Renaissance Technologies LLC boosted its holdings in shares of Silvercorp Metals Inc. (NYSEAMERICAN:SVM - Free Report) by 21.6% in the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 5,778,796 shares of the company's stock after acquiring an additional 1,025,000 shares during the period. Renaissance Technologies LLC owned 2.65% of Silvercorp Metals worth $17,336,000 at the end of the most recent reporting period.

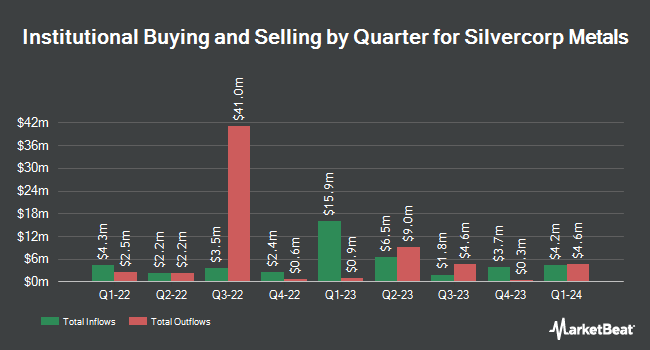

Other hedge funds also recently bought and sold shares of the company. BNP Paribas Financial Markets raised its holdings in shares of Silvercorp Metals by 1,289.7% during the 3rd quarter. BNP Paribas Financial Markets now owns 41,817 shares of the company's stock worth $183,000 after acquiring an additional 38,808 shares during the period. Public Employees Retirement System of Ohio acquired a new position in Silvercorp Metals in the 3rd quarter valued at about $441,000. Barclays PLC grew its stake in shares of Silvercorp Metals by 2,712.3% in the 3rd quarter. Barclays PLC now owns 44,997 shares of the company's stock valued at $197,000 after buying an additional 43,397 shares during the period. Geode Capital Management LLC increased its holdings in shares of Silvercorp Metals by 11.1% during the 3rd quarter. Geode Capital Management LLC now owns 100,795 shares of the company's stock worth $439,000 after buying an additional 10,085 shares during the last quarter. Finally, Virtu Financial LLC raised its position in shares of Silvercorp Metals by 21.1% during the 3rd quarter. Virtu Financial LLC now owns 54,233 shares of the company's stock valued at $237,000 after buying an additional 9,465 shares during the period. Institutional investors and hedge funds own 22.30% of the company's stock.

Silvercorp Metals Trading Down 4.6 %

SVM stock traded down $0.18 during mid-day trading on Friday, hitting $3.74. 6,049,495 shares of the company were exchanged, compared to its average volume of 3,517,352. Silvercorp Metals Inc. has a 12-month low of $2.87 and a 12-month high of $5.32. The firm has a market capitalization of $814.27 million, a P/E ratio of 10.39 and a beta of 1.20. The business has a fifty day simple moving average of $3.71 and a 200-day simple moving average of $3.70. The company has a quick ratio of 4.35, a current ratio of 4.61 and a debt-to-equity ratio of 0.13.

Silvercorp Metals Company Profile

(

Free Report)

Silvercorp Metals Inc, together with its subsidiaries, engages in the acquisition, exploration, development, and mining of mineral properties in China. The company primarily explores for silver, gold, lead, and zinc metals. It holds a 100% interest in the Kuanping silver-lead-zinc-gold project located in located in Shanzhou District, Sanmenxia City, Henan Province, China; Ying project located in the Ying Mining District in Henan Province, China; Gaocheng (GC) mine located in Guangdong Province, China; and Baiyunpu (BYP) mine located in Hunan Province, China.

Recommended Stories

Before you consider Silvercorp Metals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Silvercorp Metals wasn't on the list.

While Silvercorp Metals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.