Franklin Resources Inc. boosted its position in Silicon Laboratories Inc. (NASDAQ:SLAB - Free Report) by 1.9% in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 231,889 shares of the semiconductor company's stock after purchasing an additional 4,278 shares during the quarter. Franklin Resources Inc. owned about 0.71% of Silicon Laboratories worth $27,001,000 at the end of the most recent reporting period.

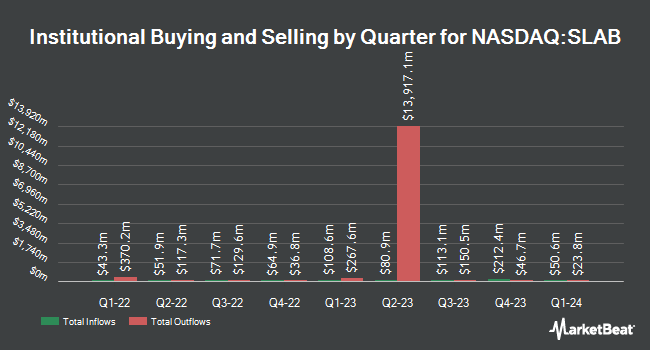

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in SLAB. Tidal Investments LLC bought a new position in Silicon Laboratories during the 3rd quarter worth $520,000. Geode Capital Management LLC raised its stake in Silicon Laboratories by 2.1% in the third quarter. Geode Capital Management LLC now owns 781,049 shares of the semiconductor company's stock valued at $90,282,000 after purchasing an additional 15,728 shares in the last quarter. Barclays PLC lifted its position in Silicon Laboratories by 23.4% during the third quarter. Barclays PLC now owns 70,568 shares of the semiconductor company's stock worth $8,157,000 after purchasing an additional 13,363 shares during the period. MML Investors Services LLC grew its stake in Silicon Laboratories by 5.3% during the third quarter. MML Investors Services LLC now owns 7,328 shares of the semiconductor company's stock worth $847,000 after buying an additional 370 shares in the last quarter. Finally, Wellington Management Group LLP grew its stake in Silicon Laboratories by 28.3% during the third quarter. Wellington Management Group LLP now owns 888,382 shares of the semiconductor company's stock worth $102,670,000 after buying an additional 195,997 shares in the last quarter.

Wall Street Analysts Forecast Growth

A number of analysts have recently weighed in on the stock. Susquehanna assumed coverage on shares of Silicon Laboratories in a report on Tuesday. They set a "neutral" rating and a $130.00 price target for the company. KeyCorp decreased their price target on Silicon Laboratories from $150.00 to $115.00 and set an "overweight" rating on the stock in a research note on Tuesday, November 5th. Benchmark reissued a "hold" rating on shares of Silicon Laboratories in a report on Tuesday, November 5th. Stifel Nicolaus reduced their price objective on Silicon Laboratories from $160.00 to $135.00 and set a "buy" rating on the stock in a research note on Tuesday, November 5th. Finally, Morgan Stanley lowered their target price on Silicon Laboratories from $123.00 to $97.00 and set an "equal weight" rating for the company in a research note on Tuesday, November 5th. One equities research analyst has rated the stock with a sell rating, six have issued a hold rating and five have issued a buy rating to the stock. According to data from MarketBeat.com, the stock has an average rating of "Hold" and an average target price of $122.44.

Read Our Latest Stock Analysis on SLAB

Silicon Laboratories Stock Up 0.8 %

Shares of SLAB stock traded up $1.01 during mid-day trading on Thursday, reaching $123.83. 272,035 shares of the stock traded hands, compared to its average volume of 299,036. The stock's fifty day simple moving average is $113.03 and its two-hundred day simple moving average is $113.02. Silicon Laboratories Inc. has a 1-year low of $94.00 and a 1-year high of $154.91. The company has a market cap of $4.02 billion, a price-to-earnings ratio of -16.73 and a beta of 1.21.

Silicon Laboratories (NASDAQ:SLAB - Get Free Report) last posted its earnings results on Monday, November 4th. The semiconductor company reported ($0.13) EPS for the quarter, topping the consensus estimate of ($0.20) by $0.07. Silicon Laboratories had a negative net margin of 46.93% and a negative return on equity of 12.60%. The business had revenue of $166.00 million for the quarter, compared to the consensus estimate of $165.50 million. During the same period last year, the company earned $0.48 EPS. The firm's revenue was down 18.5% compared to the same quarter last year. On average, equities research analysts anticipate that Silicon Laboratories Inc. will post -3.56 EPS for the current fiscal year.

About Silicon Laboratories

(

Free Report)

Silicon Laboratories Inc, a fabless semiconductor company, provides various analog-intensive mixed-signal solutions in the United States, China, Taiwan, and internationally. The company's products include wireless microcontrollers and sensor products. Its products are used in various electronic products in a range of applications for the industrial Internet of Things (IoT), including industrial automation and control, smart buildings, access control, HVAC control, and industrial wearables and power tools; smart cities applications, such as smart metering, smart street lighting, renewable energy, electric vehicle supply equipment, and smart agriculture; commercial IoT applications, including smart lighting, asset tracking, electronic shelf labels, theft protection, and enterprise access points; smart home applications, comprising home automation/security systems, smart speakers, smart lighting, HVAC control, smart cameras, smart appliances, smart home sensing, smart locks, and window/blind controls; and connected health applications, including diabetes management, consumer health and fitness, elderly care, patient monitoring, and activity tracking; as well as in commercial building automation, consumer electronics, and medical instrumentation.

Recommended Stories

Before you consider Silicon Laboratories, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Silicon Laboratories wasn't on the list.

While Silicon Laboratories currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.