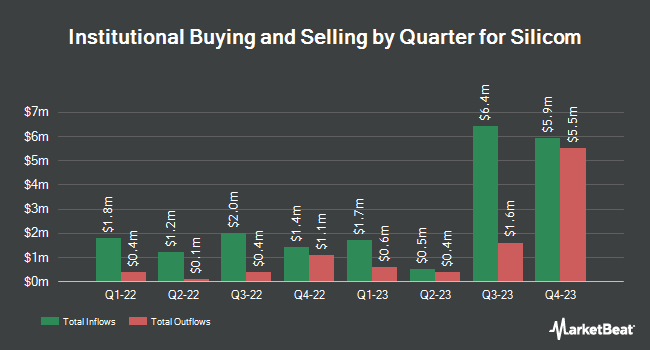

First Wilshire Securities Management Inc. lessened its holdings in Silicom Ltd. (NASDAQ:SILC - Free Report) by 29.9% during the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 390,700 shares of the technology company's stock after selling 166,564 shares during the period. Silicom comprises 1.7% of First Wilshire Securities Management Inc.'s investment portfolio, making the stock its 21st biggest holding. First Wilshire Securities Management Inc. owned 5.78% of Silicom worth $6,372,000 as of its most recent SEC filing.

Separately, Acuitas Investments LLC grew its stake in shares of Silicom by 44.2% in the 4th quarter. Acuitas Investments LLC now owns 104,379 shares of the technology company's stock worth $1,702,000 after acquiring an additional 31,990 shares in the last quarter. Hedge funds and other institutional investors own 52.85% of the company's stock.

Silicom Trading Down 4.1 %

Shares of SILC stock traded down $0.57 during trading on Friday, hitting $13.40. The company's stock had a trading volume of 28,312 shares, compared to its average volume of 24,739. The company has a market cap of $90.53 million, a PE ratio of -6.70 and a beta of 0.98. The business has a fifty day moving average of $15.91 and a 200-day moving average of $15.09. Silicom Ltd. has a 52 week low of $11.35 and a 52 week high of $18.24.

Silicom (NASDAQ:SILC - Get Free Report) last announced its quarterly earnings data on Thursday, January 30th. The technology company reported ($0.76) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.32) by ($0.44). Silicom had a negative net margin of 20.66% and a negative return on equity of 8.83%.

Analysts Set New Price Targets

Separately, Needham & Company LLC reissued a "hold" rating on shares of Silicom in a research report on Monday, February 3rd.

Check Out Our Latest Stock Report on SILC

Silicom Profile

(

Free Report)

Silicom Ltd., together with its subsidiaries, designs, manufactures, markets, and supports networking and data infrastructure solutions for servers, server-based systems, and communications devices. It offers server network interface cards; and smart cards, such as smart server adapters, which include redirector and switching cards, encryption and data compression hardware acceleration cards, forward error correction acceleration and offloading cards, time synchronization cards, and field programmable gate array-based cards.

Featured Stories

Before you consider Silicom, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Silicom wasn't on the list.

While Silicom currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.