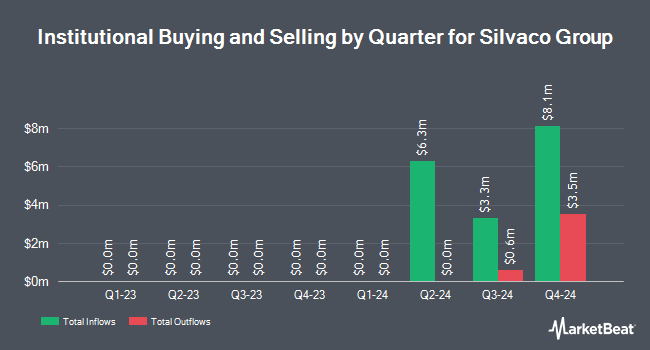

Loomis Sayles & Co. L P reduced its position in shares of Silvaco Group, Inc. (NASDAQ:SVCO - Free Report) by 12.1% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 527,500 shares of the company's stock after selling 72,500 shares during the period. Loomis Sayles & Co. L P owned approximately 2.01% of Silvaco Group worth $7,543,000 at the end of the most recent quarter.

A number of other hedge funds have also recently made changes to their positions in SVCO. Point72 Asset Management L.P. purchased a new stake in shares of Silvaco Group during the 2nd quarter valued at $1,182,000. Davidson Kempner Capital Management LP bought a new position in Silvaco Group in the second quarter valued at $3,182,000. Ghisallo Capital Management LLC purchased a new stake in Silvaco Group during the second quarter valued at about $899,000. First Eagle Investment Management LLC bought a new stake in Silvaco Group during the second quarter worth about $3,469,000. Finally, Ovata Capital Management Ltd purchased a new position in shares of Silvaco Group in the 2nd quarter worth about $1,618,000.

Silvaco Group Trading Down 1.0 %

SVCO traded down $0.08 during trading on Thursday, hitting $7.81. 198,835 shares of the stock traded hands, compared to its average volume of 383,509. Silvaco Group, Inc. has a 12-month low of $6.14 and a 12-month high of $21.59. The firm has a 50-day moving average of $9.43 and a 200 day moving average of $14.53.

Analyst Ratings Changes

A number of research firms recently weighed in on SVCO. TD Cowen dropped their target price on Silvaco Group from $20.00 to $15.00 and set a "buy" rating for the company in a research report on Wednesday, November 13th. Rosenblatt Securities cut their price objective on shares of Silvaco Group from $26.00 to $18.00 and set a "buy" rating for the company in a research note on Thursday, October 17th. Craig Hallum reduced their target price on shares of Silvaco Group from $25.00 to $17.00 and set a "buy" rating on the stock in a report on Wednesday, October 16th. Needham & Company LLC reissued a "buy" rating and issued a $19.00 price target on shares of Silvaco Group in a research note on Wednesday, November 13th. Finally, B. Riley restated a "buy" rating and set a $26.00 price target on shares of Silvaco Group in a research report on Thursday, September 19th. Six equities research analysts have rated the stock with a buy rating, Based on data from MarketBeat, Silvaco Group presently has an average rating of "Buy" and a consensus target price of $20.00.

View Our Latest Stock Report on Silvaco Group

Insider Activity

In related news, insider Eric Guichard sold 25,000 shares of the business's stock in a transaction dated Friday, November 15th. The stock was sold at an average price of $7.19, for a total transaction of $179,750.00. Following the transaction, the insider now owns 57,902 shares in the company, valued at $416,315.38. The trade was a 30.16 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link.

About Silvaco Group

(

Free Report)

Silvaco Group Inc is a provider of TCAD, EDA software and SIP solutions which enable semiconductor design and AI through software and innovation. The company's solutions are used for process and device development across display, power devices, automotive, memory, high performance compute, photonics, internet of things and 5G/6G mobile markets for complex SoC design.

Read More

Before you consider Silvaco Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Silvaco Group wasn't on the list.

While Silvaco Group currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.