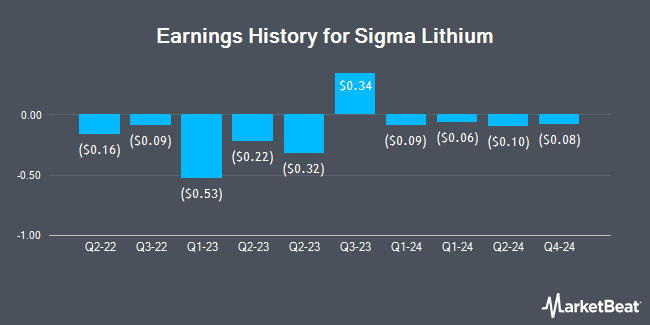

Sigma Lithium (NASDAQ:SGML - Get Free Report) will likely be posting its Q4 2024 quarterly earnings results before the market opens on Tuesday, April 29th. Analysts expect the company to announce earnings of $0.06 per share for the quarter.

Sigma Lithium (NASDAQ:SGML - Get Free Report) last released its quarterly earnings results on Monday, March 31st. The company reported ($0.08) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.06 by ($0.14). Sigma Lithium had a negative net margin of 36.85% and a negative return on equity of 38.04%. The business had revenue of $46.70 million during the quarter, compared to the consensus estimate of $71.77 million. On average, analysts expect Sigma Lithium to post $0 EPS for the current fiscal year and $1 EPS for the next fiscal year.

Sigma Lithium Price Performance

Shares of SGML stock traded down $0.02 during trading hours on Friday, reaching $8.24. 488,220 shares of the company were exchanged, compared to its average volume of 762,873. The stock's fifty day moving average is $10.12 and its two-hundred day moving average is $11.68. Sigma Lithium has a fifty-two week low of $6.76 and a fifty-two week high of $19.20. The company has a debt-to-equity ratio of 0.02, a current ratio of 0.84 and a quick ratio of 0.72. The company has a market cap of $916.94 million, a price-to-earnings ratio of -17.17 and a beta of 0.26.

Wall Street Analysts Forecast Growth

Separately, Bank of America dropped their target price on Sigma Lithium from $25.00 to $16.00 and set a "buy" rating for the company in a research report on Tuesday, January 14th.

View Our Latest Stock Report on SGML

Sigma Lithium Company Profile

(

Get Free Report)

Sigma Lithium Corporation engages in the exploration and development of lithium deposits in Brazil. It holds a 100% interest in the Grota do Cirilo, Genipapo, Santa Clara, and São José properties comprising 29 mineral rights covering an area of approximately 185 square kilometers located in the Araçuaí and Itinga regions of the state of Minas Gerais, Brazil.

Read More

Before you consider Sigma Lithium, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sigma Lithium wasn't on the list.

While Sigma Lithium currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.