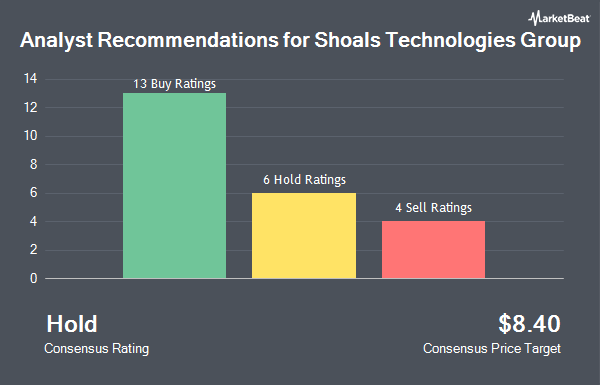

Shoals Technologies Group, Inc. (NASDAQ:SHLS - Get Free Report) has been given a consensus recommendation of "Hold" by the twenty-three research firms that are presently covering the stock, MarketBeat Ratings reports. Three investment analysts have rated the stock with a sell recommendation, seven have given a hold recommendation and thirteen have issued a buy recommendation on the company. The average 12 month price target among brokerages that have issued a report on the stock in the last year is $11.31.

A number of analysts have issued reports on the company. Piper Sandler cut their target price on Shoals Technologies Group from $10.00 to $8.00 and set an "overweight" rating for the company in a research note on Friday, November 22nd. Morgan Stanley cut their target price on Shoals Technologies Group from $8.00 to $7.00 and set an "equal weight" rating for the company in a research note on Friday, November 15th. BNP Paribas downgraded Shoals Technologies Group from an "outperform" rating to a "neutral" rating and cut their target price for the stock from $15.00 to $7.00 in a research note on Wednesday, August 7th. Roth Mkm cut their target price on Shoals Technologies Group from $7.00 to $6.00 and set a "neutral" rating for the company in a research note on Friday, September 6th. Finally, Cantor Fitzgerald reissued an "overweight" rating and set a $12.00 price objective on shares of Shoals Technologies Group in a research report on Tuesday, September 17th.

View Our Latest Stock Report on Shoals Technologies Group

Shoals Technologies Group Price Performance

SHLS stock traded up $0.25 during midday trading on Thursday, reaching $5.26. The stock had a trading volume of 3,813,759 shares, compared to its average volume of 5,011,508. The company's fifty day simple moving average is $5.29 and its 200 day simple moving average is $5.99. The company has a current ratio of 2.08, a quick ratio of 1.36 and a debt-to-equity ratio of 0.26. The company has a market cap of $876.84 million, a price-to-earnings ratio of 26.30, a price-to-earnings-growth ratio of 0.73 and a beta of 1.73. Shoals Technologies Group has a 52-week low of $4.07 and a 52-week high of $17.50.

Shoals Technologies Group (NASDAQ:SHLS - Get Free Report) last issued its earnings results on Tuesday, November 12th. The company reported $0.08 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.10 by ($0.02). Shoals Technologies Group had a return on equity of 9.83% and a net margin of 7.78%. The company had revenue of $102.20 million during the quarter, compared to analyst estimates of $98.86 million. During the same period last year, the business earned $0.16 earnings per share. The firm's revenue was down 23.8% compared to the same quarter last year. As a group, sell-side analysts predict that Shoals Technologies Group will post 0.29 earnings per share for the current fiscal year.

Insider Buying and Selling

In other news, CEO Brandon Moss purchased 22,300 shares of the business's stock in a transaction on Thursday, November 21st. The shares were bought at an average price of $4.55 per share, with a total value of $101,465.00. Following the completion of the transaction, the chief executive officer now directly owns 593,700 shares in the company, valued at approximately $2,701,335. This represents a 3.90 % increase in their position. The purchase was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. 1.67% of the stock is owned by company insiders.

Institutional Inflows and Outflows

Institutional investors have recently added to or reduced their stakes in the company. FMR LLC increased its position in Shoals Technologies Group by 48.9% during the third quarter. FMR LLC now owns 5,806 shares of the company's stock worth $33,000 after buying an additional 1,906 shares during the period. 1620 Investment Advisors Inc. acquired a new position in shares of Shoals Technologies Group in the second quarter valued at approximately $54,000. TrinityPoint Wealth LLC acquired a new position in shares of Shoals Technologies Group in the third quarter valued at approximately $60,000. Mackenzie Financial Corp acquired a new position in shares of Shoals Technologies Group in the second quarter valued at approximately $64,000. Finally, American Trust acquired a new position in shares of Shoals Technologies Group in the second quarter valued at approximately $68,000.

Shoals Technologies Group Company Profile

(

Get Free ReportShoals Technologies Group, Inc provides electrical balance of system (EBOS) solutions and components for solar, battery energy, and electric vehicle (EV) charging applications in the United States and internationally. The company designs, manufactures, and sells system solutions for both homerun and combine-as-you-go wiring architectures, as well as offers technical support services.

Featured Articles

Before you consider Shoals Technologies Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Shoals Technologies Group wasn't on the list.

While Shoals Technologies Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.