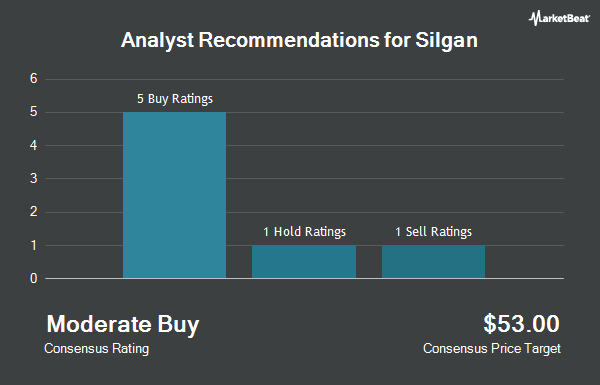

Silgan Holdings Inc. (NYSE:SLGN - Get Free Report) has been assigned a consensus recommendation of "Moderate Buy" from the eight analysts that are presently covering the firm, MarketBeat.com reports. One analyst has rated the stock with a hold recommendation and seven have issued a buy recommendation on the company. The average 12-month price target among brokerages that have issued a report on the stock in the last year is $59.75.

SLGN has been the subject of several research reports. Truist Financial lifted their price objective on shares of Silgan from $63.00 to $69.00 and gave the stock a "buy" rating in a research note on Monday, January 6th. Bank of America lifted their price target on Silgan from $60.00 to $61.00 and gave the stock a "buy" rating in a research report on Monday, January 6th. Royal Bank of Canada increased their price objective on Silgan from $58.00 to $63.00 and gave the company an "outperform" rating in a report on Thursday, December 19th. Finally, StockNews.com downgraded Silgan from a "buy" rating to a "hold" rating in a report on Wednesday, October 9th.

Read Our Latest Stock Report on Silgan

Institutional Trading of Silgan

Institutional investors have recently modified their holdings of the stock. Vanguard Personalized Indexing Management LLC raised its position in shares of Silgan by 2.6% in the second quarter. Vanguard Personalized Indexing Management LLC now owns 10,707 shares of the industrial products company's stock valued at $453,000 after buying an additional 267 shares during the last quarter. Wealth Enhancement Advisory Services LLC raised its holdings in Silgan by 7.0% in the 3rd quarter. Wealth Enhancement Advisory Services LLC now owns 5,517 shares of the industrial products company's stock valued at $290,000 after acquiring an additional 361 shares during the last quarter. Verdence Capital Advisors LLC lifted its stake in Silgan by 5.5% in the 3rd quarter. Verdence Capital Advisors LLC now owns 7,430 shares of the industrial products company's stock worth $390,000 after purchasing an additional 388 shares in the last quarter. AQR Capital Management LLC boosted its holdings in shares of Silgan by 1.1% during the 2nd quarter. AQR Capital Management LLC now owns 37,660 shares of the industrial products company's stock worth $1,594,000 after purchasing an additional 421 shares during the last quarter. Finally, Captrust Financial Advisors grew its position in shares of Silgan by 5.7% in the third quarter. Captrust Financial Advisors now owns 8,405 shares of the industrial products company's stock valued at $441,000 after purchasing an additional 456 shares in the last quarter. Institutional investors and hedge funds own 70.25% of the company's stock.

Silgan Stock Down 0.4 %

SLGN stock traded down $0.20 during trading on Monday, reaching $52.62. 457,182 shares of the company traded hands, compared to its average volume of 775,300. The company has a market capitalization of $5.62 billion, a price-to-earnings ratio of 19.07, a price-to-earnings-growth ratio of 1.16 and a beta of 0.71. The company has a debt-to-equity ratio of 1.24, a quick ratio of 0.75 and a current ratio of 1.09. The business has a 50 day simple moving average of $53.84 and a 200 day simple moving average of $51.25. Silgan has a 12 month low of $41.14 and a 12 month high of $58.14.

Silgan (NYSE:SLGN - Get Free Report) last posted its quarterly earnings data on Wednesday, October 30th. The industrial products company reported $1.21 EPS for the quarter, missing the consensus estimate of $1.23 by ($0.02). The firm had revenue of $1.75 billion for the quarter, compared to the consensus estimate of $1.82 billion. Silgan had a return on equity of 18.76% and a net margin of 5.11%. The company's revenue was down 3.2% compared to the same quarter last year. During the same quarter last year, the firm earned $1.16 EPS. On average, equities research analysts anticipate that Silgan will post 3.6 earnings per share for the current fiscal year.

Silgan Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Monday, December 16th. Stockholders of record on Monday, December 2nd were paid a dividend of $0.19 per share. This represents a $0.76 annualized dividend and a dividend yield of 1.44%. The ex-dividend date was Monday, December 2nd. Silgan's payout ratio is 27.54%.

About Silgan

(

Get Free ReportSilgan Holdings Inc, together with its subsidiaries, manufactures and sells rigid packaging solutions for consumer goods products in the United States and internationally. It operates through three segments: Dispensing and Specialty Closures, Metal Containers, and Custom Containers. The Dispensing and Specialty Closures segment offers a range of metal and plastic closures, and dispensing systems for food, beverage, health care, garden, home, personal care, beauty products, and hard surface cleaning products, as well as capping/sealing equipment and detection systems.

Read More

Before you consider Silgan, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Silgan wasn't on the list.

While Silgan currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.