FMR LLC lifted its holdings in shares of Shutterstock, Inc. (NYSE:SSTK - Free Report) by 397.5% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 39,193 shares of the business services provider's stock after buying an additional 31,315 shares during the quarter. FMR LLC owned approximately 0.11% of Shutterstock worth $1,386,000 as of its most recent SEC filing.

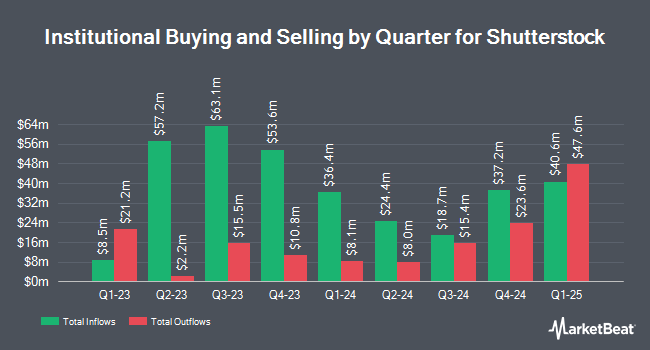

A number of other hedge funds and other institutional investors have also recently made changes to their positions in the business. Rubric Capital Management LP purchased a new stake in Shutterstock during the 2nd quarter worth approximately $14,769,000. Harbor Capital Advisors Inc. increased its position in shares of Shutterstock by 110.7% during the third quarter. Harbor Capital Advisors Inc. now owns 34,588 shares of the business services provider's stock worth $1,223,000 after purchasing an additional 18,174 shares in the last quarter. Federated Hermes Inc. increased its position in shares of Shutterstock by 95.4% during the second quarter. Federated Hermes Inc. now owns 138,719 shares of the business services provider's stock worth $5,368,000 after purchasing an additional 67,718 shares in the last quarter. Envestnet Asset Management Inc. raised its stake in Shutterstock by 13.9% in the 2nd quarter. Envestnet Asset Management Inc. now owns 184,300 shares of the business services provider's stock valued at $7,132,000 after purchasing an additional 22,459 shares during the last quarter. Finally, California First Leasing Corp purchased a new position in Shutterstock in the 2nd quarter valued at $966,000. Hedge funds and other institutional investors own 82.79% of the company's stock.

Analysts Set New Price Targets

SSTK has been the subject of a number of recent research reports. StockNews.com upgraded shares of Shutterstock from a "hold" rating to a "buy" rating in a research report on Monday, December 9th. Truist Financial cut their price objective on shares of Shutterstock from $65.00 to $56.00 and set a "buy" rating for the company in a report on Wednesday, October 30th. Needham & Company LLC reissued a "buy" rating and issued a $55.00 target price on shares of Shutterstock in a research note on Tuesday, October 29th. Finally, Morgan Stanley dropped their price target on Shutterstock from $58.00 to $50.00 and set an "equal weight" rating for the company in a research report on Monday, October 21st.

Read Our Latest Stock Report on SSTK

Shutterstock Trading Down 2.2 %

Shares of SSTK stock traded down $0.70 during trading on Monday, hitting $31.60. 260,054 shares of the stock traded hands, compared to its average volume of 501,421. The firm has a market capitalization of $1.10 billion, a P/E ratio of 30.98 and a beta of 1.08. Shutterstock, Inc. has a 52-week low of $28.85 and a 52-week high of $54.40. The company has a debt-to-equity ratio of 0.23, a current ratio of 0.42 and a quick ratio of 0.42. The firm's fifty day moving average price is $31.56 and its 200-day moving average price is $35.22.

Shutterstock (NYSE:SSTK - Get Free Report) last released its quarterly earnings results on Tuesday, October 29th. The business services provider reported $1.31 earnings per share for the quarter, topping analysts' consensus estimates of $1.06 by $0.25. The business had revenue of $250.59 million during the quarter, compared to analysts' expectations of $240.90 million. Shutterstock had a return on equity of 20.39% and a net margin of 4.03%. The company's revenue was up 7.4% compared to the same quarter last year. During the same period in the prior year, the business posted $0.99 EPS. As a group, research analysts forecast that Shutterstock, Inc. will post 3.07 earnings per share for the current fiscal year.

Shutterstock Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Friday, December 13th. Stockholders of record on Friday, November 29th were given a dividend of $0.30 per share. The ex-dividend date was Friday, November 29th. This represents a $1.20 annualized dividend and a dividend yield of 3.80%. Shutterstock's dividend payout ratio is currently 117.65%.

Shutterstock Profile

(

Free Report)

Shutterstock, Inc provides platform to connect brands and businesses to high quality content in North America, Europe, and internationally. The company offers image services consisting of photographs, vectors, and illustrations, which is used in visual communications, such as websites, digital and print marketing materials, corporate communications, books, publications, and others; footage services, including video clips, filmed by industry experts and cinema grade video effects in HD and 4K formats that are integrated into websites, social media, marketing campaigns, and cinematic productions; and music services comprising music tracks and sound effects, which are used to complement images and footage.

Read More

Before you consider Shutterstock, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Shutterstock wasn't on the list.

While Shutterstock currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.