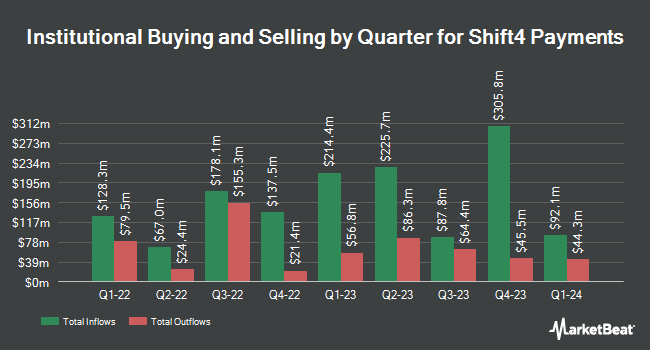

A number of other large investors have also modified their holdings of FOUR. Clearbridge Investments LLC boosted its stake in Shift4 Payments by 11.3% during the second quarter. Clearbridge Investments LLC now owns 2,314,928 shares of the company's stock worth $169,800,000 after buying an additional 235,355 shares during the last quarter. The Manufacturers Life Insurance Company grew its holdings in shares of Shift4 Payments by 11,776.9% in the second quarter. The Manufacturers Life Insurance Company now owns 1,730,704 shares of the company's stock valued at $126,947,000 after purchasing an additional 1,716,132 shares during the period. Janus Henderson Group PLC increased its position in Shift4 Payments by 21.7% during the first quarter. Janus Henderson Group PLC now owns 1,434,890 shares of the company's stock worth $94,803,000 after purchasing an additional 255,741 shares during the last quarter. Ensign Peak Advisors Inc raised its stake in Shift4 Payments by 6,185.0% during the second quarter. Ensign Peak Advisors Inc now owns 1,095,546 shares of the company's stock worth $80,358,000 after purchasing an additional 1,078,115 shares during the period. Finally, Dimensional Fund Advisors LP boosted its holdings in Shift4 Payments by 35.3% in the 2nd quarter. Dimensional Fund Advisors LP now owns 849,564 shares of the company's stock valued at $62,315,000 after purchasing an additional 221,881 shares during the last quarter. Hedge funds and other institutional investors own 98.87% of the company's stock.

Shift4 Payments Stock Up 4.1 %

Shares of NYSE:FOUR traded up $3.96 during trading on Monday, hitting $100.97. 2,580,108 shares of the company were exchanged, compared to its average volume of 1,375,344. The company has a debt-to-equity ratio of 2.71, a current ratio of 2.98 and a quick ratio of 1.34. The firm's 50 day moving average price is $90.75 and its 200-day moving average price is $77.90. The stock has a market capitalization of $8.95 billion, a P/E ratio of 52.72, a PEG ratio of 1.17 and a beta of 1.64. Shift4 Payments, Inc. has a 12-month low of $55.87 and a 12-month high of $106.31.

Insider Activity at Shift4 Payments

In other news, CFO Nancy Disman sold 20,000 shares of Shift4 Payments stock in a transaction on Friday, September 13th. The shares were sold at an average price of $81.30, for a total value of $1,626,000.00. Following the transaction, the chief financial officer now directly owns 182,959 shares of the company's stock, valued at $14,874,566.70. The trade was a 9.85 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link. Also, insider Jordan Frankel sold 12,500 shares of the firm's stock in a transaction on Monday, September 16th. The stock was sold at an average price of $82.57, for a total transaction of $1,032,125.00. Following the transaction, the insider now directly owns 228,021 shares in the company, valued at $18,827,693.97. The trade was a 5.20 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 30.57% of the stock is owned by corporate insiders.

Wall Street Analysts Forecast Growth

A number of equities research analysts have commented on FOUR shares. Piper Sandler lifted their target price on Shift4 Payments from $93.00 to $120.00 and gave the company an "overweight" rating in a research report on Wednesday, November 13th. William Blair began coverage on shares of Shift4 Payments in a report on Wednesday, September 4th. They issued an "outperform" rating for the company. Oppenheimer initiated coverage on Shift4 Payments in a research note on Tuesday, October 1st. They issued an "outperform" rating and a $109.00 price objective for the company. Barclays started coverage on Shift4 Payments in a report on Wednesday, October 9th. They set an "overweight" rating and a $120.00 target price for the company. Finally, Benchmark reiterated a "buy" rating and set a $99.00 price target on shares of Shift4 Payments in a research note on Thursday, September 5th. Three equities research analysts have rated the stock with a hold rating and eighteen have given a buy rating to the company's stock. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average price target of $100.15.

Read Our Latest Stock Report on FOUR

Shift4 Payments Company Profile

(

Free Report)

Shift4 Payments, Inc (NYSE FOUR) provides integrated payment processing and technology solutions in the United States. Its payments platform provides omni-channel card acceptance and processing solutions, including end-to-end payment processing for various payment types; merchant acquiring; proprietary omni-channel gateway; complementary software integrations; integrated and mobile point-of-sale (POS) solutions; security and risk management solutions; and reporting and analytical tools, as well as tokenization, risk management/underwriting, payment device and chargeback management, fraud prevention, and gift card solutions.

Recommended Stories

Before you consider Shift4 Payments, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Shift4 Payments wasn't on the list.

While Shift4 Payments currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.